Photronics Intrinsic Value Calculation – Photronics Reports Impressive Q3 Results with Non-GAAP EPS of $0.54 and Revenue of $229.3M Surpassing Estimates

May 25, 2023

Trending News ☀️

Photronics ($NASDAQ:PLAB), Inc., a leading global supplier of photomasks and related services, has reported its third quarter results and surpassed expectations. Photronics’ non-GAAP earnings per share (EPS) of $0.54 exceeded estimates by $0.10, with revenue of $229.3M surpassing projections by $18.3M. This is a very impressive performance for the company as it continues to deliver strong financial results. The company offers its core photomask services, along with advanced optical imaging technologies and products, to a wide range of customer markets, including semiconductor devices, flat panel displays, MEMS, and data storage.

Photronics also provides specialized services for optoelectronic device manufacturing such as laser diodes, optical networks, and fiber optic components. Photronics’ strong performance in the third quarter is a testament to the effectiveness of its strategy in leveraging its photomask technology to gain market share. It is well positioned to continue delivering impressive results in the coming quarters as well.

Earnings

In its earning report of FY2023 Q1 ending January 31 2023, PHOTRONICS earned 211.09M USD in total revenue, 13.99M USD in net income. This translates to an impressive 11.2% increase in total revenue compared to the previous year and a significant 39.3% decrease in net income. These results demonstrate PHOTRONICS’ continued commitment to provide quality products and services to its customers.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Photronics. More…

| Total Revenues | Net Income | Net Margin |

| 845.81 | 109.71 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Photronics. More…

| Operations | Investing | Financing |

| 243.74 | -158.71 | -48.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Photronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.44k | 258.96 | 13.68 |

Key Ratios Snapshot

Some of the financial key ratios for Photronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | 56.1% | 29.9% |

| FCF Margin | ROE | ROA |

| 14.1% | 18.1% | 11.0% |

Market Price

PHOTRONICS, a leading provider of photomask and photomask technology solutions, reported impressive third-quarter results on Wednesday, surpassing analysts’ estimates. The company’s Non-GAAP EPS was $0.54, while revenue stood at $229.3M. On the day, the stock opened at $18.9 and closed at $18.4, representing an increase of 6.7% from its previous closing price of 17.2. This is in line with the strong demand for its products as businesses increasingly rely on automated manufacturing processes to remain competitive in the market. Photronics_Reports_Impressive_Q3_Results_with_Non-GAAP_EPS_of_0.54_and_Revenue_of_229.3M_Surpassing_Estimates”>Live Quote…

