UNUM GROUP Reports Impressive Q4 FY2022 Results with 75.1% Year-Over-Year Revenue Growth and 0.9% Net Income Growth.

February 15, 2023

Earnings report

UNUM GROUP ($NYSE:UNM), a leading global provider of innovative risk management solutions, reported its financial results for the fourth quarter of FY2022, which ended on December 31, 2022, on January 31, 2023. Its total revenue was USD 279.6 million, a significant 75.1% increase year over year. The company also reported net income of USD 3005.7 million, a 0.9% year-over-year growth. UNUM GROUP is a top provider of life, accident and health insurance, as well as retirement services for employers and their employees. UNUM GROUP’s strong financial results in the fourth quarter reflect their commitment to providing customers with quality risk management solutions and reliable service.

The company has made significant investments in their operations in recent years to strengthen their customer service capabilities, increase operational efficiency and realize cost savings. These efforts have enabled them to report strong financial performance despite the volatile economic environment. Overall, UNUM GROUP’s impressive fourth quarter results demonstrate their continued commitment to delivering value and long-term growth for their shareholders. The company expects to continue this trend into the future as they focus on developing new products and services to meet their customers’ evolving needs.

Stock Price

On Tuesday, UNUM GROUP reported impressive Q4 FY2022 results with 75.1% year-over-year revenue growth and 0.9% net income growth. This was reflected in the stock market with UNUM GROUP stock opening at $41.1 and closing at $42.0, up by 2.3% from the previous closing price of 41.1. UNUM GROUP’s impressive results were supported by its solid performance across all its business segments in the quarter. In addition to its strong financial performance, UNUM GROUP also announced several new initiatives in the quarter, including a partnership with a major Chinese mobile wallet provider, the launch of a new mobile application, and the expansion of its digital product offerings.

All of these efforts are expected to further strengthen UNUM GROUP’s competitive edge and help drive future growth. Overall, UNUM GROUP’s Q4 FY2022 results demonstrate the company’s resilience and adaptability in the face of challenging market conditions and highlight its potential to become a major player in the global market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Unum Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.99k | 1.31k | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Unum Group. More…

| Operations | Investing | Financing |

| 1.54k | -1.34k | -168.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Unum Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 61.43k | 52.24k | 46.51 |

Key Ratios Snapshot

Some of the financial key ratios for Unum Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.0% | – | 15.2% |

