Zacks Research Downgrades EPS Estimate for Imperial Oil Limited in 2023

January 6, 2023

Trending News 🌧️

Imperial Oil ($TSX:IMO) Limited is a Canadian integrated oil and gas company with operations across the nation. It is a subsidiary of ExxonMobil and is the country’s largest producer of crude oil and natural gas. The company has a wide network of refineries, terminals, and pipelines to transport and market its products. Recently, Zacks Research has downgraded their EPS estimates for Imperial Oil Limited in 2023. Zacks also noted that the company’s capital expenditure plans are likely to reduce its free cash flow in the near term. This news has caused a dip in the stock price of Imperial Oil Limited.

Investors are advised to exercise caution when considering investments in this stock. The company may face additional risks if the global economy does not recover as expected. It is important to do thorough research and analysis before investing in this stock. Investors should take this news into consideration when making investment decisions.

Market Price

This news caused the stock price to open at CAD$65.7 and close at CAD$63.3, a decrease of 4.0% from its previous closing price of 66.0. The news coverage of this downgrade has been mostly negative. It operates in a variety of sectors including exploration, production, refining, transportation, and marketing of oil and gas products. The company has been facing financial issues due to the current economic climate, leading to the Zacks Research downgrade. Imperial Oil has been actively working to reduce costs, improve efficiency, and increase production to help offset the effects of the economic downturn. Despite this, the EPS estimates for 2023 are still lower than expected. Investors should be aware of the risks associated with investing in such a large oil and gas company, particularly in light of the decreased EPS estimates for 2023. It is important to stay up to date on the company’s performance and any news updates that could affect its stock price.

Additionally, investors should consider other factors such as potential risks and rewards associated with investing in Imperial Oil Limited before making any decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Imperial Oil. More…

| Total Revenues | Net Income | Net Margin |

| 50.36k | 2.48k | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Imperial Oil. More…

| Operations | Investing | Financing |

| 9.32k | -544 | -7.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Imperial Oil. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 44.89k | 22.91k | 35.94 |

Key Ratios Snapshot

Some of the financial key ratios for Imperial Oil are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 34.6% | 9.4% |

