EMBECTA CORP Seeks to Increase Capital Productivity and Profit Growth

May 6, 2023

Trending News ☀️

Embecta Corp ($NASDAQ:EMBC) is a leading technology company that specializes in providing innovative solutions to businesses of all sizes. The company is dedicated to helping its clients maximize their capital productivity and profit growth. Embecta’s main challenges in achieving this goal include increasing efficiency, reducing costs and improving customer service.

In addition, the company is aiming to expand its operations in order to reach new markets and customers. The company’s strategy to increase capital productivity and bring in more profits is to focus on improving the efficiency of their operations and leveraging the latest technological advancements. Embecta has invested in the development of a number of new products and services that are designed to increase efficiency and reduce costs.

Additionally, the company is working on ways to improve customer service by providing a more personalized experience for customers. Embecta has also been actively engaged in expanding its operations both domestically and internationally. The company is looking to enter into new markets and establish partnerships with other businesses in order to increase its reach and profitability. Embecta is also investing in research and development in order to stay ahead of the competition. Embecta Corporation is well-positioned to take advantage of the current market conditions and capitalize on its strengths in order to drive increased capital productivity and profit growth. With its innovative solutions, experienced leadership team, and commitment to excellence, Embecta is well-equipped to continue achieving great success in the future.

Share Price

Friday’s trading session saw EMBECTA CORP stock open at $29.0 and close at a higher price of $29.2, representing a 2.2% increase from the previous closing price of 28.5. The company is taking steps to improve the efficiency and performance of their investments, with a view to boosting profitability and long-term growth. Additionally, it appears that investors have responded positively to EMBECTA CORP’s announced plans for increased capital productivity, which has been reflected in the stock’s appreciation over the course of the day. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Embecta Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.12k | 160 | 18.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Embecta Corp. More…

| Operations | Investing | Financing |

| 333.8 | -24.4 | 80.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Embecta Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.2k | 2.03k | -14.61 |

Key Ratios Snapshot

Some of the financial key ratios for Embecta Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -9.8% | 24.0% |