| FCF Margin | ROE | ROA |

| 12.0% | 12.7% | 1.9% |

Analysis

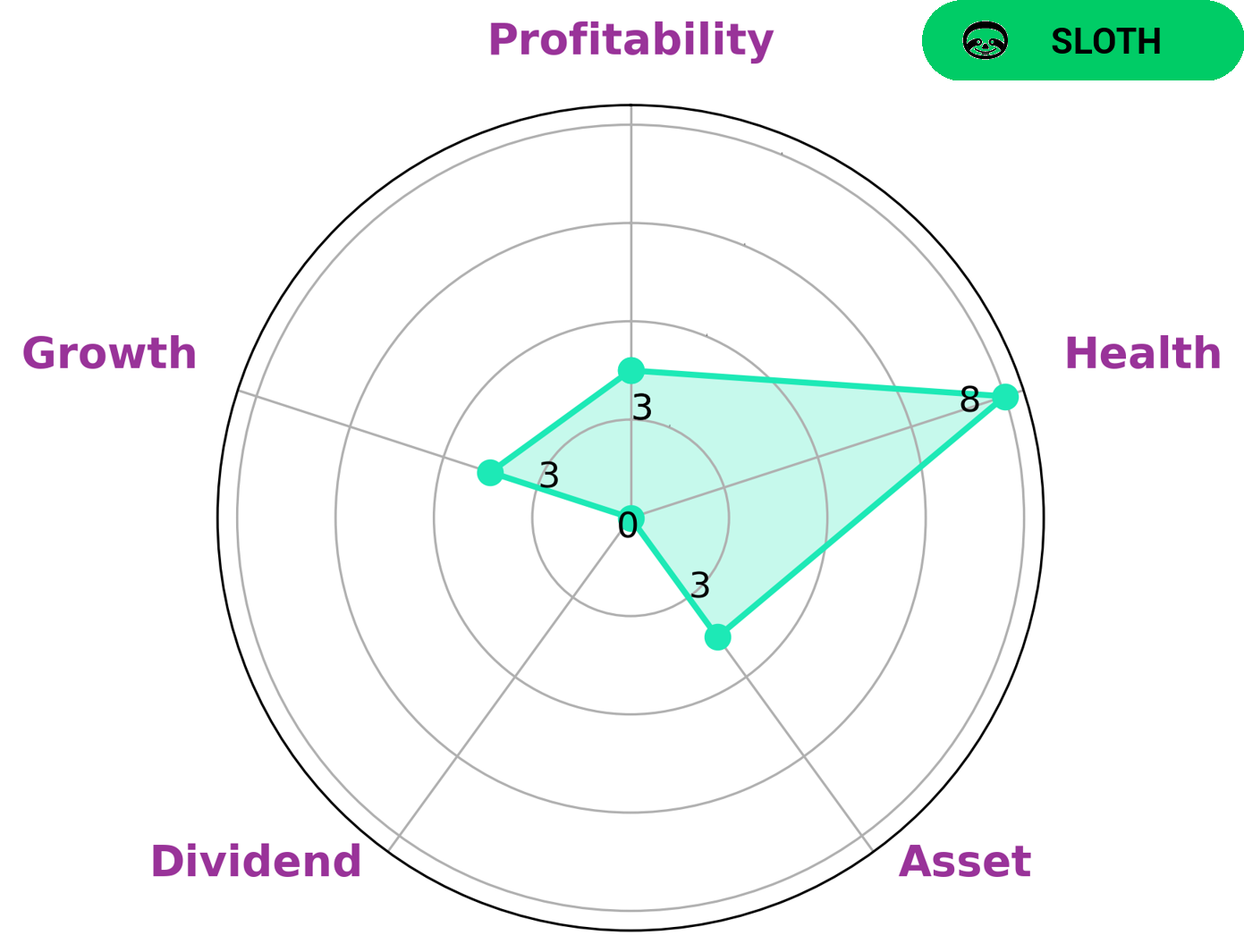

GoodWhale’s analysis of UNUM GROUP’s financials shows that the company is classified as ‘sloth’, a type of company that has achieved revenue or earnings growth slower than the overall economy. According to Star Chart UNUM GROUP is strong in terms of liquidity and weak in terms of asset, dividend, growth, and profitability. The health score given by GoodWhale is 8/10 which is quite good considering its cash flows and debt, implying that the company is capable to pay off debt and fund future operations. Given the financial position of UNUM GROUP, investors who prefer a more conservative approach and are not in search of short-term gains would be interested in this company. These investors seek steady returns over a longer period of time and are not worried about the volatility inherent with higher risk investments. Furthermore, long-term investors who prefer safety of principal and high dividends might also be interested in the company, as UNUM GROUP is liquid and has a strong cash flow position. Overall, UNUM GROUP appears to be an attractive investment for conservative investors who are looking for steady returns and are able to withstand any market fluctuation. The company’s healthy cash flow position and liquidity makes it a secure and stable investment. More…

Peers

The company offers a variety of products and services to its customers. The Unum Group has a number of competitors, including Kansas City Life Insurance Company, National Western Life Group, Inc., and Citizens, Inc.

– Kansas City Life Insurance Co ($OTCPK:KCLI)

Kansas City Life Insurance Company has a market cap of 283.24M as of 2022. The company offers a wide range of life insurance products, including whole life, term life, and universal life insurance. Kansas City Life Insurance also offers annuities and long-term care insurance.

– National Western Life Group Inc ($NASDAQ:NWLI)

National Western Life Group, Inc. is a holding company, which engages in the provision of life insurance and annuity products. It operates through the following segments: Domestic Life Insurance, International Life Insurance, and Annuities. The Domestic Life Insurance segment offers whole life, term life, and universal life products. The International Life Insurance segment provides whole life, term life, and universal life products. The Annuities segment offers fixed and variable annuities. The company was founded by Oliver W. Isbell and H.C. Waggoner in 1906 and is headquartered in Austin, TX.

– Citizens Inc ($NYSE:CIA)

Citizens Inc is a Texas-based insurance holding company that offers life insurance, annuity, and property and casualty insurance products. The company’s market cap as of 2022 is $142.93M. Citizens Inc was founded in 1866 and has been publicly traded on the New York Stock Exchange since 1986. The company employs over 1,000 people and has over $5 billion in assets.

Summary

UNUM Group is a strong investment option for investors, as the company’s fourth quarter FY2022 earnings results show strong growth. Total revenue grew by 75.1% year-over-year to USD 279.6 million, while reported net income increased 0.9% to USD 3005.7 million.

Additionally, UNUM Group’s strong financial position gives it the ability to make strategic investments in areas such as research and development, innovation and acquisitions, providing added value to investors. Furthermore, the company has a wide portfolio of products and services, allowing it to remain competitive in its industry. In conclusion, UNUM Group’s fourth quarter FY2022 earnings results demonstrate that it is an attractive option for investors looking for short or long-term investments.

Recent Posts