| FCF Margin | ROE | ROA |

| 15.6% | 9.7% | 5.1% |

VI Analysis

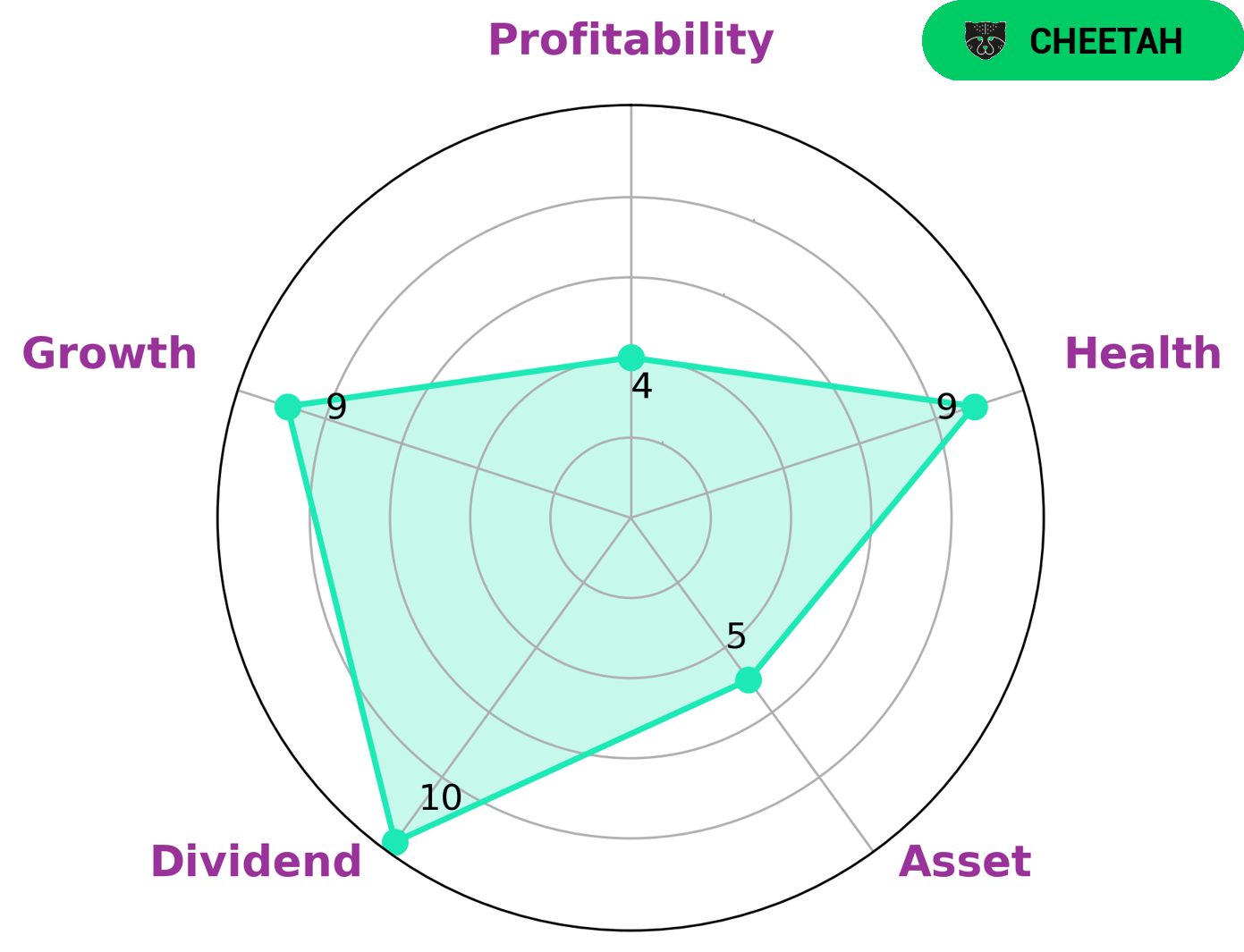

IMPERIAL OIL is a company with strong fundamentals that reflect its long-term potential. According to the VI Star Chart, IMPERIAL OIL has a high health score of 9/10, indicating that it has the capability to pay off its debts and fund future operations. It is classified as a ‘Cheetah’ type of company, which is a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This makes it an attractive option for investors looking for high returns from dividend payments, as well as those who are seeking growth in the market. The company also has a medium rating for asset and profitability, making it a more moderate choice for those who want both stability and growth opportunities. However, those looking for higher returns may find this company more suitable than others. Overall, IMPERIAL OIL is a strong and stable company with good prospects for the future. With its high health rating, strong dividend payments, and moderate asset and profitability ratings, it is an attractive option for investors who are looking for both stability and growth opportunities. More…

VI Peers

Its main competitors include Cenovus Energy Inc, YPF SA, and Equinor ASA. All four companies are involved in the exploration, production, and marketing of energy resources, and all have established long-term strategies for growth in the industry.

– Cenovus Energy Inc ($TSX:CVE)

Cenovus Energy Inc is a Calgary-based integrated oil and natural gas company that focuses on the development, production and marketing of crude oil, natural gas and natural gas liquids. As of 2022, Cenovus Energy Inc has a market capitalization of 47.01 billion, making it one of the largest oil and gas companies in Canada. The company also boasts a solid Return on Equity of 19.76%, which is higher than the industry average of 18.2%. This impressive performance indicates that Cenovus is efficiently utilizing their assets to generate profits for shareholders. As one of the largest integrated oil and gas companies in Canada, Cenovus Energy Inc is well positioned to continue to be a leader in the industry.

– YPF SA ($BER:YPF)

YPF SA is an integrated oil and gas company based in Argentina. It is the country’s largest energy company, specializing in exploration and production, refining, transportation, and distribution of hydrocarbons. The company’s market cap of 2.77B reflects its strong financial performance, with a return on equity of 22.79%. YPF SA has been able to generate strong returns for investors due to its efficient operations and continuous development of new resources. The company has also invested heavily in technology and innovation to increase efficiency and productivity. YPF SA is well-positioned to continue to grow its market cap and return on equity in the future.

– Equinor ASA ($OTCPK:STOHF)

Equinor ASA is a multinational energy company based in Norway. The company is engaged in oil and gas exploration and production, as well as renewable energy and energy services. As of 2021, the company has a market capitalization of 111.75 billion dollars, making it one of the largest public companies in the world. Additionally, the company has an impressive return on equity of 116.26%, reflecting strong performance in its core business segments. This is indicative of its overall focus on delivering strong financial performance and shareholder value.

Summary

Imperial Oil (TSX:IMO) is a Canadian oil and gas company that focuses on exploration, production and development. Recently, Zacks Research downgraded Imperial Oil’s earnings per share (EPS) estimate for 2023. As news of the downgrade has spread, the market’s response has been mostly negative. Consequently, Imperial Oil’s stock price has dropped significantly.

Investors should consider their risk tolerance before investing in Imperial Oil, as the company’s outlook remains uncertain. It may be wise to wait and see how Imperial Oil’s future earnings prospects pan out before making an investment decision.

Recent Posts