Par Pacific Shares Growth Plans During January Investor Presentation

January 7, 2023

Trending News ☀️

Par Pacific ($NYSE:PARR) is a leading energy and logistics company that trades on the New York Stock Exchange under the ticker symbol PARR. The company is headquartered in Houston, Texas and has operations in the United States and Canada. The presentation focused on the company’s commitment to safety, environmental protection, and operational excellence, as well as how they plan to increase their profits through the expansion of their current operations. Par Pacific executives discussed the company’s strategies for increasing its presence in the North American market. The company plans to expand its network of refineries and terminals, invest in new technology, and focus on capitalizing on opportunities in the energy sector.

Par Pacific also plans to acquire new assets in order to further diversify their portfolio. The company plans to reduce their environmental impact by investing in low-carbon technologies and renewable energy sources. Par Pacific is also dedicated to developing innovative products and services that will help reduce energy consumption. With their focus on safety, environmental protection, and operational excellence, Par Pacific is sure to continue providing energy solutions to customers for many years to come.

Share Price

Par Pacific has been receiving a lot of positive media coverage recently, which has been reflected in their stock performance. On Friday, PAR PACIFIC stock opened at $22.5 and closed at $22.6, up by 2.2% from prior closing price of 22.1. This growth can be attributed to the company’s recent investor presentation held in January. They outlined their strategies for increasing revenue and profitability, as well as plans for improving their operations and customer experience. The presentation also included details about their long-term goals and objectives. They discussed plans to acquire new customers and build stronger relationships with existing ones, as well as ways to develop new products and services that meet the needs of the market.

They also highlighted the importance of investing in research and development, in order to remain competitive. Overall, the presentation received positive feedback from investors and analysts alike. PAR PACIFIC shares have been steadily increasing since the presentation, showing that investors are confident in the company’s growth plans. With the continued support of their investors, PAR PACIFIC looks set to continue their impressive growth trajectory in the coming months and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Par Pacific. More…

| Total Revenues | Net Income | Net Margin |

| 6.81k | 287.56 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Par Pacific. More…

| Operations | Investing | Financing |

| -1.78 | 74.63 | -1.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Par Pacific. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.25k | 2.97k | 4.63 |

Key Ratios Snapshot

Some of the financial key ratios for Par Pacific are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 44.5% | 5.2% |