| FCF Margin | ROE | ROA |

| 27.7% | -19.4% | 14.0% |

Analysis

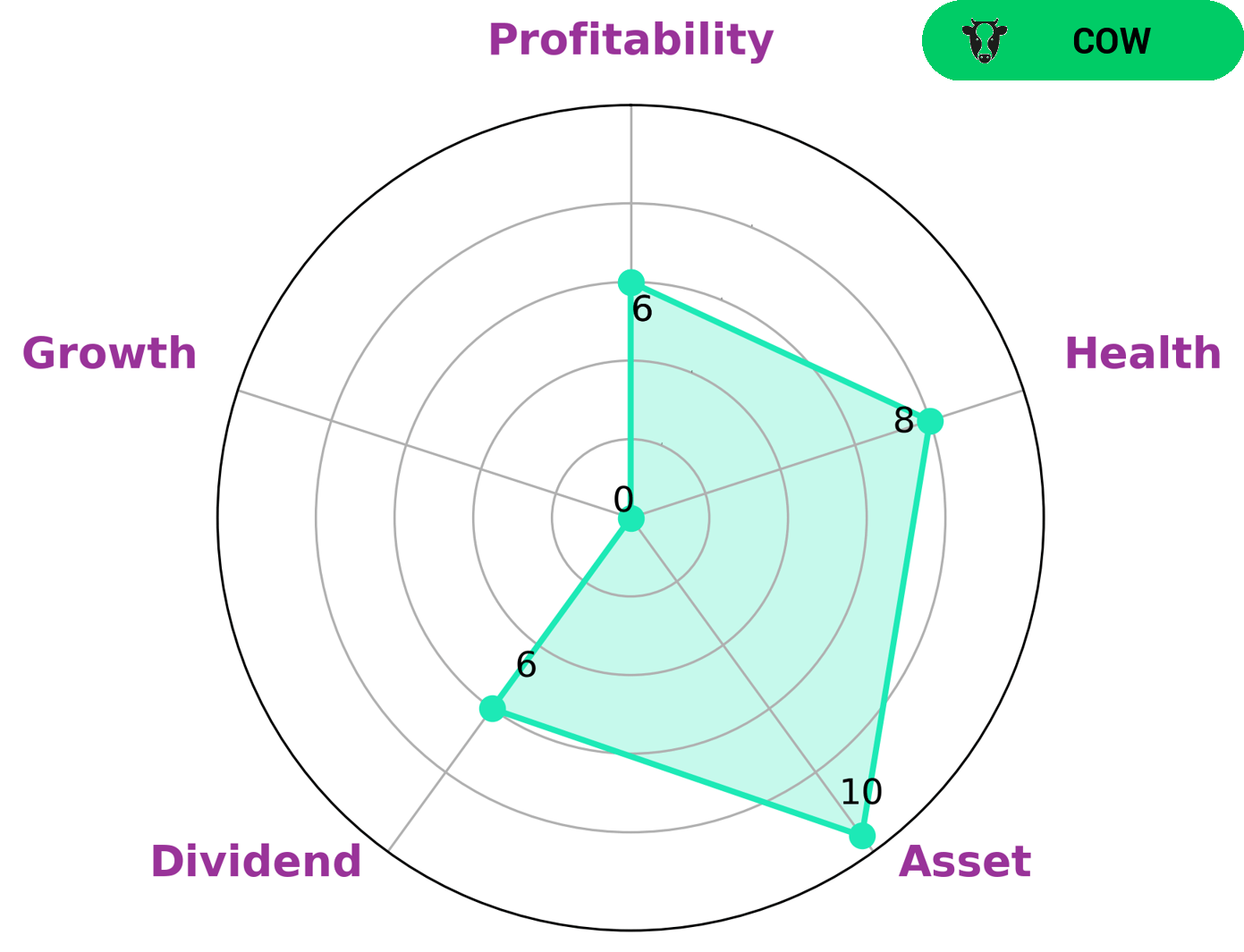

At GoodWhale, we analyze the financials of companies to determine their suitability for investors. After running our analysis on EMBECTA CORP, we have come to the conclusion that they are a “cow”, which means they have a track record of paying out consistent and sustainable dividends. This type of company would be attractive to conservative investors who prioritize stability over rapid growth. We have also given EMBECTA CORP a health score of 8/10, considering both their cashflows and debt. This suggests that the company is quite capable of sustaining future operations, even in times of crisis. Further examination of their financials reveals that the company is strong in terms of assets, medium in terms of dividend, profitability and weak in terms of growth potential. More…

Peers

The company was founded in 1980 and is headquartered in New York, NY. Embecta Corp‘s products include prescription drugs for the treatment of cardiovascular disease, diabetes, and cancer. The company’s competitors include Uluru Inc, RxSight Inc, and Modalis Therapeutics Corp.

– Uluru Inc ($OTCPK:ULUR)

RxSight Inc is a medical device company that develops and commercializes innovative ophthalmic implants that allow ophthalmologists to more precisely treat complex retinal diseases. As of 2022, the company has a market capitalization of 318.4 million and a return on equity of -31.3%.

– RxSight Inc ($NASDAQ:RXST)

Modalis Therapeutics Corp is a biopharmaceutical company that focuses on the development of therapeutics for the treatment of cancer and other diseases. The company has a market cap of 11.21B as of 2022 and a return on equity of -13.14%. Modalis Therapeutics Corp is headquartered in New York, New York.

Summary

Embecta Corp is a company focused on capital productivity and incremental profit growth. Investing analysis of the company requires understanding its current financial position, competitive advantages, and potential risks. To start, a thorough review of the company’s financial statements, including cash flow, income statement and balance sheet, is recommended. This will give an idea of the company’s current fiscal health and standing.

Additionally, an analysis of the competitive landscape can offer insight into the potential for growth and market share. Lastly, the business environment must be considered to assess any risk factors that may impact future performance.

Recent Posts