Insider Sells $4.74 Million Worth of KEYS Stock, Raising Questions about Future of Keysight Technologies

April 2, 2024

☀️Trending News

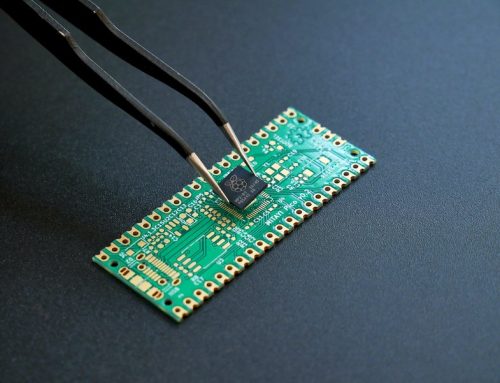

Keysight Technologies ($NYSE:KEYS) Inc. is a leading technology company that provides electronic design and test solutions to a wide range of industries including automotive, aerospace and defense, and telecommunications. Their stock, listed under the ticker symbol KEYS, has been performing well in the market and has gained the attention of many investors.

However, a recent announcement by the company has raised questions about the future of Keysight Technologies Inc. On December 27, 2023, it was reported by Knox Daily that Director Nersesian Ronald S. of Keysight Technologies Inc sold $4.74 million worth of the company’s stock. This sale, according to the report, was a part of Nersesian’s insider trading activities. Insider trading is when an individual with confidential information about a company’s financial performance uses it to make trades on their own behalf. While it is not illegal for insiders to trade their own company’s stock, it can raise concerns about the company’s future. The news of Nersesian selling off a significant amount of Keysight Technologies Inc’s stock has left many investors wondering about the future direction of the company. This is especially concerning as Nersesian is not just any insider, but the Director of the company. As an executive, he is privy to confidential information about the company’s financial performance and future plans. His decision to sell off such a large amount of stock could indicate that he has concerns about the company’s future profitability. This insider selling also brings into question the overall sentiment of other insiders and institutional investors towards Keysight Technologies Inc. It is common for insiders to sell their stock for various reasons, such as diversifying their investment portfolio or personal financial needs. However, if more insiders follow suit and start selling their stock, it could indicate a lack of confidence in the company’s future prospects. Investors should keep a close eye on any further developments regarding this insider selling at Keysight Technologies Inc. While it is important to note that one insider’s actions do not necessarily reflect the overall health of the company, it is always advisable to conduct thorough research and analysis before making any investment decisions. As with any stock, there are always risks involved, and it is crucial to stay informed and vigilant to make informed investment choices.

Market Price

On Tuesday, shares of KEYSIGHT TECHNOLOGIES opened at $152.9 and closed slightly lower at $152.3, representing a decrease of 0.2% from its prior closing price of $152.6. The insider’s decision to sell a substantial amount of company stock may signal a lack of confidence in the company’s performance and prospects. This action could potentially cause concern among investors and lead to further decline in the stock price. It is also worth noting that this sale occurred just days before KEYSIGHT TECHNOLOGIES is set to release its quarterly earnings report, adding to the speculation about the company’s financial health. KEYSIGHT TECHNOLOGIES, a leading electronic measurement company, has recently been experiencing strong growth and success in the industry.

However, this insider sale may cause uncertainty and raise doubts about the company’s future growth potential. Investors will be closely watching the upcoming earnings report for any indications of potential issues within the company. Moreover, this insider sale has also sparked discussions about potential changes in leadership or strategy within KEYSIGHT TECHNOLOGIES. The timing of the sale, just before the earnings report, could suggest that the executive is making a strategic move to reduce their stake in the company before any potential negative news is announced. While it is too early to make any definitive conclusions, investors will be closely monitoring the upcoming earnings report for any potential impacts on the stock price and the overall direction of KEYSIGHT TECHNOLOGIES Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Keysight Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 5.34k | 969 | 18.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Keysight Technologies. More…

| Operations | Investing | Financing |

| 1.37k | -739 | -1.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Keysight Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.06k | 4.24k | 27.58 |

