Ellomay Capital Reports Record Quarterly Revenues of $8.64M, EPS of $0.27

April 3, 2023

Trending News 🌥️

The company reported a gross profit of $8.64 million and earnings per share of $0.27. This marks a significant milestone for Ellomay Capital ($NYSEAM:ELLO), as it marks the company’s highest quarterly revenues and earnings in its history. The company’s strong results were driven by an increase in the number of customers, higher electricity prices, and reduced operations costs.

This enabled the company to invest more in its growth initiatives and to fund further expansion. Overall, the company is well-positioned for continued success.

Stock Price

On Friday, ELLOMAY CAPITAL reported record quarterly revenues of $8.64M and earnings per share of $0.27. The company’s stock opened at $12.2 and closed at $12.0, a 6.0% drop from the prior closing price of 12.8. This record performance was attributed to the company’s aggressive capital management strategy and ability to adapt quickly to changing market conditions. The company is committed to continue building upon its success and remains confident in its ability to further solidify its position as a leader in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ellomay Capital. More…

| Total Revenues | Net Income | Net Margin |

| 53.36 | -0.36 | -1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ellomay Capital. More…

| Operations | Investing | Financing |

| 11.32 | -24.38 | 22.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ellomay Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 576.16 | 493.08 | 7.15 |

Key Ratios Snapshot

Some of the financial key ratios for Ellomay Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.1% | -16.9% | 25.6% |