Analysis – Photronics Intrinsic Value Calculation

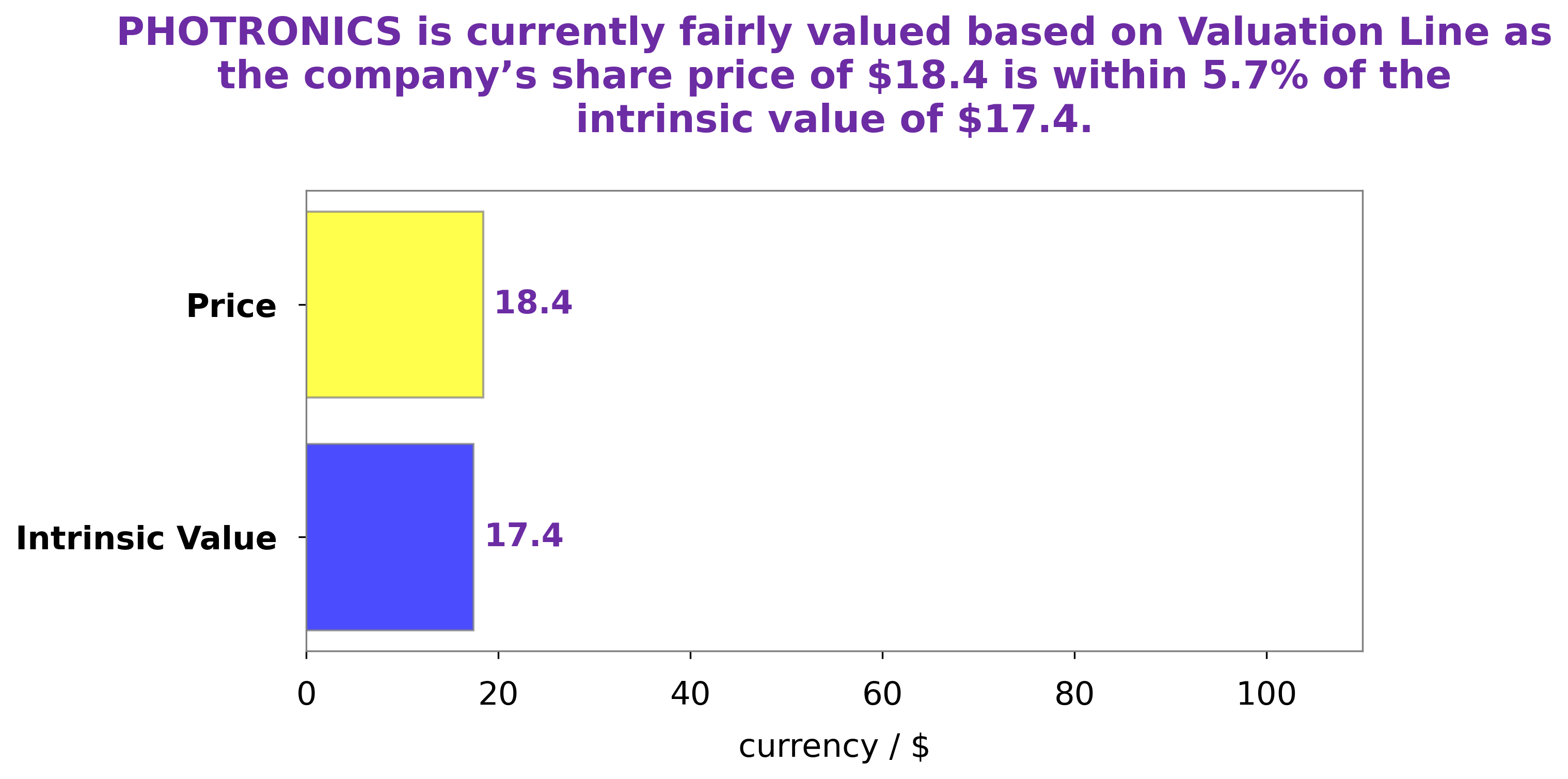

At GoodWhale, we recently did an analysis of PHOTRONICS’s fundamentals. After looking at their financials and making calculations, our proprietary Valuation Line tool determined that the intrinsic value of PHOTRONICS’s share is around $17.4. Currently, PHOTRONICS’s stock is being traded at $18.4, a fair price that is slightly overvalued by 5.9%. Our analysis suggests that the stock might not be a good long-term investment for investors seeking to maximize returns on their investments. Photronics_Reports_Impressive_Q3_Results_with_Non-GAAP_EPS_of_0.54_and_Revenue_of_229.3M_Surpassing_Estimates”>More…

Peers

They specialize in photomask products and services, including photomask design, mask-making, and mask-processing. Photronics Inc has a strong presence in the photomask industry, providing high quality products and services to their customers.

– Veeco Instruments Inc ($NASDAQ:VECO)

Veeco Instruments Inc is a leading global provider of enabling technologies for the production of advanced semiconductor, LED, and other compound optoelectronic devices. Its products are used by customers in the data storage, wireless, display, and other markets. As of 2022, the company has a market cap of 1 billion dollars and a Return on Equity of 9.03%. This figure is an indication that the company is generating profits from its operations and is efficiently utilizing its shareholders’ investments to generate returns. Veeco Instruments Inc is well positioned for continued growth and success in the semiconductor and optoelectronic industries.

– Orient Semiconductor Electronics Ltd ($TWSE:2329)

Orient Semiconductor Electronics Ltd is a leading global semiconductor company that designs, manufactures, and sells a wide range of electronic components and devices. With a market cap of 10.25B as of 2022, Orient Semiconductor is one of the most valuable companies in the semiconductor industry. Additionally, the company has an impressive Return on Equity of 14.91%, indicating that it is generating strong returns on its investments.

– Nova Ltd ($NASDAQ:NVMI)

Nova Ltd is a leading international manufacturer of consumer electronics. With a market cap of 2.56B as of 2022 and a Return on Equity of 19.83%, the company is well-positioned to continue its success in the future. Its market cap indicates that it has a large presence in the industry and its high return on equity shows that it is efficiently using its shareholders’ investments to generate profits. Nova Ltd is committed to providing innovative products to meet the needs of its customers, while delivering superior value and quality.

Summary

Photronics is a leading global supplier of photomasks for semiconductor device fabrication, with a strong financial performance. Their non-GAAP EPS of $0.54 exceeded analyst expectations by $0.10, and revenue of $229.3M beat estimates by $18.3M. This impressive showing caused the stock price to move up the same day, which is a positive sign for investors.

Looking forward, analysts believe that Photronics will continue to benefit from strong demand for their products and services, particularly from the expanding semiconductor industry. With its solid financials and growth potential, Photronics is an attractive option for investors seeking exposure to the semiconductor space.

Recent Posts