Thrivent Financial for Lutherans Sells 38.9% of Shares in Garmin Ltd

May 27, 2023

Trending News ☀️

Recently, Thrivent Financial for Lutherans, a highly recognized institutional investor based in the United States, has sold 38.9% of its shares in Garmin Ltd ($NYSE:GRMN). Garmin Ltd is a multinational technology company that specializes in developing and producing navigation, communication, and other services for consumers, pilots, and professionals. The company’s products include activity trackers, sports watches, navigation systems, and automobile tracking and navigation systems.

Additionally, the company has developed a variety of products for the marine and aviation industry. Due to its wide range of products, the company has experienced steady growth over the past few years. Thrivent Financial’s recent decision to sell 38.9% of its shares in the company is an indication of the confidence the investor has in Garmin’s ability to remain competitive in its respective market.

Analysis

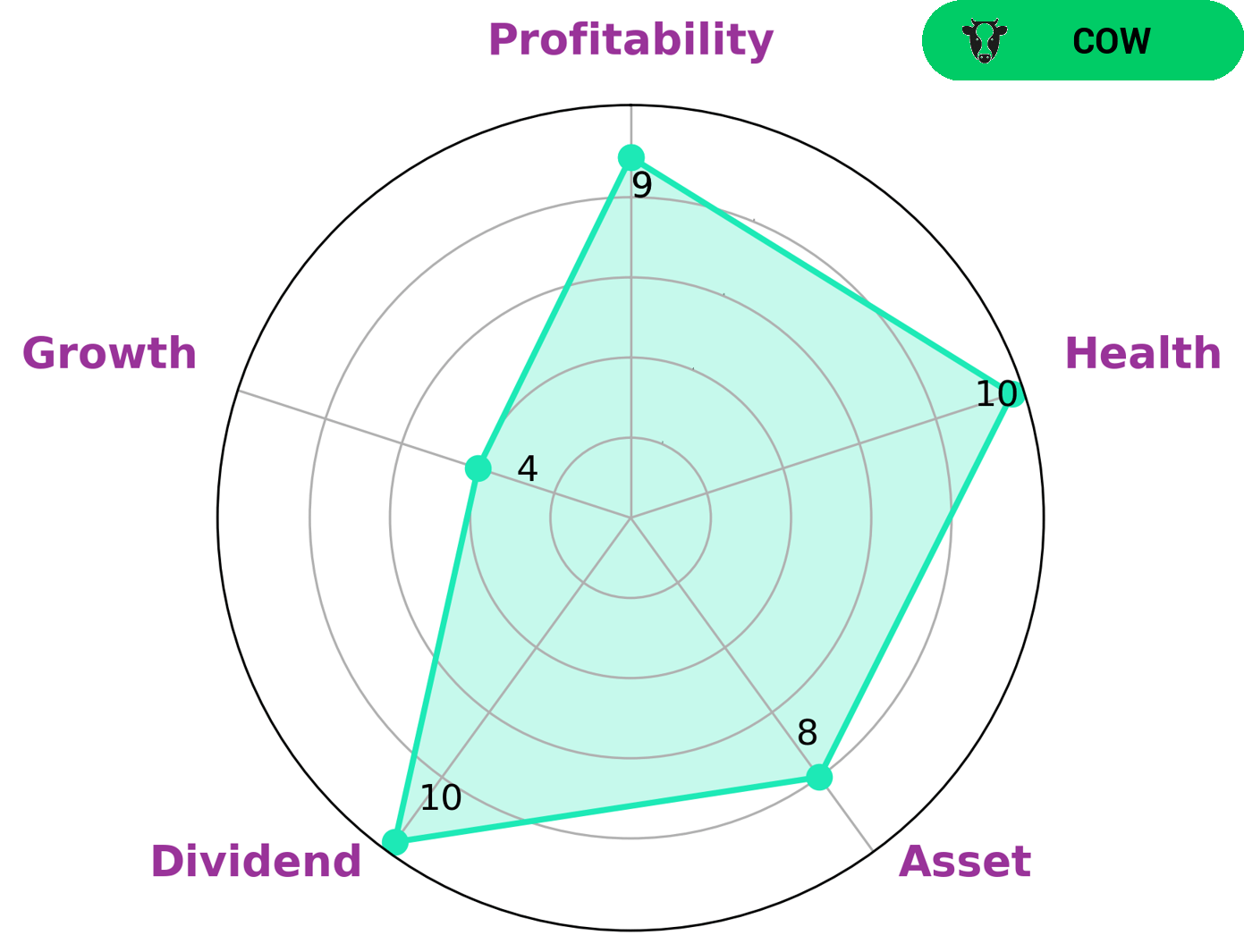

We at GoodWhale have conducted an analysis of GARMIN LTD‘s financials and have concluded that with a high health score of 10/10 with regard to its cashflows and debt, it is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, we have classified GARMIN LTD as a ‘cow’, a type of company with the track record of paying out consistent and sustainable dividends. Given GARMIN LTD’s strength in asset, dividend, profitability, and medium in growth, it is likely to attract investors who prioritize such qualities in their investments. Such investors may include dividend-seeking investors as well as value-seekers who want to take advantage of its relatively low P/E ratio. Moreover, GARMIN LTD’s stability and strong financial position also make it attractive to those who are risk-averse and prefer to invest in low-risk stocks. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Garmin Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 4.84k | 964.32 | 19.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Garmin Ltd. More…

| Operations | Investing | Financing |

| 881.84 | -17.14 | -909.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Garmin Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.73k | 1.32k | 33.48 |

Key Ratios Snapshot

