UNUM GROUP Reports Record Revenue and Net Income Increase for Fourth Quarter of FY2022.

February 16, 2023

Earnings report

The company posted record highs in both revenue and net income. The impressive financial results are attributed to a combination of factors, such as new product launches, strategic investments, and cost-cutting initiatives. The company has invested in new technologies and product development to drive innovation and create more value for their customers.

Additionally, the company has implemented cost reduction strategies to reduce costs and make more efficient use of their resources. Moreover, UNUM GROUP ($NYSE:UNM) has also leveraged its integrated marketing initiatives to drive demand for its products and services. The company has used digital advertising campaigns and promotions to reach new customers and build brand awareness. The company has also partnered with influencers and celebrities to create more engagement with their target audience. Overall, the financial results for the fourth quarter of FY2022 are poised to be a strong indicator for UNUM GROUP’s future performance. By continuing to invest in new technologies and product development, the company is well-positioned to remain competitive in the market. The impressive revenue and net income increases are a testament to the company’s commitment to excellence, and they are likely to continue in the coming quarters.

Price History

UNUM GROUP, one of the leading providers of financial services and insurance products in the United States, reported record revenue and net income increases for the fourth quarter of its FY2022. On Tuesday, UNUM GROUP stock opened at $41.1 and closed at $42.0, up by 2.3% from its previous closing price of $41.1. These figures exceeded analysts’ expectations, and the company’s stock price rose on the news. The company attributed its strong performance to a combination of higher markets, strong investment performance and a focus on increasing customer value by providing innovative products and services. The company also noted that it had improved its efficiency by streamlining operations to reduce costs and increase efficiency.

UNUM GROUP has also been able to increase its share of the financial services and insurance market by increasing its customer base through acquisitions, organic growth and strategic partnerships. The company is optimistic about continuing to grow its market share in the coming quarters. Overall, UNUM GROUP’s strong performance in the fourth quarter of FY2022 is an indication of the company’s commitment to providing quality products and services to its customers and to increasing value for its shareholders. The company’s stock price rise on Tuesday reflects investors’ confidence in the company’s ability to continue to deliver steady returns and growth over the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Unum Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.99k | 1.31k | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Unum Group. More…

| Operations | Investing | Financing |

| 1.54k | -1.34k | -168.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Unum Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 61.43k | 52.24k | 46.51 |

Key Ratios Snapshot

Some of the financial key ratios for Unum Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | – | 15.2% |