| FCF Margin | ROE | ROA |

| -69.9% | 9.6% | 1.5% |

Analysis

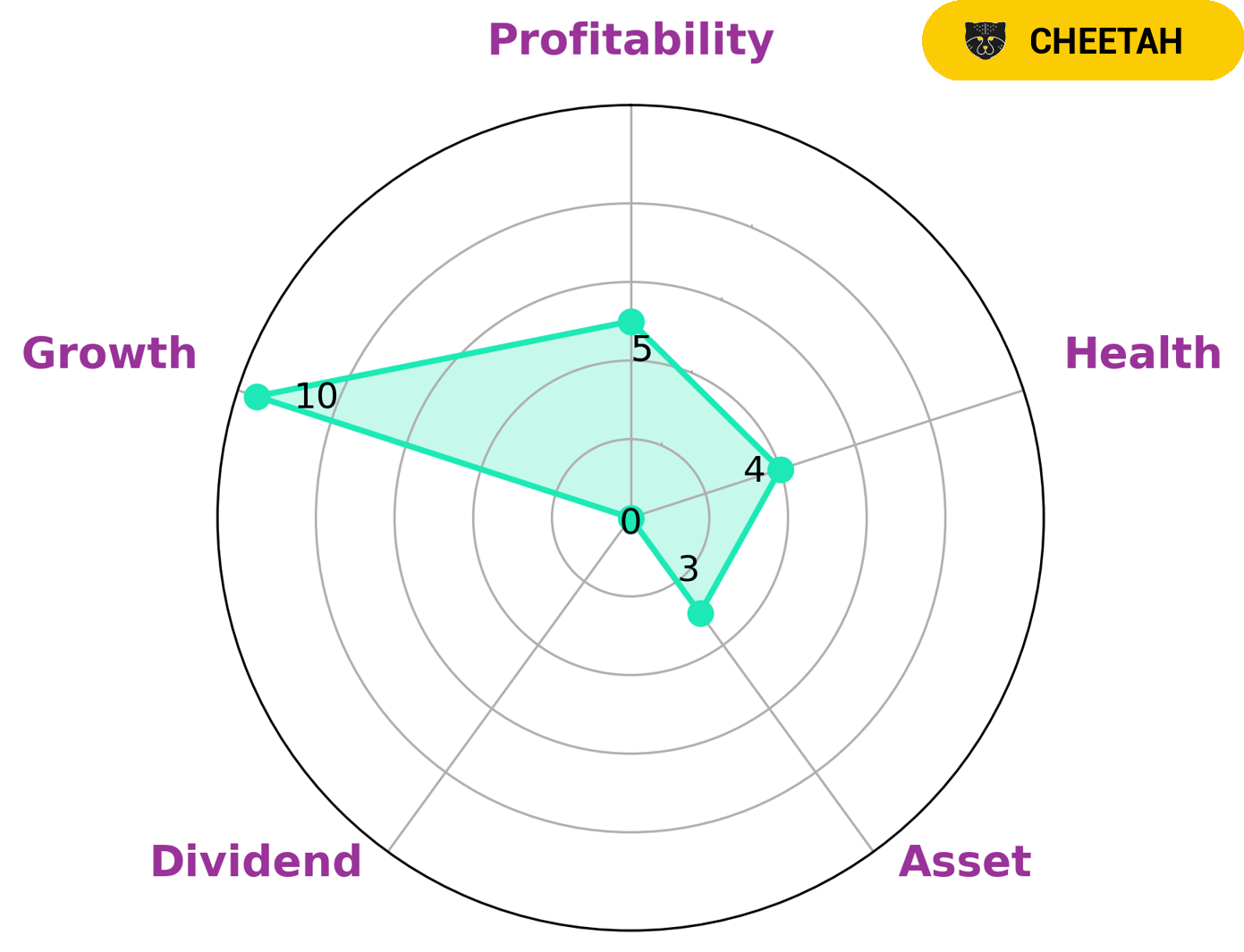

At GoodWhale, we conducted an analysis of ELLOMAY CAPITAL‘s wellbeing. Our assessment, based on the Star Chart, revealed that ELLOMAY CAPITAL is strong in growth, medium in profitability and weak in asset and dividend. We classified this company as a ‘cheetah’, one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this data, we believe that ELLOMAY CAPITAL may be of interest to investors seeking higher rewards through growth but must take into account the lower stability associated with the cheetah classification. We also determined that ELLOMAY CAPITAL has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The competition between Ellomay Capital Ltd and its competitors is fierce. Each company is vying for a share of the renewable energy market, and each has its own strengths and weaknesses. Ellomay Capital Ltd has a strong financial backing, and its experience in the industry gives it a leg up on the competition.

However, its competitors are not to be underestimated. SAAM Energy Development PCL has a strong presence in the Southeast Asian market, and Magnora ASA has a strong technological edge. Tidewater Renewables Ltd is a new player in the industry, but its innovative approach to renewable energy development could give it a competitive advantage.

– SAAM Energy Development PCL ($SET:SAAM)

SAAM Energy Development PCL has a market cap of 1.98B as of 2022, a Return on Equity of 13.96%. The company is engaged in the business of power generation and distribution in Thailand.

– Magnora ASA ($LTS:0MHQ)

Magnora ASA is a Norwegian-based company engaged in the development and commercialization of advanced technology solutions. The Company’s core technology is a nanomaterial with unique properties that can be used in a wide range of applications. Magnora’s nanomaterial is based on carbon nanotubes and has been shown to be up to 1,000 times more conductive than copper, making it an ideal material for a variety of applications in the electronics industry. Magnora is also developing applications for its nanomaterial in the renewable energy, automotive, and aerospace industries.

– Tidewater Renewables Ltd ($TSX:LCFS)

Tidewater Renewables Ltd is a renewable energy company that focuses on the development, construction, and operation of renewable energy projects. The company has a market cap of 441.54M as of 2022 and a Return on Equity of -15.75%. Tidewater Renewables Ltd’s main business activities include the development, construction, and operation of renewable energy projects. The company has a strong focus on the development of offshore wind farms.

Summary

Ellomay Capital is an Israeli publicly traded company in the energy sector. It provides a range of services including solar energy, hydroelectricity, biogas and other renewable energy sources. Recently, the company posted its quarterly results, showing GAAP earnings per share (EPS) of $0.27 and revenue of $8.64 million. On the same day, the stock price moved down, likely due to investors not being impressed with the results. Ellomay Capital has seen fairly volatile trading over the last year, with some positive and negative news affecting the stock price. Investors should be aware of the risks that come with investing in this company and monitor the news for potential changes in sentiment. To make an informed decision about investing in Ellomay Capital, investors should analyze the company’s financials and research the industry for potential catalysts.

Additionally, investors should look for potential partnership opportunities that may help drive the stock price in the future.

Recent Posts