Citigroup Initiates Coverage of BRP

February 2, 2023

Trending News 🌥️

Citigroup recently initiated coverage of BRP ($TSX:DOO) Inc., a Canadian manufacturer and distributor of power sports vehicles. BRP has seen strong growth in recent years, driven by the strength of its products and a product mix that is designed to appeal to a wide range of customers. This has resulted in a steady increase in sales and profitability. They believe that BRP’s portfolio of vehicles and parts will continue to drive strong sales and market share gains in the near-term.

Additionally, its strong balance sheet and cash flow provide it with the resources to expand its production capacity in order to meet increasing demand. Overall, Citigroup analysts are bullish on BRP’s prospects and view it as a strong investment opportunity. They believe that the company’s current valuation does not reflect its long-term potential and that it is poised to generate significant returns for investors over the long-term.

Market Price

On Tuesday, Citigroup initiated coverage of BRP Inc. (TSX:DOO), a Canadian manufacturer of recreational products and vehicles. At the start of trading, the stock opened at CA$108.6 and finished the day up 2.2% at CA$111.0, closing higher than its prior-day closing price of CA$108.6. BRP Inc. is a global leader in the design, development, manufacturing, distribution and marketing of powersports vehicles and propulsion systems. It offers a portfolio of products including snowmobiles, ATVs, side-by-side vehicles, motorcycles, outboard engines and personal watercraft. It operates through six business segments: Ski-Doo and Lynx, Sea-Doo, Can-Am Off-Road, Can-Am On-Road, Evinrude Outboard Motors and Rotax Propulsion Systems.

Its product offerings are recognized as some of the best in the industry and they are backed by a strong customer experience program. The company has been rapidly expanding its global footprint through strategic acquisitions and partnerships. The company’s strong performance was attributed to its broad product line and successful marketing initiatives. The company is well-positioned to continue to capitalize on opportunities in the powersports industry and capitalize on its existing relationships with its dealers and partners. Investors should continue to watch the stock performance of BRP Inc. as it looks to expand further into new markets and product lines. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brp Inc. More…

| Total Revenues | Net Income | Net Margin |

| 9.3k | 708 | 9.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brp Inc. More…

| Operations | Investing | Financing |

| 1.05k | -928.4 | -57.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brp Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.15k | 5.98k | 2.11 |

Key Ratios Snapshot

Some of the financial key ratios for Brp Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.1% | 33.1% | 11.7% |

