Monday Sees Record Trading Volume for The Brink’s Company

December 25, 2022

Trending News 🌥️

The Brink’s Company ($NYSE:BCO) is an American security and protection services provider based in Richmond, Virginia. It provides a variety of services, such as armored car transportation, ATM services, cash-in-transit, cash management services, and electronic security systems. It is one of the largest and most recognizable names in the security industry. The surge in trading volume was likely due to investors’ anticipation of the company’s upcoming earnings report due out later in the month. Analysts are expecting a solid performance from the company, with some forecasting a year-over-year increase in profits in the third quarter. The Brink’s Company is well-positioned to take advantage of strong demand for its services, particularly in the retail and banking sectors. Its strong balance sheet and solid financials have enabled it to make strategic acquisitions and expand its service offerings.

Additionally, the company has made significant investments in technology and cutting-edge security solutions, which has helped to bolster its competitive advantage in the industry. With the stock trading at a relatively low valuation and expectations of robust earnings growth this quarter, investors appear optimistic about the company’s prospects. Monday’s record trading volume is indicative of the strong interest from investors, and if the company meets expectations, it could be in for further gains as investors continue to take notice.

Stock Price

Monday saw a record trading volume for The Brink’s Company, a global provider of security-related services. Right now, media coverage of the company is mostly positive. On Thursday, the BRINK’S COMPANY stock opened at $57.8 and closed at $56.4, down by 3.6% from the prior closing price of 58.5. This marks the third consecutive day of decline for the company’s stock, suggesting that investors are not as confident in the company as they have been in the past. Despite this decline in its stock value, The Brink’s Company has had a good year in terms of its overall performance. It has seen strong growth in its revenue and profits, and has continued to expand its operations and customer base.

Additionally, the company has made significant investments in its technology and infrastructure, which have helped to improve its operational efficiency and enhance its service offerings. The Brink’s Company is well positioned to continue to benefit from the growing demand for its services. With its strong financial position and experienced management team, it is well placed to capitalize on the increasing demand for security-related services. As such, the company is likely to experience further growth in the coming months and years. In the meantime, investors should keep an eye on how the company’s stock performs in response to any changes in market sentiment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brink’s Company. More…

| Total Revenues | Net Income | Net Margin |

| 4.44k | 175.2 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brink’s Company. More…

| Operations | Investing | Financing |

| 404.9 | -176.5 | 228.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brink’s Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.93k | 5.61k | 5.1 |

Key Ratios Snapshot

Some of the financial key ratios for Brink’s Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 13.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 5.0% | 103.5% | 3.9% |

