Argan, Experiences Good Growth & Attractive Valuations

June 4, 2023

☀️Trending News

Argan ($NYSE:AGX), Inc., a publicly traded company, is enjoying solid growth prospects at attractive valuations. The company has established itself as a leader in its respective industry, providing innovative products and solutions to its customers. With a history of consistent financial performance, Argan is well-positioned to take advantage of the current market conditions and capitalize on potential opportunities. Argan’s stock price has been steadily rising, making it an attractive option for investors. The company’s strong balance sheet and experienced management team have enabled it to maintain high levels of profitability, with consistent revenue and earnings growth.

Investors are attracted to the company’s long-term potential, as well as its robust dividend payments. Overall, Argan is an attractive investment for those looking for solid growth prospects at attractive valuations. The company’s strong financials and strategic positioning in its industry make it an ideal choice for those interested in investing in a secure and reliable stock.

Price History

Argan, Inc. experienced good growth and attractive valuations on Friday. The stock opened at $40.1 and closed at $41.1, a 3.2% increase from the previous closing price of 39.8. This positive performance is indicative of a steady growth in the company’s stock value and positive sentiment surrounding the stock. It also demonstrates that investors are increasingly viewing Argan, Inc. with high valuations, which bodes well for its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Argan. More…

| Total Revenues | Net Income | Net Margin |

| 455.04 | 33.1 | 7.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Argan. More…

| Operations | Investing | Financing |

| -30.06 | -63.12 | -82.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Argan. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 489.49 | 208.59 | 20.9 |

Key Ratios Snapshot

Some of the financial key ratios for Argan are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.9% | 7.9% | 9.2% |