| FCF Margin | ROE | ROA |

| 3.5% | 791.4% | 11.0% |

Analysis

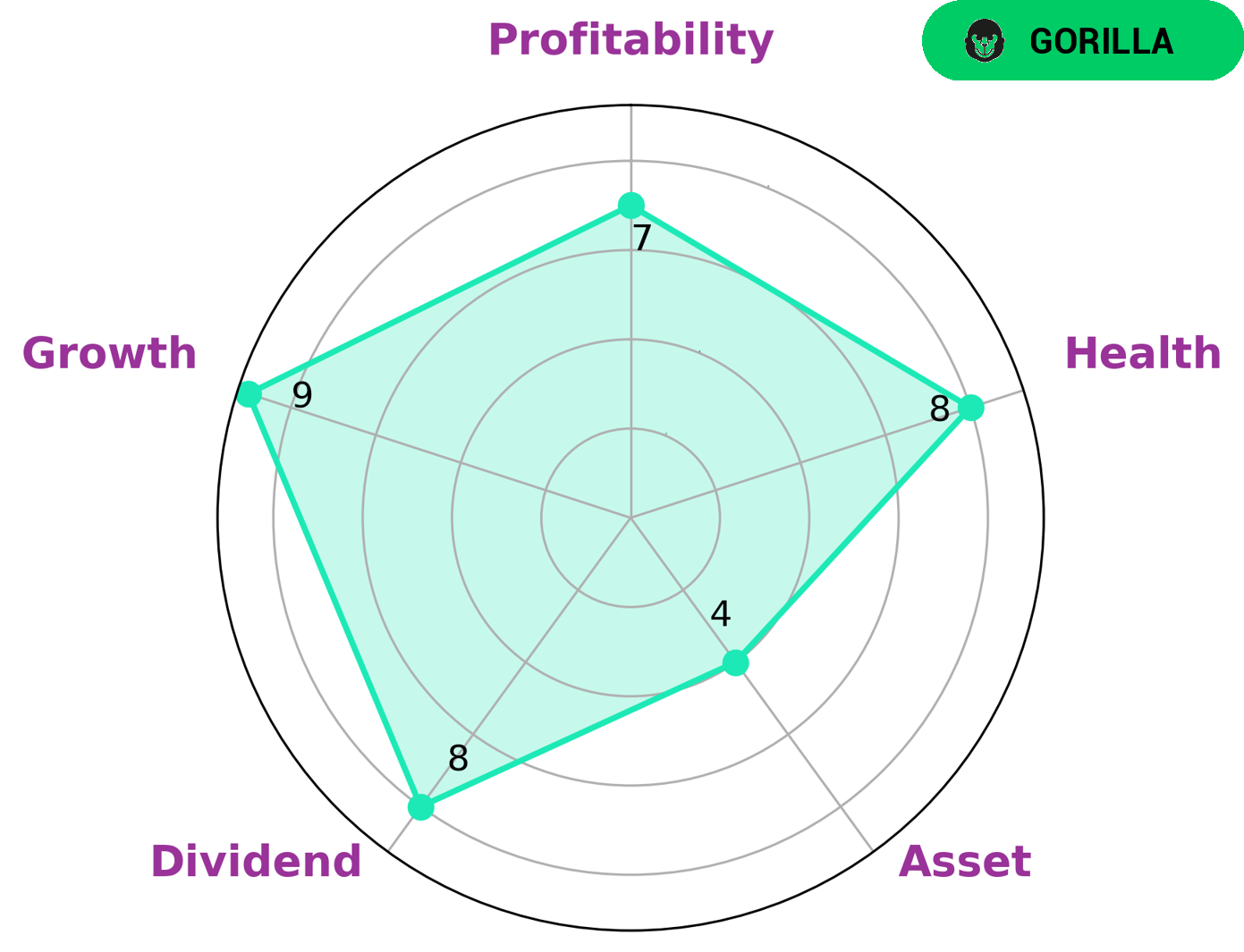

GoodWhale has conducted an analysis of BRP INC‘s fundamentals and classified it as a ‘gorilla’ company. These are companies that have achieved stable and high revenue or earning growth due to their strong competitive advantage. As a result, BRP INC is likely to attract interest from many types of investors. BRP INC has an impressive health score of 8/10, indicating its ability to sustain future operations in times of crisis. This is due to its strong cashflows and debt management. Furthermore, BRP INC stands out in terms of dividend, growth, and profitability. It is also relatively strong in terms of asset, although not as strong as the other categories. Overall, BRP INC is an attractive investment opportunity for many types of investors. Its solid financials, competitive advantage, and impressive health score make it an appealing long-term investment for those seeking returns in a variety of ways. More…

Peers

In the highly competitive world of recreational vehicles, BRP Inc. has been a leader for over 75 years. The company’s innovative products have allowed it to stay ahead of the competition, but it is not without challengers. Zhejiang CF Moto Power Co Ltd, LGA Holdings Inc, and Motorcycle Holdings Ltd are all companies that compete with BRP Inc for market share. Each company has its own unique strengths and weaknesses, but all are formidable competitors.

– Zhejiang CF Moto Power Co Ltd ($SHSE:603129)

Zhejiang CF Moto Power Co Ltd is a Chinese manufacturer of motorcycles, ATVs, and scooters. Founded in 1989, the company has a market cap of 19.98B as of 2022 and a return on equity of 11.52%. CF Moto produces a wide range of vehicles for both street and off-road use, and has a strong presence in the Chinese market. The company has been seeking to expand internationally in recent years, and has begun to establish a presence in Europe and North America.

– LGA Holdings Inc ($ASX:MTO)

Honda Motorcycle Holdings Ltd is a Japanese manufacturer of motorcycles. The company has a market cap of 185.31M as of 2022 and a return on equity of 13.44%. Honda Motorcycle Holdings Ltd is a leading manufacturer of motorcycles in Japan and exports its products to over 100 countries worldwide.

Summary

Investment analysts at Citigroup have initiated coverage of BRP Inc. with a “Buy” rating. They believe the company has strong fundamentals, with attractive long-term growth potential and an attractive valuation. They cite BRP’s strong balance sheet, experienced management team, and positive customer sentiment as key factors in their assessment. They also point to the company’s strong portfolio of innovative products and its greater-than-expected market share gains as reasons to invest.

Additionally, they believe that the company could benefit from a favorable industry outlook, especially in the recreational vehicle market, where BRP has a leading position. Overall, the analysts believe that BRP is a good investment for those looking for long-term returns.

Recent Posts