| FCF Margin | ROE | ROA |

| 12.0% | 12.7% | 1.9% |

Analysis

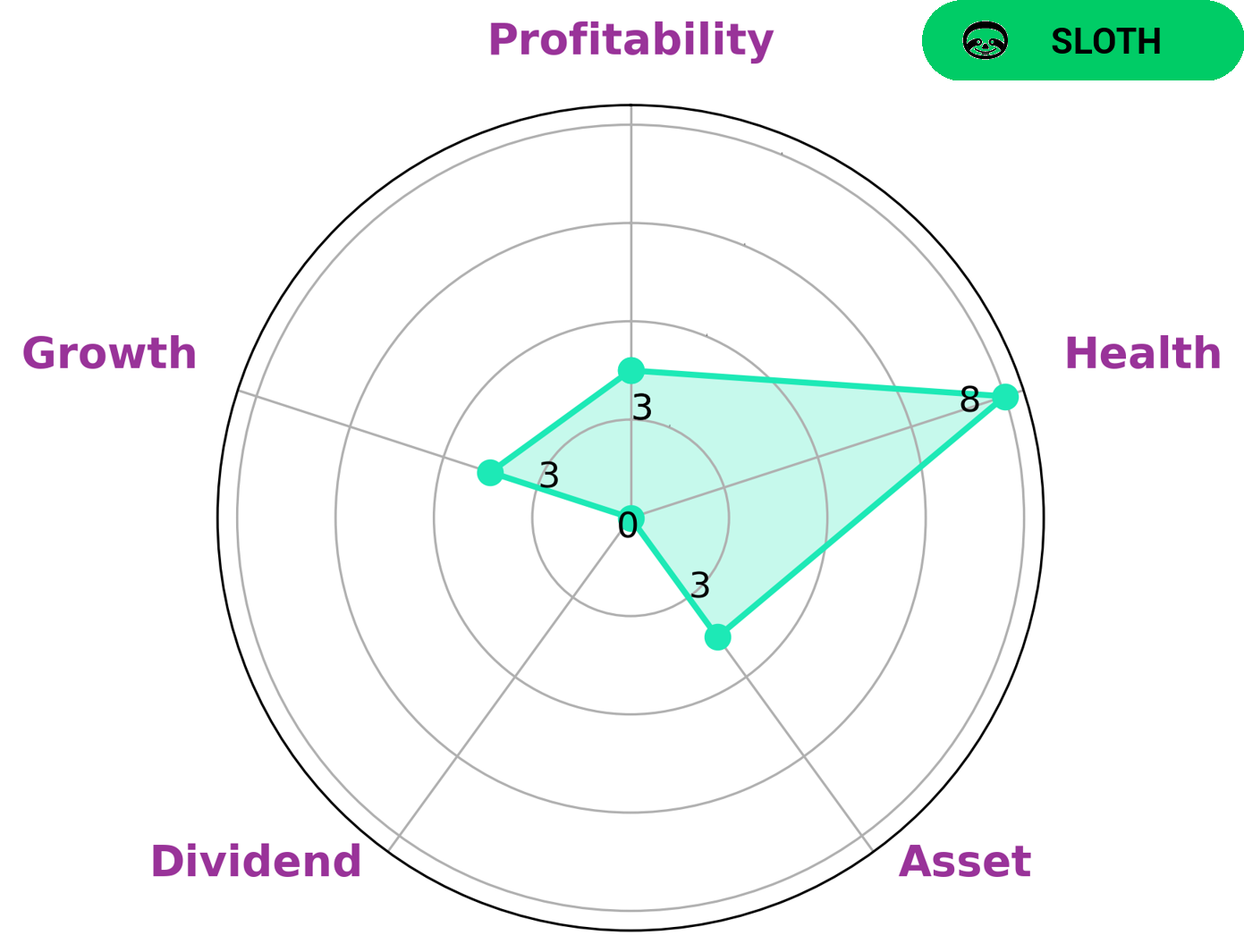

GoodWhale has conducted an analysis of UNUM GROUP‘s financials, which shows that the company is classified as a ‘sloth’ – a type of company that has achieved revenue or earnings growth slower than the overall economy. This means that UNUM GROUP may not be of interest to investors who are looking for rapid growth in the short term. However, UNUM GROUP has strengths in other areas. It has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of paying off its debt and funding future operations. Additionally, it has a strong balance sheet, which suggests that it has good financial stability. Furthermore, UNUM GROUP has a dividend payout ratio of above average, meaning that it is likely to provide some return in the form of dividends to shareholders. Investors with a long-term investment strategy may find that UNUM GROUP is a good fit with their aims, as it has a strong balance sheet and is capable of generating returns for shareholders. On the other hand, investors with a more short-term approach may prefer to focus on companies with more rapid growth potential. More…

Peers

The company offers a variety of products and services to its customers. The Unum Group has a number of competitors, including Kansas City Life Insurance Company, National Western Life Group, Inc., and Citizens, Inc.

– Kansas City Life Insurance Co ($OTCPK:KCLI)

Kansas City Life Insurance Company has a market cap of 283.24M as of 2022. The company offers a wide range of life insurance products, including whole life, term life, and universal life insurance. Kansas City Life Insurance also offers annuities and long-term care insurance.

– National Western Life Group Inc ($NASDAQ:NWLI)

National Western Life Group, Inc. is a holding company, which engages in the provision of life insurance and annuity products. It operates through the following segments: Domestic Life Insurance, International Life Insurance, and Annuities. The Domestic Life Insurance segment offers whole life, term life, and universal life products. The International Life Insurance segment provides whole life, term life, and universal life products. The Annuities segment offers fixed and variable annuities. The company was founded by Oliver W. Isbell and H.C. Waggoner in 1906 and is headquartered in Austin, TX.

– Citizens Inc ($NYSE:CIA)

Citizens Inc is a Texas-based insurance holding company that offers life insurance, annuity, and property and casualty insurance products. The company’s market cap as of 2022 is $142.93M. Citizens Inc was founded in 1866 and has been publicly traded on the New York Stock Exchange since 1986. The company employs over 1,000 people and has over $5 billion in assets.

Summary

Investors are closely monitoring UNUM GROUP’s recent earnings releases as the company reported strong financial results for the fourth quarter of FY2022. With total revenue increasing by 75.1% year-over-year to USD 279.6 million, and net income increasing by 0.9% year-over-year to USD 3005.7 million, the market is encouraged by the performance of the company. This strong financial performance indicates that UNUM GROUP is well-positioned to drive further growth in the coming quarters. Analysts are expecting growth in the company’s sales and profits as they continue to develop and expand their product offerings in the coming quarters. Analysts believe that UNUM GROUP’s strategic focus on integrating digital-first solutions, such as social media and mobile apps, into their products will enable them to attract more customers and drive growth.

Additionally, UNUM GROUP has been investing in research and development, expanding its operations internationally, and launching new products and services. These investments have allowed the company to remain competitive in its industry and should continue to drive its growth. Overall, UNUM GROUP has demonstrated positive momentum in its financial results and appears well-positioned to continue to generate value for its shareholders. Investors should keep an eye on the company’s future earnings releases to further assess its performance and potential opportunities for investment.

Recent Posts