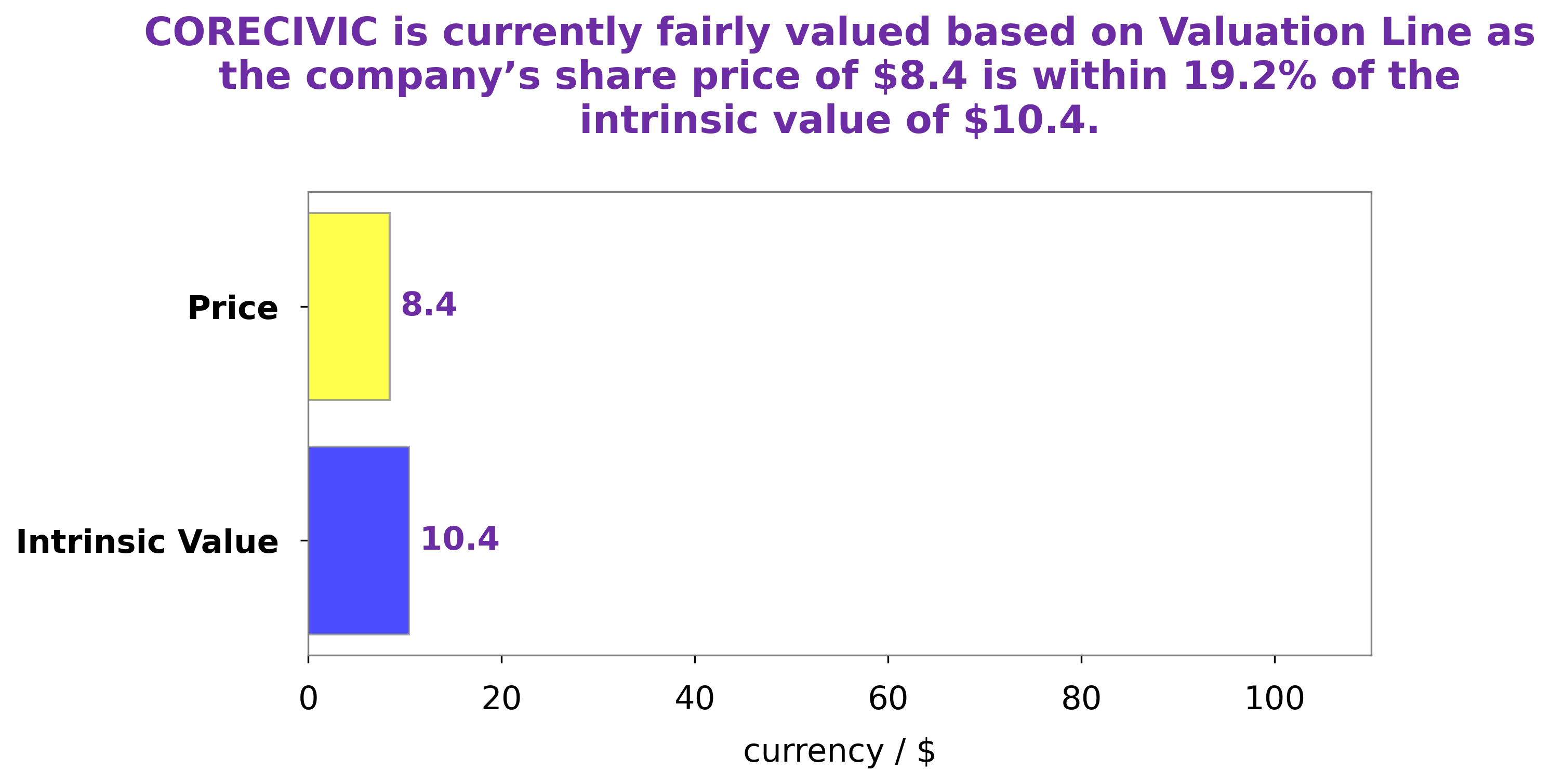

Corecivic Intrinsic Stock Value – CoreCivic Stock Closes at $8.44, Down -0.59% from Previous Close

June 3, 2023

🌥️Trending News

CORECIVIC ($NYSE:CXW): CoreCivic Inc.’s stock saw a decrease of -0.59% yesterday, closing at $8.44. This was a decline from its previous closing price of $8.49. It is the largest such provider in the United States, operating a variety of government-run correctional and detention facilities. The company is also involved in providing various services such as inmate education, healthcare, food services, and other rehabilitation programs. CoreCivic has seen consistent growth over the years, and its stock has gained significantly in the past decade.

However, the company has recently faced criticism over its management of a number of prisons and detention centers, leading to some volatility in its stock price.

Analysis – Corecivic Intrinsic Stock Value

At GoodWhale, we have conducted an analysis of CORECIVIC’s wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of CORECIVIC share to be around $10.4. This suggests that the current trading price of $8.4 is a fair price, however it is undervalued by 19.1%. We believe investors should consider taking advantage of this opportunity to buy the stock while it is undervalued. CoreCivic_Stock_Closes_at_8.44_Down_-0.59_from_Previous_Close”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Corecivic. More…

| Total Revenues | Net Income | Net Margin |

| 1.85k | 115.72 | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Corecivic. More…

| Operations | Investing | Financing |

| 153.58 | 73.04 | -375.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Corecivic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.06k | 1.64k | 12.38 |

Key Ratios Snapshot

Some of the financial key ratios for Corecivic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.4% | -14.5% | 13.0% |

| FCF Margin | ROE | ROA |

| 3.9% | 10.6% | 4.9% |

Peers

The Company operates through its subsidiaries, CoreCivic Properties and CoreCivic Communities. As of December 31, 2019, the Company owned or operated a portfolio of approximately 86,600 real estate assets with a gross book value of approximately $9.9 billion. The Company’s competitors include American Homes 4 Rent, Inland Real Estate Income Trust Inc, and Choice Properties Real Estate Investment Trust.

– American Homes 4 Rent ($NYSE:AMH)

American Homes 4 Rent is a real estate investment trust that acquires, renovates, leases, and manages single-family homes in the United States. As of December 31, 2020, the company owned 53,545 homes in 22 states.

– Inland Real Estate Income Trust Inc ($OTCPK:INRE)

Inland Real Estate Income Trust Inc is a real estate investment trust that focuses on generating income through investments in real estate. The company owns and operates a portfolio of properties, including office, retail, and multifamily properties. Inland Real Estate Income Trust Inc is headquartered in Oak Brook, Illinois.

– Choice Properties Real Estate Investment Trust ($TSX:CHP.UN)

Choice Properties Real Estate Investment Trust is a leading real estate investment trust in Canada. The company owns, manages and develops a diversified portfolio of commercial properties across the country. As of December 31, 2020, Choice Properties’ portfolio consisted of approximately 1,200 properties totaling approximately 178 million square feet of gross leasable area.

Summary

CoreCivic Inc., a real estate investment firm, has seen its stock price drop by -0.59% to close at $8.44. This decline marks an end to a recent period of stability, as the stock had been trading at $8.49 since the previous close. Investors may want to consider this new information when deciding whether to enter or exit the market in CoreCivic. Investors should always do their own research prior to investing in any stock.

Recent Posts