Urban-gro Stock Intrinsic Value – Urban-Gro Reports Lower-Than-Expected GAAP EPS Despite Higher-Than-Expected Revenue

May 11, 2023

Trending News 🌥️

URBAN-GRO ($NASDAQ:UGRO): Urban-Gro is a leading provider of integrated solutions to the commercial cannabis industry. Specifically, their GAAP EPS of -$0.48 was short of the forecast by $0.15, while their revenue of $16.8M exceeded expectations by $1.11M. However, despite the lower-than-expected GAAP EPS, the company showed solid progress in its strategic objectives and initiatives. Investors should keep an eye on Urban-Gro to see how it continues to perform and if it can reach its goals in the future.

Stock Price

Despite the positive revenue results, URBAN-GRO revealed that net income for the year was below their initial projections. This news caused their stock to open at $1.8 and close at $1.8, representing a 2.2% decrease from their last closing price. The company cited higher costs as the main reason for their disappointing earnings performance, which weighed heavily on the overall performance of the business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Urban-gro. More…

| Total Revenues | Net Income | Net Margin |

| 67.03 | -15.28 | -18.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Urban-gro. More…

| Operations | Investing | Financing |

| -12.61 | -4.45 | -5.52 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Urban-gro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.07 | 27.33 | 3.53 |

Key Ratios Snapshot

Some of the financial key ratios for Urban-gro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 40.5% | – | -23.2% |

