ANGIODYNAMICS: AngioVac Profit Headwinds Unappealing

May 25, 2023

Trending News ☀️

ANGIODYNAMICS ($NASDAQ:ANGO): AngioDynamics is a medical device company that specializes in vascular access, peripheral vascular, and oncology/surgery products. Their flagship product, AngioVac, is a device used to filter and remove diseased blood from the circulatory system. Despite its advantages, the company has recently experienced profit headwinds that make the product unappealing. The profit headwinds stem from the fact that AngioVac is a costlier alternative than traditional treatments such as bypass surgery or thrombolytic drugs.

Additionally, many medical personnel are unfamiliar with the product, which requires a learning curve to effectively use it. As a result of these factors, AngioDynamics has seen a slower uptake of the product and their profits have been affected. Given these headwinds, investors may think twice before investing in AngioDynamics. Although AngioVac has potential to be a great product, the current financial outlook is not attractive. With their profits under pressure, it may be best to wait for more favorable conditions before investing in this company.

Share Price

On Wednesday, AngioDynamics (ANGIODYNAMICS) stock opened at $9.8 and closed the day at $9.7, down by 0.6% from its last closing price of 9.7. This latest decline in stock price has been driven by increasing headwinds to its AngioVac product line. The AngioVac is a device used in the treatment of certain vascular conditions, and its sales have been impacted by increased competition from other medical companies in the space.

This, in turn, has led to a decrease in demand for the product and ultimately, a decrease in profits for AngioDynamics. These unfavorable trends have caused investors to be unappealing of the stock, leading to the overall decline in stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Angiodynamics. ANGIODYNAMICS_AngioVac_Profit_Headwinds_Unappealing”>More…

| Total Revenues | Net Income | Net Margin |

| 334.68 | -37.24 | -6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Angiodynamics. ANGIODYNAMICS_AngioVac_Profit_Headwinds_Unappealing”>More…

| Operations | Investing | Financing |

| -7.32 | -11.99 | 25.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Angiodynamics. ANGIODYNAMICS_AngioVac_Profit_Headwinds_Unappealing”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 542.85 | 145.19 | 10.33 |

Key Ratios Snapshot

Some of the financial key ratios for Angiodynamics are shown below. ANGIODYNAMICS_AngioVac_Profit_Headwinds_Unappealing”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 14.7% | -11.1% |

