Ternium Reports Lower-Than-Expected Q4 2023 Non-GAAP EPS of $0.20.

February 15, 2023

Trending News 🌥️

Ternium ($NYSE:TX) S.A. is a leading global steel producer headquartered in Luxembourg. Ternium recently reported its fourth quarter 2023 Non-GAAP Earnings Per Share (EPS) of $0.20, which fell short of expectations by a margin of $0.01. He noted that the company had faced a challenging macroeconomic environment in 2023, which had resulted in slower global steel demand. Despite this, Ternium had achieved its financial targets for the year, helped by its cost-cutting initiatives, efficiency drives and focus on cash generation. Looking ahead, Ternium plans to continue to focus on its strategic priorities to drive growth and increase shareholder value.

These include increasing production efficiency, exploiting new markets and expanding its product portfolio. The company also plans to invest in new technology and digital transformation initiatives in order to become more competitive in the global steel market. Ultimately, while the lower-than-expected Q4 2023 Non-GAAP EPS of $0.20 was a disappointment, Ternium remains well-positioned to capitalize on future growth opportunities and drive value for its shareholders.

Price History

Ternium S.A reported a lower-than-expected non-GAAP EPS of $0.20 for the fourth quarter of 2023. At the time of writing, media exposure has been mostly negative due to the unexpected results. Despite this, on Tuesday, the stock opened at $37.9 and closed at $39.1, up by 3.1% from its last closing price of 37.9. The lower-than-expected results were largely attributed to higher operating expenses and higher taxes, which weighed on profits.

Additionally, sales volume was lower than expected due to supply chain disruptions caused by the pandemic. Investors were nevertheless encouraged by the fact that Ternium’s cash position was strong and it is expected to strengthen further in the coming quarters. The company is also investing in new technology and capital expenditures to improve its production and product offerings, as well as exploring new markets to increase its presence around the world. Despite the lower-than-expected non-GAAP EPS, Ternium S.A remains a strong company with a resilient balance sheet and robust operations. Investors will be closely monitoring the company’s future performance and prospects in order to determine whether or not the stock is a good investment in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ternium S.a. More…

| Total Revenues | Net Income | Net Margin |

| 17.2k | 2.73k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ternium S.a. More…

| Operations | Investing | Financing |

| 2.86k | -1.34k | -968.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ternium S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.42k | 3.64k | 59.99 |

Key Ratios Snapshot

Some of the financial key ratios for Ternium S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 51.7% | 23.9% |