| FCF Margin | ROE | ROA |

| -19.7% | -26.9% | -15.7% |

Analysis – Urban-gro Stock Intrinsic Value

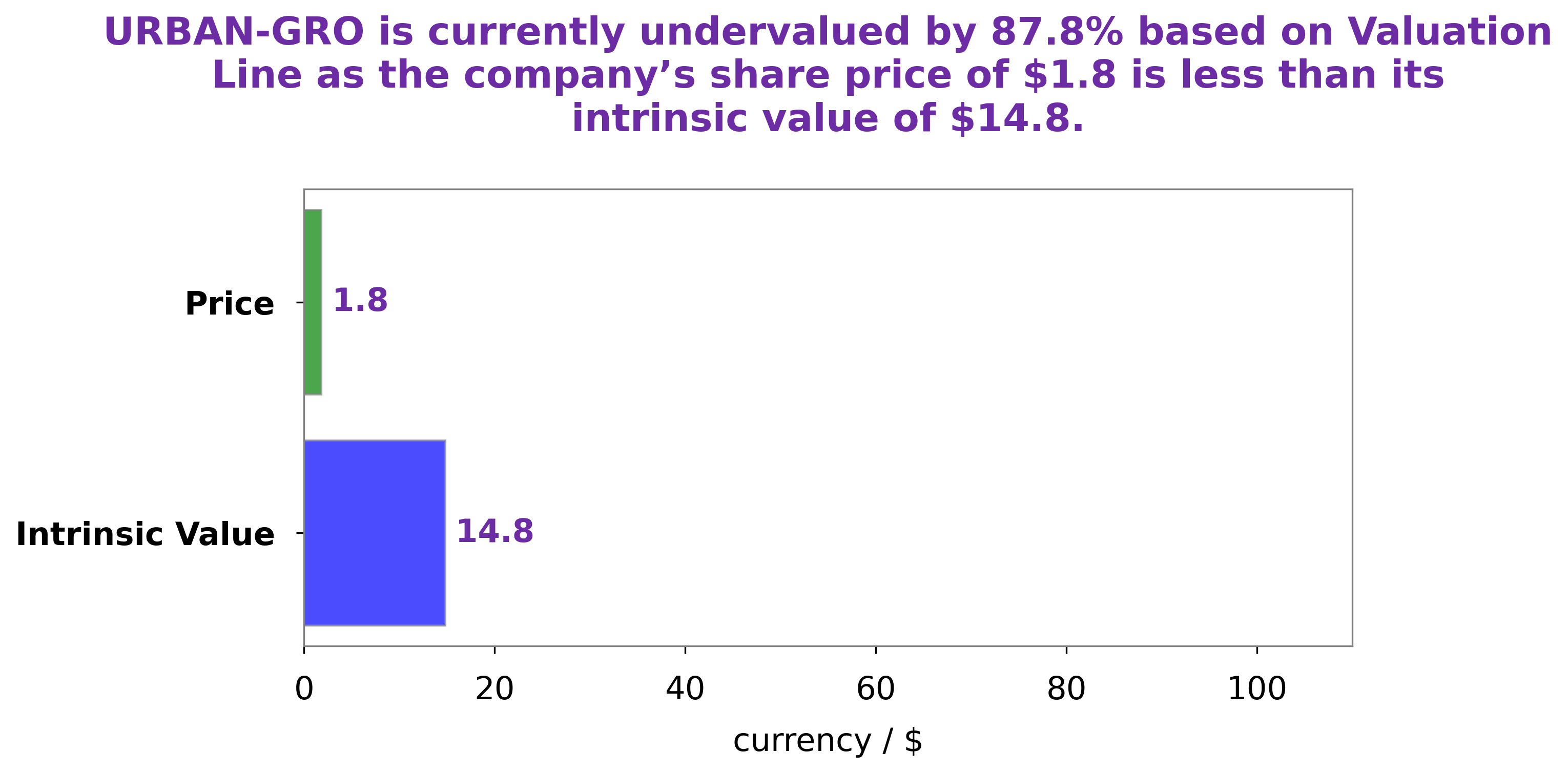

At GoodWhale, we have conducted an analysis of URBAN-GRO‘s wellbeing. After taking all factors into consideration, our proprietary Valuation Line has calculated that URBAN-GRO’s intrinsic value is around $14.8. However, URBAN-GRO is currently being traded at only $1.8, meaning it is undervalued by 87.8%. This is an incredible opportunity for investors to buy URBAN-GRO at a fraction of its true value. More…

Peers

The company was founded in 2006 and is headquartered in Colorado, United States. The company has a team of engineers, designers, and project managers who have experience in designing and constructing horticultural facilities. The company offers services for both indoor and outdoor horticultural projects. The company has completed projects for clients in the United States, Canada, Europe, and Asia. The company’s competitors include CEA Industries Inc, County Line Energy Corp, GreenGro Technologies Inc. These companies are also engaged in providing engineering and design services for the horticultural industry.

– CEA Industries Inc ($NASDAQ:CEAD)

CEA Industries Inc is engaged in the business of manufacturing and marketing health and beauty aids, fragrances and other personal care products. The company has a market cap of 7.16M as of 2022 and a Return on Equity of -15.53%. The company’s products are sold under the brand names of CEA, Prince & Spring, Royal and Erno Laszlo.

– County Line Energy Corp ($OTCPK:CYLC)

County Line Energy Corp is a publicly traded company that focuses on oil and gas exploration, development, and production. The company has a market capitalization of $659.57 million as of March 2022 and a return on equity of 15.96%. County Line Energy Corp is headquartered in Calgary, Alberta, Canada.

– GreenGro Technologies Inc ($OTCPK:GRNH)

GreenGro Technologies Inc is a publicly traded company that provides indoor gardening products and services. It has a market cap of 3.51M as of 2022 and a Return on Equity of -382.76%. The company offers a variety of products and services for indoor gardening, including hydroponic systems, grow lights, nutrients, and soil. It also provides consulting services for indoor gardeners.

Summary

Urban-Gro Inc. is a publicly traded company that specializes in horticultural supplies and services. Its recent financial results showed a GAAP EPS of -$0.48, which missed the estimate by $0.15. On the other hand, its revenue of $16.8M beat the expectations by $1.11M.

Analysts believe that its focus on innovation, efficient operations, and expansion of its customer base is likely to benefit the company going forward. Investors should watch for any news or developments concerning Urban-Gro, as this could affect its stock price.

Recent Posts