| FCF Margin | ROE | ROA |

| -3.3% | -5.7% | -4.3% |

Analysis

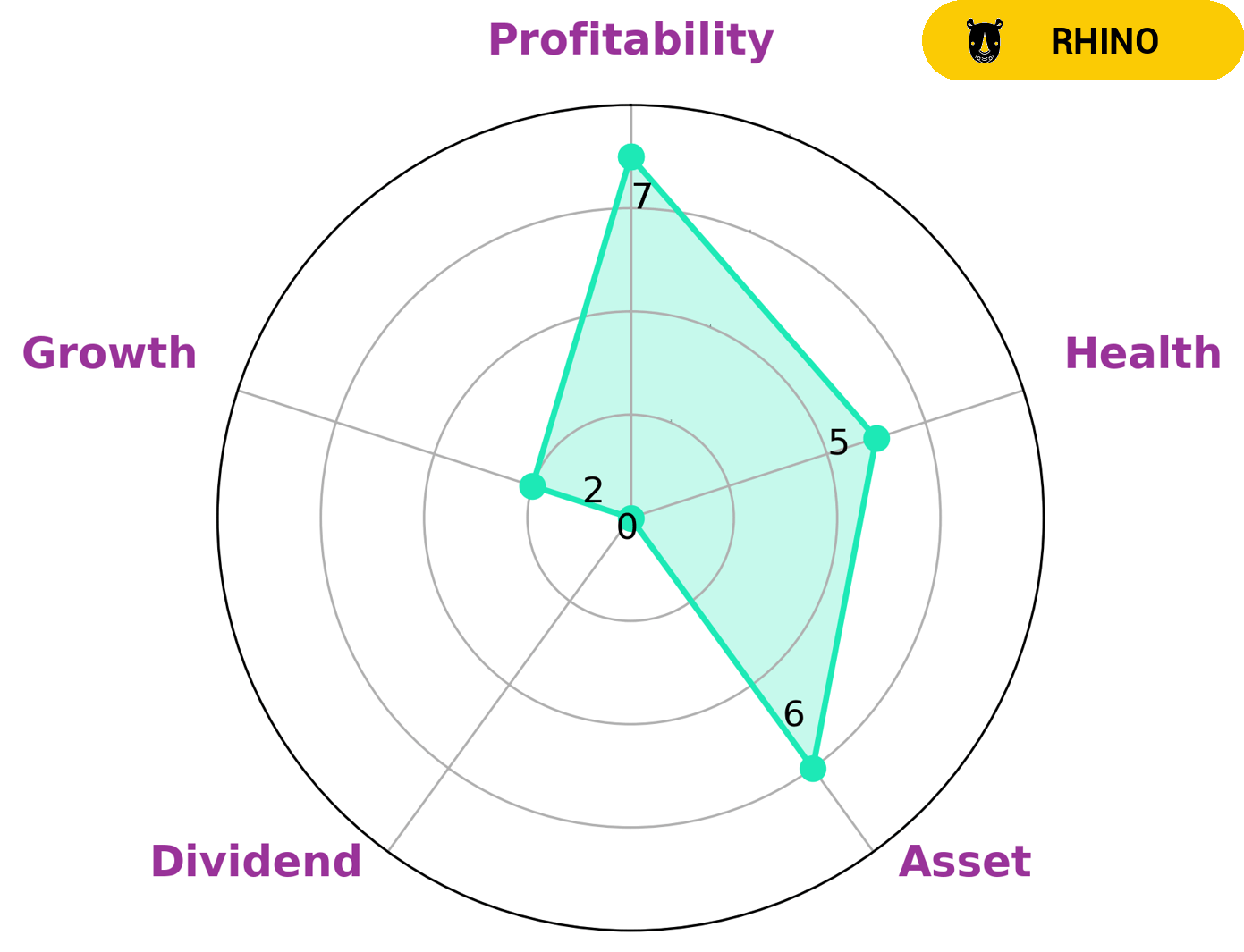

GoodWhale recently conducted an analysis of ANGIODYNAMICS‘s wellbeing. According to Star Chart, ANGIODYNAMICS has an intermediate health score of 5/10 considering its cashflows and debt. This indicates that the company might be able to pay off debt and fund future operations. After analyzing the company’s metrics, we have classified ANGIODYNAMICS as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given the company’s strengths and weaknesses, we think that investors who are looking for a long-term investment with a moderate potential for growth may be interested in ANGIODYNAMICS. Specifically, the company is strong in profitability, medium in asset and weak in dividend and growth. While ANGIODYNAMICS might not be the most exciting investment to make, it is a reliable stock with moderate potential for growth. More…

Peers

The competition between AngioDynamics Inc and its competitors is fierce. Each company is striving to be the best in the industry, and they are all fighting for market share. AtriCure Inc is a leading provider of surgical devices for the treatment of atrial fibrillation. LeMaitre Vascular Inc is a leading provider of products and services for the treatment of vascular diseases. NuVasive Inc is a leading provider of minimally invasive surgical products and services.

– AtriCure Inc ($NASDAQ:ATRC)

AtriCure, Inc. has a market cap of $2.1 billion as of 2022 and a return on equity of -7.05%. The company is a medical device company that specializes in the treatment of atrial fibrillation, or AFib. AFib is a type of irregular heartbeat that can lead to serious complications, including stroke. AtriCure’s devices are designed to correct the underlying cause of AFib, which is often an imbalance in the electrical signals that control the heart’s rhythm. The company’s products are approved for use in the United States, Europe, and Japan.

– LeMaitre Vascular Inc ($NASDAQ:LMAT)

LeMaitre Vascular Inc is a medical device company that develops, manufactures and markets medical devices for the treatment of peripheral vascular disease. The company’s products include endovascular and open surgical vascular devices. The company has a market cap of 1.01B as of 2022 and a ROE of 6.77%. The company’s products are used by vascular surgeons and interventionalists to treat aortic aneurysms, peripheral artery disease, venous disease and other vascular conditions.

– NuVasive Inc ($NASDAQ:NUVA)

NuVasive Inc is a medical device company that focuses on developing minimally invasive surgical products and procedures for spine conditions. As of 2022, the company has a market capitalization of 2.06 billion dollars and a return on equity of 0.29%. The company’s products are used in over 70 countries around the world and its procedures are performed on over 600,000 patients annually.

Summary

AngioDynamics is an American manufacturer of medical devices used in minimally invasive surgical procedures. Recent investment analysis on AngioDynamics has been mixed, with analysts citing low profit headwinds as a potential hurdle. Their flagship product, the AngioVac, is seen as a promising device, however it is not expected to significantly boost profits in the near future.

The device is being used in various clinical trials, and investors will be keeping a close eye on any potential developments. In the meantime, while there are some potential positives to investing in AngioDynamics, the profit headwinds may be too strong to make it an attractive option for investors.

Recent Posts