Micron Technology Intrinsic Value – Micron Technology Sees Poor Results & Plummeting China Sales – Investors Urged to Steer Clear

November 21, 2023

🌧️Trending News

The tech giant Micron Technology ($NASDAQ:MU) has seen a recent collapse in their stock value, with poor overall results and sales in China plummeting. This news has caused investors to be urged to stay away from any investments in Micron Technology. Micron Technology is a semiconductor manufacturer and one of the world’s leading providers of advanced memory and storage solutions. Recent reports of poor results and a dramatic decline in the sale of Micron’s memory chips in China have caused investors to become skeptical about the company’s future growth prospects. This is due to an ongoing trade dispute between the United States and China, which has caused a slowdown in demand for Micron’s products.

Additionally, weak pricing pressure from competitors have contributed to even further losses for the company. With all these factors in mind, analysts are advising investors to steer clear of any investments in Micron Technology for the time being. This makes it a risky investment and not suitable for those looking for long-term gains. Therefore, investors should take the necessary precautions before investing in Micron Technology.

Market Price

On Monday, Micron Technology stock opened at $77.3 and closed at $78.6, up by 1.4% from the previous closing price of 77.6. This is likely due to the ongoing trade war between the US and China. The poor performance from Micron Technology has prompted many analysts to recommend that shareholders sell their stock.

Given the potential for the situation in China to worsen, Micron Technology is expected to continue to suffer in the coming months, with no clear resolution to the trade war on the horizon. Investors should therefore exercise caution when considering investing in this company and should consider other options instead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Micron Technology. More…

| Total Revenues | Net Income | Net Margin |

| 15.54k | -5.83k | -36.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Micron Technology. More…

| Operations | Investing | Financing |

| 1.56k | -6.19k | 4.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Micron Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 64.25k | 20.13k | 40.28 |

Key Ratios Snapshot

Some of the financial key ratios for Micron Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.2% | 9.5% | -33.9% |

