GlobalFoundries Shares Rise as Loop Capital Initiates Coverage with Buy Rating, Citing Profits and Industry Transformation

January 31, 2023

Trending News ☀️

GLOBALFOUNDRIES ($NASDAQ:GFS): On Tuesday, premarket trading revealed a slight rise in GlobalFoundries’ shares as Loop Capital initiated coverage of the international semiconductor foundry with a buy rating. GlobalFoundries is one of the world’s leading semiconductor foundries, providing services to customers in the automotive, Internet of Things, data center, and smart device industries. Charles Park, the analyst, argued that GlobalFoundries is well-positioned to capitalize on the developing trends in multiple industries. He believes the chip fabricating industry is in a period of transformation, which could be beneficial to GlobalFoundries, likely due to the current chip deficit, escalating geopolitical issues, and the company’s own profits that are on the rise from 15% in 2021 to an expected 28% in 2022. Park is optimistic that GlobalFoundries will reach its 40% profitability goal in the near future. GlobalFoundries’ focus on customer service has enabled it to build strong relationships across a wide range of industries. The company strives to create solutions that meet customer needs and ensure reliability and consistency. Its research and development efforts have resulted in a range of services and products that are tailored to meet each customer’s unique requirements.

In addition, GlobalFoundries has an experienced management team that is experienced in the semiconductor industry and understands the needs of the customer base. This has enabled them to be agile in their approach to developing solutions and responding to industry changes quickly and efficiently. All these factors have convinced Loop Capital of GlobalFoundries’ potential for growth and profitability in the coming years. The buy rating and slight rise in share prices on Tuesday show that investors are beginning to take notice of GlobalFoundries and its potential for success. With its expertise, customer-centric approach, and experienced leadership team, GlobalFoundries is well-positioned to be a leader in the semiconductor industry for years to come.

Price History

On Tuesday, GLOBALFOUNDRIES INC stock opened at $58.0 and closed at $59.0, up by 0.6% from last closing price of 58.7. Loop Capital is a full-service investment bank and financial services firm. Loop Capital’s research report noted that GLOBALFOUNDRIES INC has a strong presence in the semiconductor industry. GLOBALFOUNDRIES INC’s stock has seen a steady rise over the past year.

The company’s strong financial performance, combined with its participation in the industry’s transformation, is likely to continue to drive the stock upwards in the future. Analysts at Loop Capital have suggested that investors should consider buying GLOBALFOUNDRIES INC shares as part of their long-term investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Globalfoundries Inc. More…

| Total Revenues | Net Income | Net Margin |

| 7.85k | 822.69 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Globalfoundries Inc. More…

| Operations | Investing | Financing |

| 3.28k | -3.63k | 1.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Globalfoundries Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.21k | 8.13k | 16.58 |

Key Ratios Snapshot

Some of the financial key ratios for Globalfoundries Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.1% | – | 12.7% |