VI Analysis

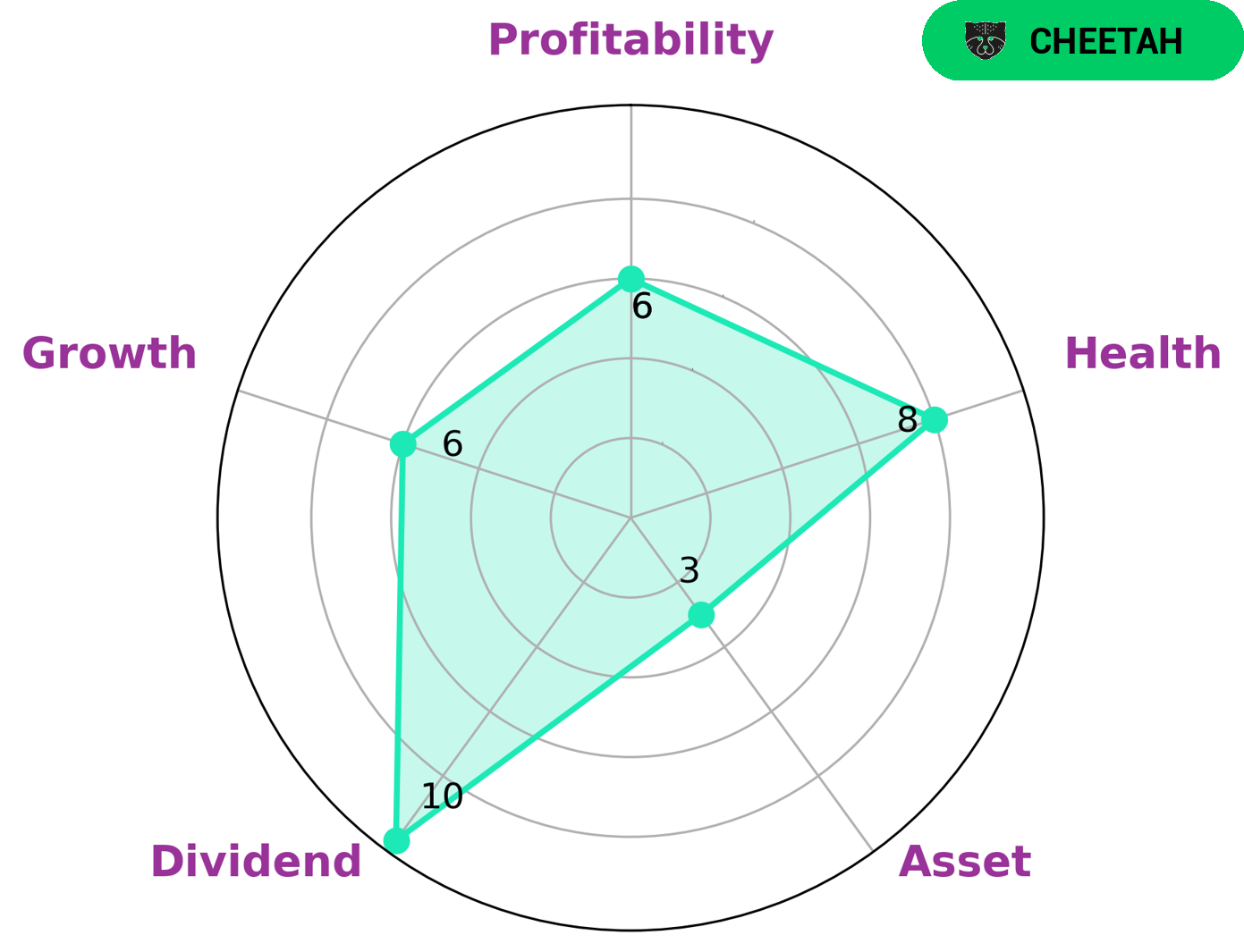

This type of company may be attractive to investors who are looking for potential upside and are willing to take on more risk compared to other companies. BRINK’S COMPANY stands out in terms of dividend, but has a medium performance in terms of growth, profitability, and asset. However, with a high health score of 8/10 considering its cashflows and debt, BRINK’S COMPANY is considered capable of paying off debt and funding future operations. This may also appeal to investors who are looking for a safe and secure investment. Overall, BRINK’S COMPANY has the potential to be a lucrative investment for those who are willing to take on more risk for the chance of a higher reward. More…

VI Peers

The Brink’s Company and its competitors, Global Payments Inc, Prosegur Compania De Seguridad SA, and GATX Corp, are all vying for a share of the global market for security and cash management solutions. The Brink’s Company has a strong history and reputation in the industry, and is the largest provider of security solutions in the world.

However, its competitors are large and well-established companies in their own right, with a strong foothold in different regions of the world. The competition between these companies is fierce, and each is constantly innovating and expanding its offerings in order to gain an edge over the others.

– Global Payments Inc ($NYSE:GPN)

Global Payments Inc. is a provider of payment technology services. The Company operates through three segments: Merchant Services, Issuer Solutions and Institutional Services. The Company’s Merchant Services segment provides payment solutions to merchants and integrated software and hardware products that enable merchants to accept various payment types. The Company’s Issuer Solutions segment provides card issuing services and fraud management solutions. The Company’s Institutional Services segment provides transaction processing, data analytics and other services to central banks, financial institutions and other customers.

– Prosegur Compania De Seguridad SA ($LTS:0Q8P)

Prosegur Compania De Seguridad SA is a security company that provides a range of security services, including armored car transportation, cash management, and security systems. The company has a market cap of $949.56 million and a return on equity of 14.6%. Prosegur Compania De Seguridad SA operates in Spain, Portugal, Argentina, Chile, Brazil, Colombia, Mexico, the United States, and other countries.

– GATX Corp ($NYSE:GATX)

GATX Corporation is an American global railway leasing company headquartered in Chicago, Illinois. as of 2022, its market cap is 3.82B with a ROE of 12.42%. The company owns a large portfolio of locomotives, freight cars, and other rolling stock in North America and Europe. It also operates a number of railroads and railway terminals.

Summary

Investing in The Brink’s Company can be a lucrative opportunity for investors, as it recently saw record trading volume on Monday. The surge in trading volume is likely due to the company’s positive media coverage, which is likely the result of its good performance in the market.

However, despite its positive media coverage and strong market performance, the stock price for The Brink’s Company dropped on Monday. This may be because investors are unsure about the future of the company, or because they are not confident in its long-term prospects. Despite this drop, The Brink’s Company is still a potentially good investment opportunity. The Brink’s Company has a variety of products and services that have been successful in the past, such as its cash handling services, armored car services, and security services.

In addition, the company has been expanding its operations into other areas such as electronic security systems and mobile banking services. These new products and services could help The Brink’s Company increase its revenues and profits in the future. Overall, investing in The Brink’s Company could be a good option for investors who are looking for an opportunity to get into the market. Despite its stock price dropping on Monday, the company is still performing well and has potential for growth in the future. Investors should research the company thoroughly before making any investment decisions, as any investment carries some risk.

Recent Posts