| FCF Margin | ROE | ROA |

| -39.4% | -7.4% | -5.1% |

Analysis – Micron Technology Intrinsic Value

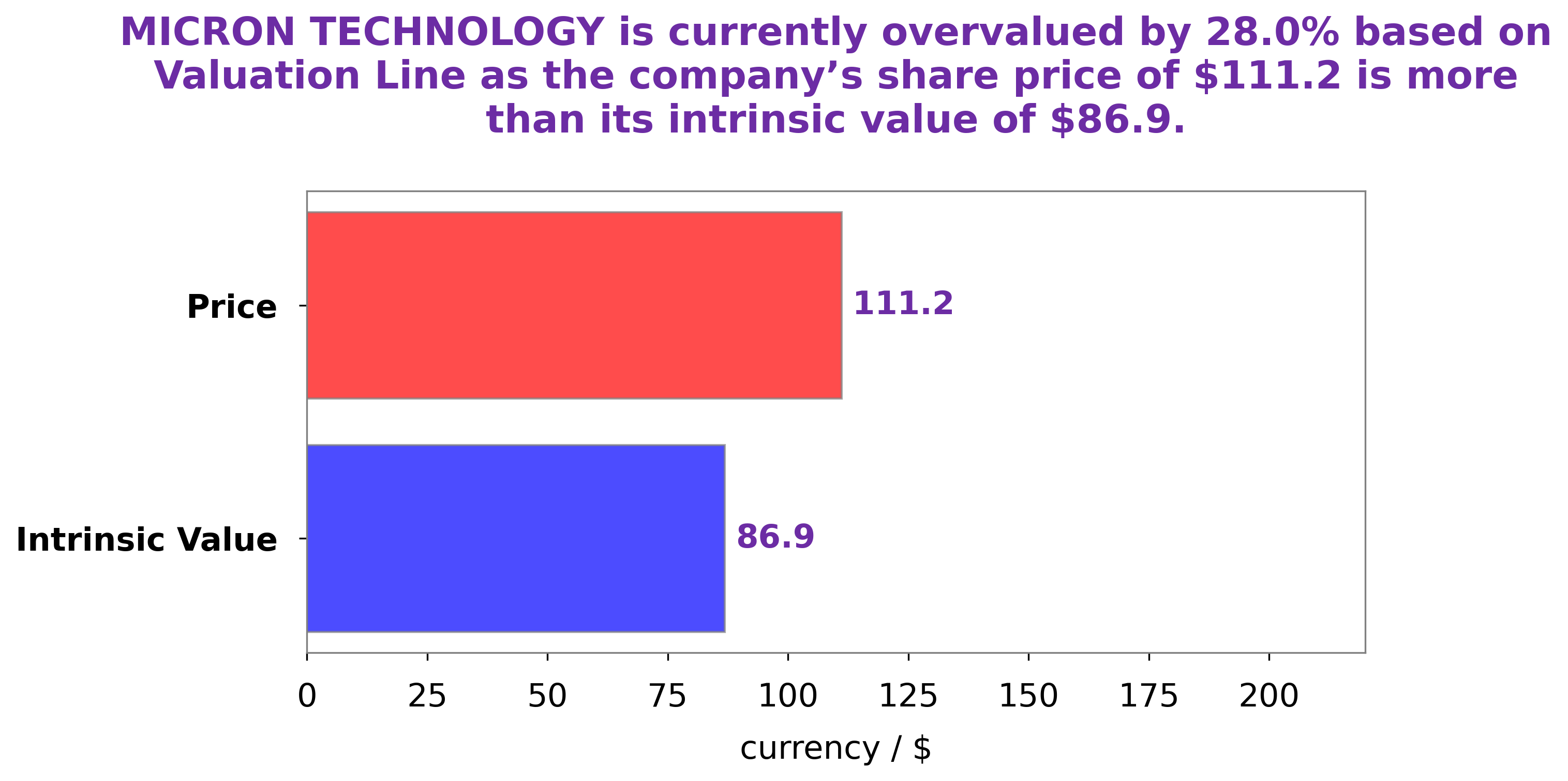

At GoodWhale, we have conducted an analysis of MICRON TECHNOLOGY‘s financials and determined the fair value of its share is around $91.5. This figure was calculated using our proprietary Valuation Line, which is tailored to meet the requirements of each individual company. Currently, MICRON TECHNOLOGY shares are trading at $78.6, making them a good deal for investors looking to get in at a fair price that is undervalued by 14.1%. As a result, we believe MICRON TECHNOLOGY is an attractive buy at its current stock price. More…

Peers

In the semiconductor industry, there is intense competition between Micron Technology Inc and its competitors: Intel Corp, Advanced Micro Devices Inc, GLOBALFOUNDRIES Inc. All four companies are striving to develop the most innovative and efficient products to stay ahead of the competition. This competition benefits consumers as it drives down prices and leads to continuous innovation in the semiconductor industry.

– Intel Corp ($NASDAQ:INTC)

Intel is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s second largest and second highest valued semiconductor chip maker based on revenue after being overtaken by Samsung, and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also makes motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

As of 2022, Intel has a market capitalization of 106.76 billion dollars. This is a decrease from previous years, likely due to increased competition from other companies such as AMD. Despite this, Intel still remains one of the most valuable and well-known semiconductor companies in the world. In addition to its market cap, Intel also has a return on equity (ROE) of 19.16%. This is a measure of how profitable the company is relative to the amount of money that shareholders have invested. A higher ROE indicates that the company is more efficient at generating profits and is a better investment.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

As of 2022, AMD has a market cap of 92.39B and a ROE of 4.13%. The company is a global semiconductor company that designs, manufactures, and markets computer processors, graphics cards, and related technologies. Its products are used in personal computers, game consoles, and cloud computing.

– GLOBALFOUNDRIES Inc ($NASDAQ:GFS)

As of 2022, GLOBALFOUNDRIES Inc has a market cap of 28.29B and a Return on Equity of 5.09%. The company is a leading provider of advanced semiconductor manufacturing services.

Summary

Investing in Micron Technology is a risky venture at the moment, as the company is experiencing poor results and sales in China are plummeting. Investors should avoid investing in Micron Technology until the company shows signs of improvement in their results and sales. It is important to monitor the company’s performance and watch for potential trends before making any decisions about investing. Analyzing the financial data, the stock market, and sector news to make an informed investment decision should be a priority.

In addition, investors should consider factors such as competitive landscape, capital structure, and risk appetite when making an investment decision.

Recent Posts