Key Ratios Snapshot

Some of the financial key ratios for Keysight Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | 17.5% | 25.0% |

| FCF Margin | ROE | ROA |

| 22.2% | 17.6% | 9.2% |

Analysis

As an analyst at GoodWhale, I have thoroughly analyzed the fundamentals of KEYSIGHT TECHNOLOGIES and found some key points that may be of interest to potential investors. Firstly, according to our Star Chart, KEYSIGHT TECHNOLOGIES appears to be a strong company in terms of profitability. This is reflected in its high return on equity and net profit margins. However, it should be noted that the company is only average in terms of asset utilization, growth potential, and dividend payouts. In terms of financial health, KEYSIGHT TECHNOLOGIES scores a perfect 10/10. This is due to its strong cashflows and manageable debt levels. The company has enough cash reserves to pay off its debt and fund future operations, which suggests a stable and reliable financial situation. Based on our analysis, we would classify KEYSIGHT TECHNOLOGIES as a ‘rhino’ type of company. This means that it has achieved moderate growth in terms of revenue and earnings. While it may not have the rapid growth potential of a ‘unicorn’ company, it also tends to be more stable and less risky. Investors who may be interested in KEYSIGHT TECHNOLOGIES are those looking for a reliable and profitable company with a strong financial standing. This could include long-term investors who value stability and consistent returns, as well as more risk-averse investors who prefer to avoid companies with high levels of debt. Ultimately, it would depend on an individual’s investment goals and risk tolerance. More…

Peers

The company’s products and services are used in a variety of industries, including telecommunications, aerospace and defense, automotive, and semiconductor. Keysight’s main competitors are Sensata Technologies Holding PLC, Horiba Ltd, and ESCO Technologies Inc.

– Sensata Technologies Holding PLC ($NYSE:ST)

Sensata Technologies Holding PLC is a company that manufactures and sells sensors and sensing solutions. The company has a market cap of 6.47B as of 2022 and a Return on Equity of 11.06%. The company’s products are used in a variety of applications, including automotive, appliance, aircraft, industrial, military, and other applications.

– Horiba Ltd ($TSE:6856)

As of 2022, Horiba Ltd has a market cap of 251.07B and a return on equity of 9.91%. The company is a leading provider of measurement and analytical instruments. Its products are used in a wide range of industries, including automotive, semiconductor, environmental, life science, and solar energy.

– ESCO Technologies Inc ($NYSE:ESE)

Comtech Telecommunications Corp. is a world leader in secure and highly reliable communications technologies. The company designs, develops, produces and markets innovative products, systems and services for advanced communications solutions. Comtech’s solutions are used in a variety of mission-critical and commercial applications, including air traffic control, emergency response, public safety, satellite communications, commercial aviation, ground transportation and more.

Comtech’s products include high-power amplifiers, modem systems, solid-state power amplifiers, frequency upconverters and block upconverters, satellite transponders, ground station equipment, mobile satellite equipment and more. The company’s solutions enable customers to increase capacity, improve performance and extend coverage.

Comtech’s products are used by leading communications service providers, broadcasters, governments and enterprises around the world. The company’s common stock is listed on the Nasdaq Global Select Market under the symbol “CMTL”.

Summary

In December 2023, Keysight Technologies Inc’s Director, Nersesian Ronald S., sold $4.74 million worth of company shares. This could be seen as a negative sign for investors, as it indicates that a key insider is cashing out and may have a negative outlook on the company’s future performance. Additionally, it could also suggest that the company’s stock is overvalued.

However, it is important to note that this is just one data point and should not be used as the sole basis for investment decisions. Investors should conduct thorough research and analysis on the company’s financials and other market indicators before making any investment decisions.

Recent Posts