Some of the financial key ratios for Garmin Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | 0.8% | 20.6% |

| FCF Margin | ROE | ROA |

| 13.4% | 9.9% | 8.1% |

Peers

Its competitors include NetApp Inc, Jiangsu Leike Defense Technology Co Ltd, and Red Cat Holdings Inc.

– NetApp Inc ($NASDAQ:NTAP)

NetApp Inc is a American multinational storage and data management company headquartered in Sunnyvale, California. It is a member of the NASDAQ-100 and S&P 500. The company was founded in 1992 with an initial public offering in 1995. NetApp offers a wide range of products and services for enterprise storage, including software-defined storage, flash storage, converged systems, data management, and more. The company has a market cap of $14.66B as of 2022 and a Return on Equity of 100.42%.

– Jiangsu Leike Defense Technology Co Ltd ($SZSE:002413)

Jiangsu Leike Defense Technology Co Ltd is a Chinese company that specializes in the development and manufacture of defense products. The company has a market cap of 6.76B as of 2022 and a Return on Equity of -4.34%. Jiangsu Leike Defense Technology Co Ltd’s products include missiles, armored vehicles, and other defense products. The company is headquartered in Nanjing, China.

– Red Cat Holdings Inc ($NASDAQ:RCAT)

Red Cat Holdings Inc is a development stage company that focuses on acquiring, developing, and commercializing technology in the field of 3D printing. The company was founded in 2013 and is headquartered in Vancouver, Canada.

Red Cat has a market cap of $76.86M as of 2022 and a ROE of -11.27%. The company focuses on acquiring, developing, and commercializing technology in the field of 3D printing.

Summary

Thrivent Financial for Lutherans, a prominent US-based institutional investor, recently sold 38.9% of its shares in Garmin Ltd. This sale has generated considerable interest among investors as Garmin Ltd has consistently outperformed the market over the past few years, with strong sales across its core product lines. Garmin Ltd has also invested in new technology and services to drive innovation and enhance customer experience, while strengthening its competitive advantage. Overall, Garmin Ltd appears to be a good investment opportunity, offering a strong financial track record and continued growth potential.

Recent Posts