| FCF Margin | ROE | ROA |

| -0.7% | 79.7% | 6.8% |

VI Analysis

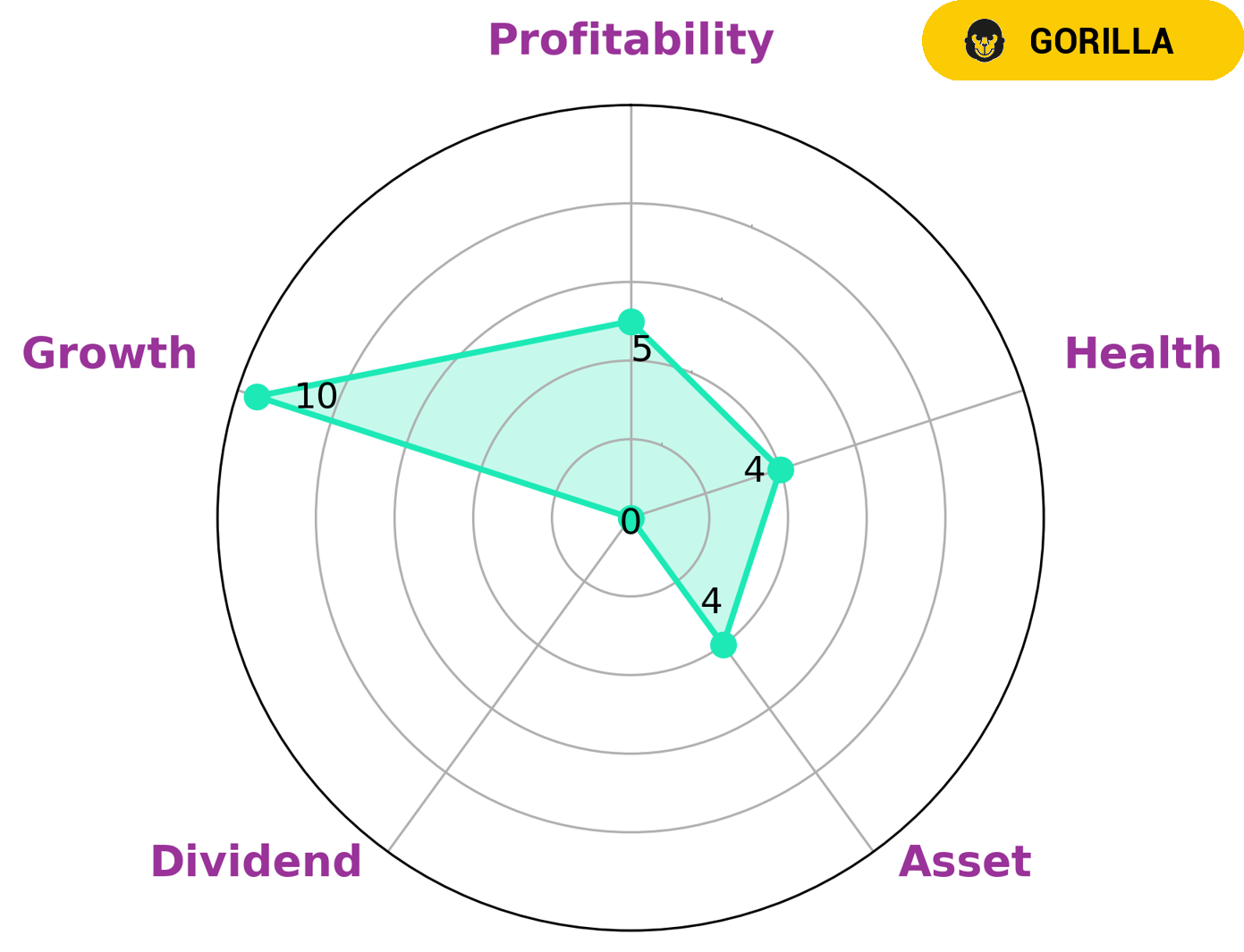

Company fundamentals are an important indicator of a company’s long-term potential and can be quickly assessed using the VI app. In the case of PAR PACIFIC, the VI Star Chart shows that it is strong in growth, but medium in asset, profitability, and dividend. PAR PACIFIC is classified as a ‘gorilla’, meaning it has achieved high and stable revenue or earning growth due to its strong competitive advantage. This type of company may be of interest to investors who are looking for a long-term investment with potential for growth. They may also be interested in its intermediate health score of 4/10 with regard to its cashflows and debt, meaning that its operations are likely to be sustainable in times of crisis. In conclusion, PAR PACIFIC is a company with strong fundamentals, making it an attractive option for investors looking to make a long-term investment. Its intermediate health score ensures that the company is likely to survive through difficult times, making it an even more attractive option for investors. More…

VI Peers

The competition among Par Pacific Holdings Inc and its competitors is fierce. CVR Energy Inc, HF Sinclair Corp, and PBF Energy Inc are all major players in the petroleum refining industry, and each company is striving to gain market share. The company’s innovative approach to refining has allowed it to quickly gain market share and become a major competitor.

– CVR Energy Inc ($NYSE:CVI)

CVR Energy Inc. is a petroleum refining and marketing company. It owns and operates two petroleum refineries in the United States. CVR Energy’s operations are conducted through its subsidiaries, CVR refining LP and CVR Partners LP. The company was founded in 2008 and is headquartered in Sugar Land, Texas.

– HF Sinclair Corp ($NYSE:DINO)

Sinclair Broadcast Group, Inc. is one of the largest and most diversified television broadcasting companies in the country. The company owns, operates and/or provides services to more than 190 television stations in 89 markets. Sinclair is the leading local news provider in the country, as well as a producer of sports content. Sinclair’s content is delivered via multiple-platforms, including over-the-air, multi-channel video program distributors, and digital platforms. The company also owns and operates the Tennis Channel and the Ring of Honor professional wrestling promotion.

– PBF Energy Inc ($NYSE:PBF)

PBF Energy Inc is an American oil refining and marketing company. The company owns and operates oil refineries in the United States. PBF Energy Inc has a market cap of 5.73B as of 2022 and a Return on Equity of 52.76%. The company’s primary business is the refining of crude oil into petroleum products. PBF Energy Inc also owns and operates a petrochemical plant in Delaware City, Delaware.

Summary

Par Pacific Holdings Inc. (PAR) has been seeing positive sentiment from the investing community since its January investor presentation, where the company outlined its growth plans for the foreseeable future. PAR has a diversified portfolio of energy assets, including transportation and refining, as well as retail and midstream operations. The company is focused on expanding its presence in the U.S. and has seen recent success in increasing its market share in Hawaii.

PAR is looking to leverage the strength of its portfolio to capitalize on opportunities to increase profitability, including investing in new projects and acquisitions. Overall, PAR has been making strides to position itself as a leader in the energy industry and investors have responded positively to their growth plans.

Recent Posts