| FCF Margin | ROE | ROA |

| 13.4% | 21.7% | 14.7% |

Analysis

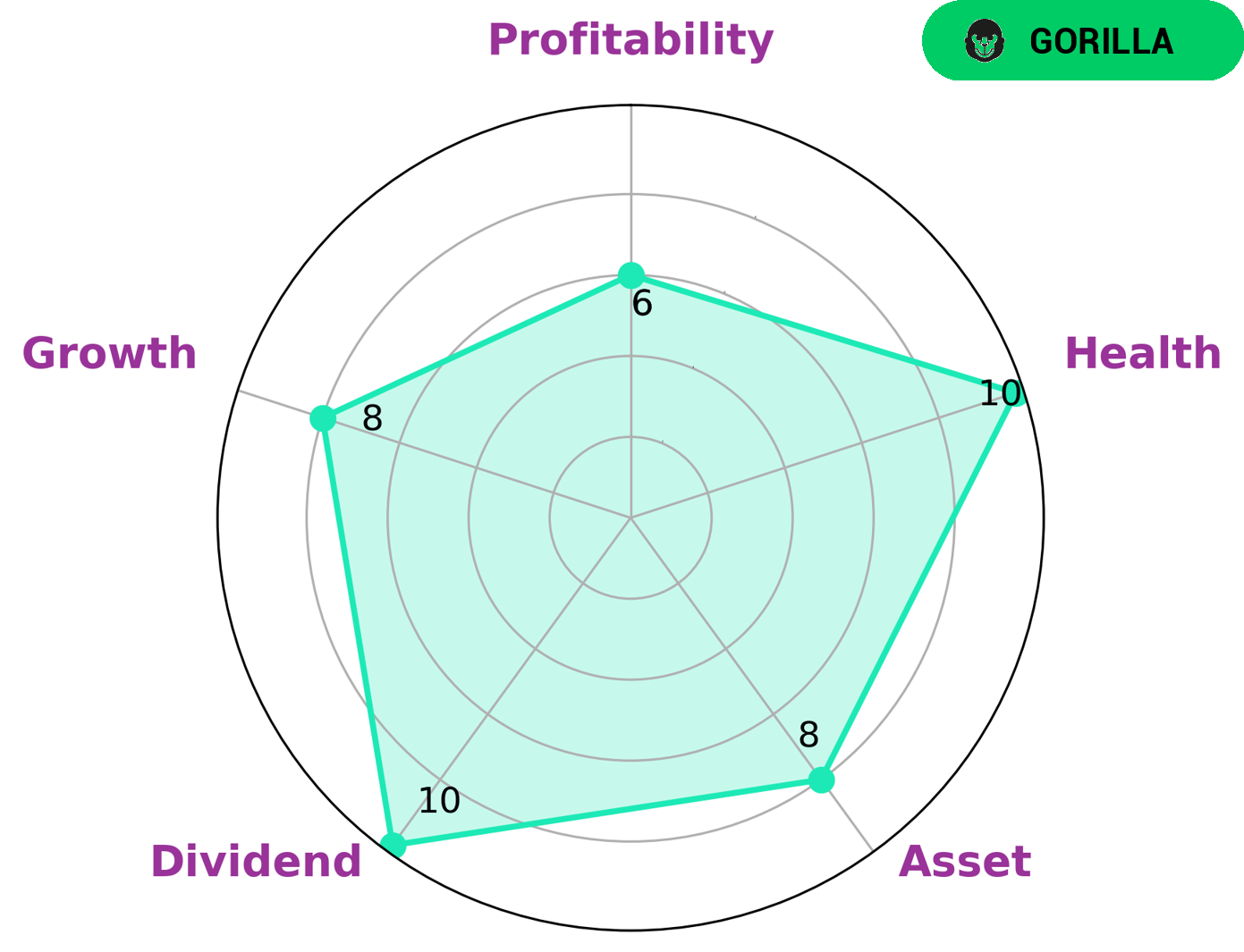

GoodWhale has conducted an analysis of TERNIUM S.A‘s financials and the results show that it has a very high health score of 10/10 when it comes to cashflows and debt, meaning that the company is capable to safely ride out any crisis without the risk of bankruptcy. The Star Chart also indicates that TERNIUM S.A is strong in asset, dividend, and growth, as well as having a medium score in terms of profitability. Furthermore, TERNIUM S.A is classified as a ‘gorilla’ company, which is characterized by achieving stable and high revenue or earning growth due to its strong competitive advantage. Investors that may be interested in such a company include those looking to invest in a safe, long-term option with potential for strong returns over time. Other investors may also be interested in companies with strong competitive advantages, as these companies are often more resilient to disruption and may be able to weather changes in the market. More…

Peers

In recent years, the Chinese steel industry has been undergoing a period of intense competition, with a number of major players vying for market share. Among them, Ternium SA has emerged as a key competitor, particularly in the production of high-quality steel products. The company has invested heavily in research and development in order to maintain its position as a leading player in the industry, and this has paid off in terms of both market share and profitability. While Ternium faces stiff competition from a number of other major Chinese steel producers, it is well-positioned to continue its growth in the years ahead.

– Lingyuan Iron & Steel Co Ltd ($SHSE:600231)

Lingyuan Iron & Steel Co Ltd is a Chinese steel producer with a market cap of $5.88B as of 2022. The company has a Return on Equity of -2.8%. Lingyuan Iron & Steel Co Ltd produces a variety of steel products including pipes, plates, and coils. The company has over 3,500 employees and operates in China, Europe, and the United States.

– Daehan Steel Co Ltd ($KOSE:084010)

Daehan Steel Co Ltd is a South Korean steel manufacturer. The company has a market cap of 232.09B as of 2022 and a Return on Equity of 28.52%. Daehan Steel Co Ltd is a leading manufacturer of steel products in South Korea. The company produces a wide range of steel products, including hot rolled coils, cold rolled coils, galvanized steel coils, and pre-painted steel coils.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd is a Chinese steel company with a market cap of 5.72 billion as of 2022. The company has a Return on Equity of -24.16%. The company is involved in the production of iron and steel products.

Summary

Ternium S.A. has recently reported its fourth quarter 2023 earnings, with non-GAAP earnings per share of $0.20, lower than the expected numbers. Despite the unexpected results, the stock price has moved up the same day. This suggests that the market is bullish on the company’s future prospects and sees potential for further growth.

It is important to note that media exposure has mostly been negative as of this writing, and investors should proceed with caution when making investing decisions. Analyzing industry trends and analyzing financial statements are essential in evaluating the long-term viability of any company.

Recent Posts