| FCF Margin | ROE | ROA |

| -7.3% | 9.4% | 5.3% |

Analysis

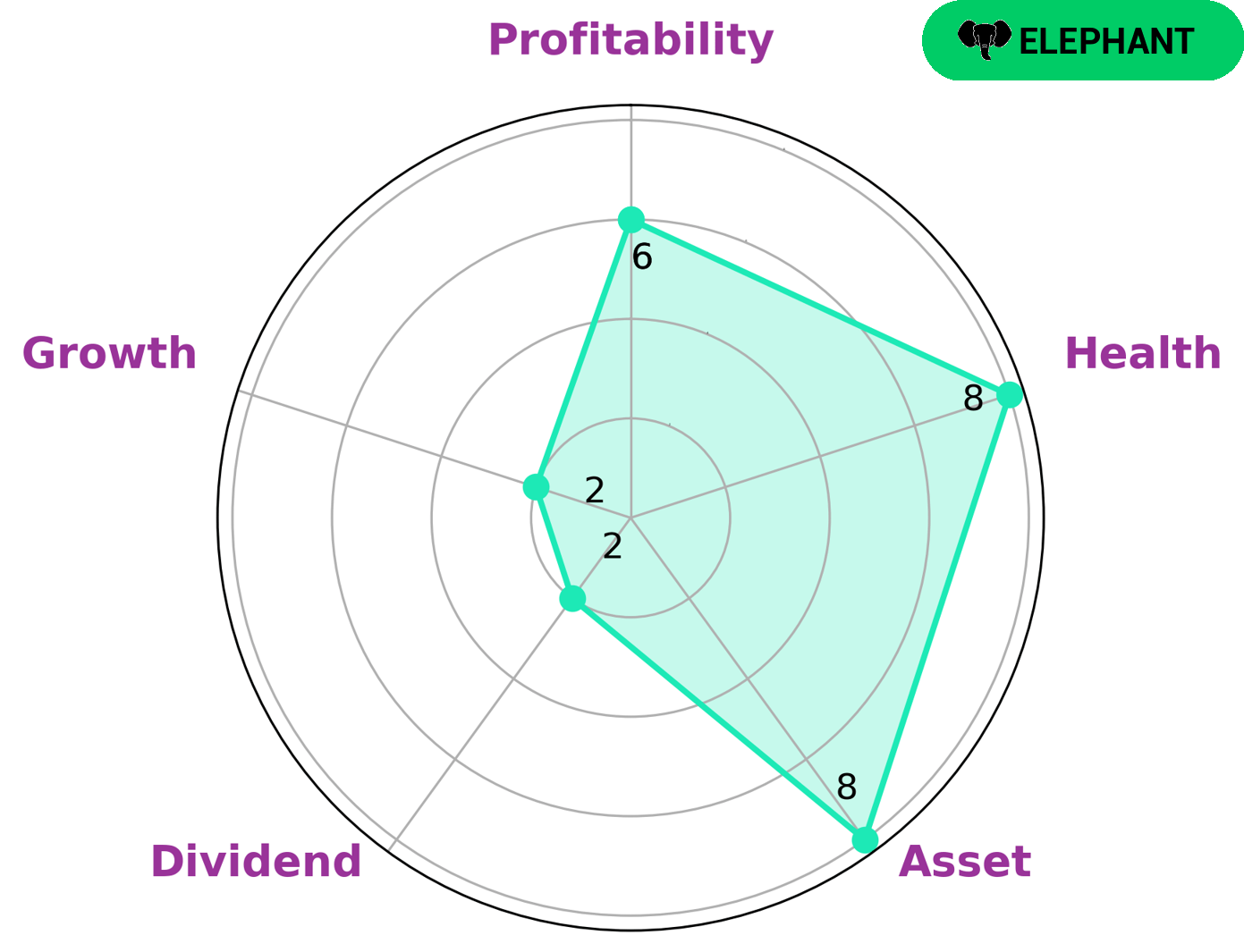

At GoodWhale, we strive to provide our clients with the best possible analysis of both current and potential investments. We recently had the opportunity to analyze ARGAN‘s financials, and applied our proprietary Star Chart methodology to reach our conclusion. Our analysis showed that ARGAN has a high health score of 8/10, meaning it is capable of paying off debt and funding future operations. Additionally, we classified ARGAN as an ‘elephant’ due to its rich assets and low liabilities. This makes it an attractive prospect for any investor looking for a stable investment with a high return. Despite its strong asset base, ARGAN may not be the right choice for those looking for a high dividend or rapid growth. The company has a medium rating when it comes to profitability, and a weak rating when it comes to dividends and growth. For these investors, other investments may be more suitable. More…

Peers

Taisei Corp, Enka Insaat Ve Sanayi AS, and Koninklijke Bam Groep NV are all leading competitors in the EPC space.

– Taisei Corp ($TSE:1801)

Taisei Corp is a Japanese construction company with a market cap of 782.86B as of 2022. The company has a Return on Equity of 7.8%. Taisei Corp is involved in the construction of buildings, roads, bridges, and other infrastructure. The company also has a history of working on large-scale projects such as the Tokyo Skytree and the Tokyo Olympics Stadium.

– Enka Insaat Ve Sanayi AS ($OTCPK:EKIVF)

Enka Insaat Ve Sanayi AS is a construction and engineering company based in Turkey. The company has a market cap of 5.85B as of 2022 and a Return on Equity of -2.88%. Enka Insaat Ve Sanayi AS is involved in the construction of buildings, infrastructure, and industrial facilities.

– Koninklijke Bam Groep NV ($LTS:0LNQ)

Koninklijke Bam Groep NV is a leading Dutch construction and engineering company. The company has a market cap of 574.15M as of 2022 and a Return on Equity of 10.57%. Koninklijke Bam Groep NV is a leading provider of construction and engineering services in the Netherlands. The company has a strong focus on sustainable construction and engineering solutions.

Summary

Argan, Inc. has been a great investment for investors who have been tracking its stock performance. The company’s stock price has seen steady growth over the past few months, and it looks to continue steadily growing at attractive valuations. Analysts have been bullish on the company’s potential, citing strong financial growth and a robust business model.

Additionally, the company has seen an increase in revenue and profit margins since its inception. This is due in part to its focus on customer satisfaction and quality assurance. With its strong fundamentals and attractive valuation, Argan, Inc. provides an interesting opportunity for investors to benefit from its potential success in the long run.

Recent Posts