| FCF Margin | ROE | ROA |

| 7.2% | 7.1% | 3.6% |

VI Analysis

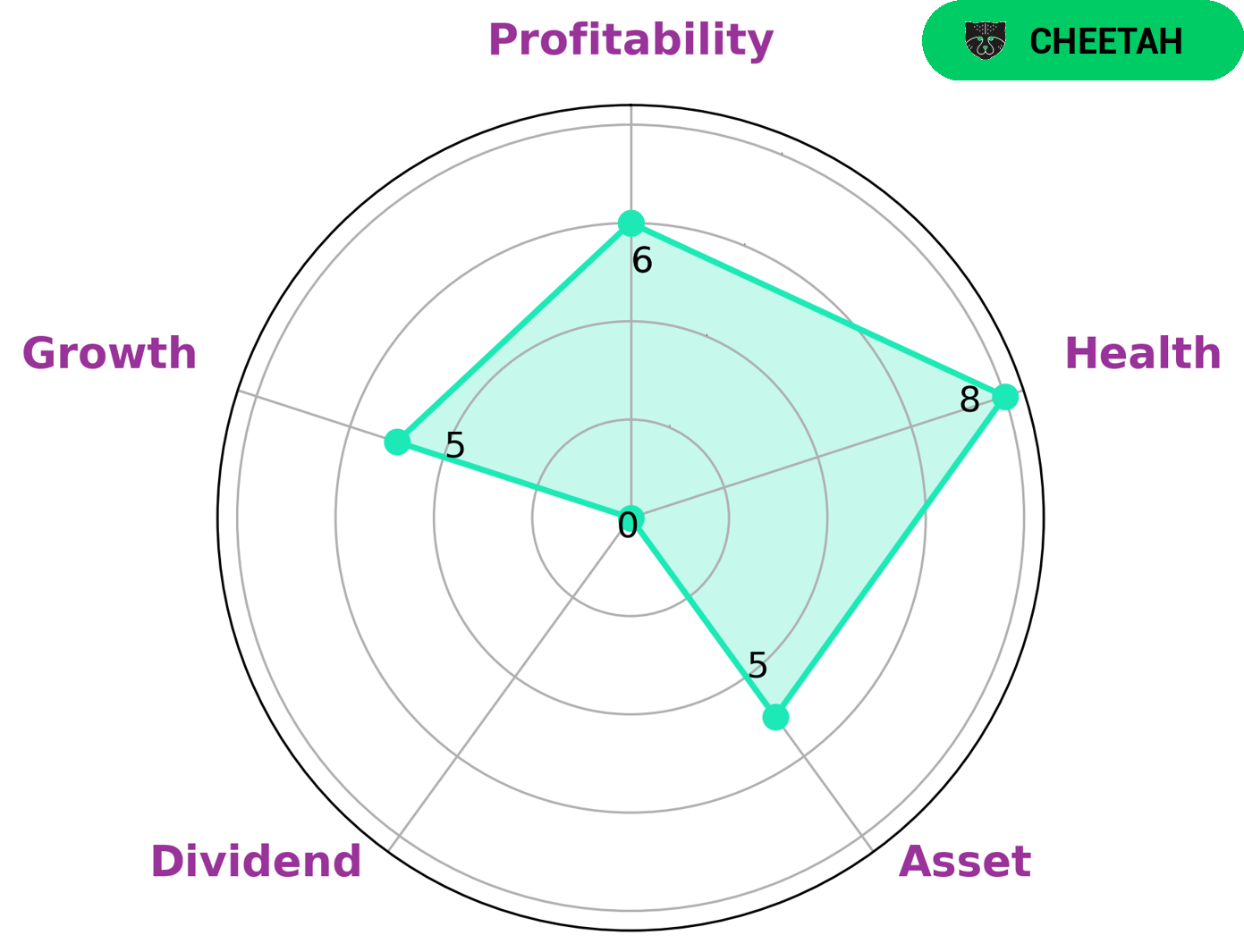

GLOBALFOUNDRIES INC is a company with strong fundamentals reflected in its high health score of 8/10, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Analyzing its performance further, it is considered strong in terms of asset, medium in terms of growth, profitability and weak in dividend. This suggests that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in GLOBALFOUNDRIES INC should consider its current financial position as well as its long-term potential. It could be an attractive investment opportunity for those looking for a company that is likely to experience significant growth in the future. However, it is important to note that there is always some risk involved and investors should take into account the company’s current financial position before making any decisions. Those who are risk-averse may want to look elsewhere for more stable investments. On the other hand, those who are willing to take some risks and have a long-term investment horizon may find GLOBALFOUNDRIES INC an attractive investment opportunity. Its current financial position and potential for growth suggest that it could be a profitable investment in the long run. More…

VI Peers

With the technological advances in the semiconductor industry, the competition between foundries has become increasingly fierce. GLOBALFOUNDRIES Inc, a leading foundry company, has been locked in a battle with its competitors, Advanced Micro Devices Inc, Taiwan Semiconductor Manufacturing Co Ltd, and Intel Corp. In order to maintain its competitive edge, GLOBALFOUNDRIES has made significant investments in cutting-edge manufacturing technologies and has been aggressively expanding its production capacity.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

Advanced Micro Devices, Inc. (AMD) is an American multinational semiconductor company based in Santa Clara, California, that develops computer processors and related technologies for business and consumer markets. AMD’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations and personal computers, and embedded systems applications.

As of 2022, AMD has a market cap of $93.57 billion and a return on equity (ROE) of 4.13%. The company’s products are used in a variety of electronic devices, including personal computers, game consoles, and servers. AMD is a leading supplier of microprocessor technology for the PC market.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

Taiwan Semiconductor Manufacturing Co Ltd is a semiconductor foundry. The company has a market cap of 10.29T as of 2022 and a Return on Equity of 22.34%. Taiwan Semiconductor Manufacturing Co Ltd is the world’s largest dedicated semiconductor foundry and one of the largest fabless semiconductor companies. The company offers a comprehensive set of IC design enablement tools, libraries, IPs, design services, advanced packaging, test and yield optimization solutions to help customers accelerate time-to-market.

– Intel Corp ($NASDAQ:INTC)

Intel Corp. is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer based on revenue and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

The company’s market cap is $108.48B as of 2022 and has a return on equity of 19.16%. Intel Corp is a technology company that designs and manufactures computer processors and other components. The company is headquartered in Santa Clara, California, in the Silicon Valley.

Summary

Loop Capital has initiated coverage of GlobalFoundries Inc with a buy rating, citing the company’s strong profits and its role in transforming the semiconductor industry. GlobalFoundries Inc is an American semiconductor manufacturer which produces integrated circuits for a variety of industries. Investors are confident that GlobalFoundries Inc’s innovative products and lucrative profit margins will lead to continued success in the future, pushing their shares up. The company is well-positioned to benefit from the increasing demand for semiconductors and their role in the transformation of the industry.

Recent Posts