Toll Brothers Stock Fair Value – Toll Brothers Reports 7.7% Increase in Total Revenue for Third Quarter of Fiscal Year 2023

September 6, 2023

☀️Earnings Overview

TOLL BROTHERS ($NYSE:TOL) reported total revenue of USD 2687.6 million at the close of its fiscal third quarter on July 31, 2023, which represented a 7.7% rise compared to the corresponding period in the prior year. Net income also saw a major jump, increasing by 51.7% year-on-year to USD 414.8 million. This data was divulged on August 22, 2023.

Analysis – Toll Brothers Stock Fair Value

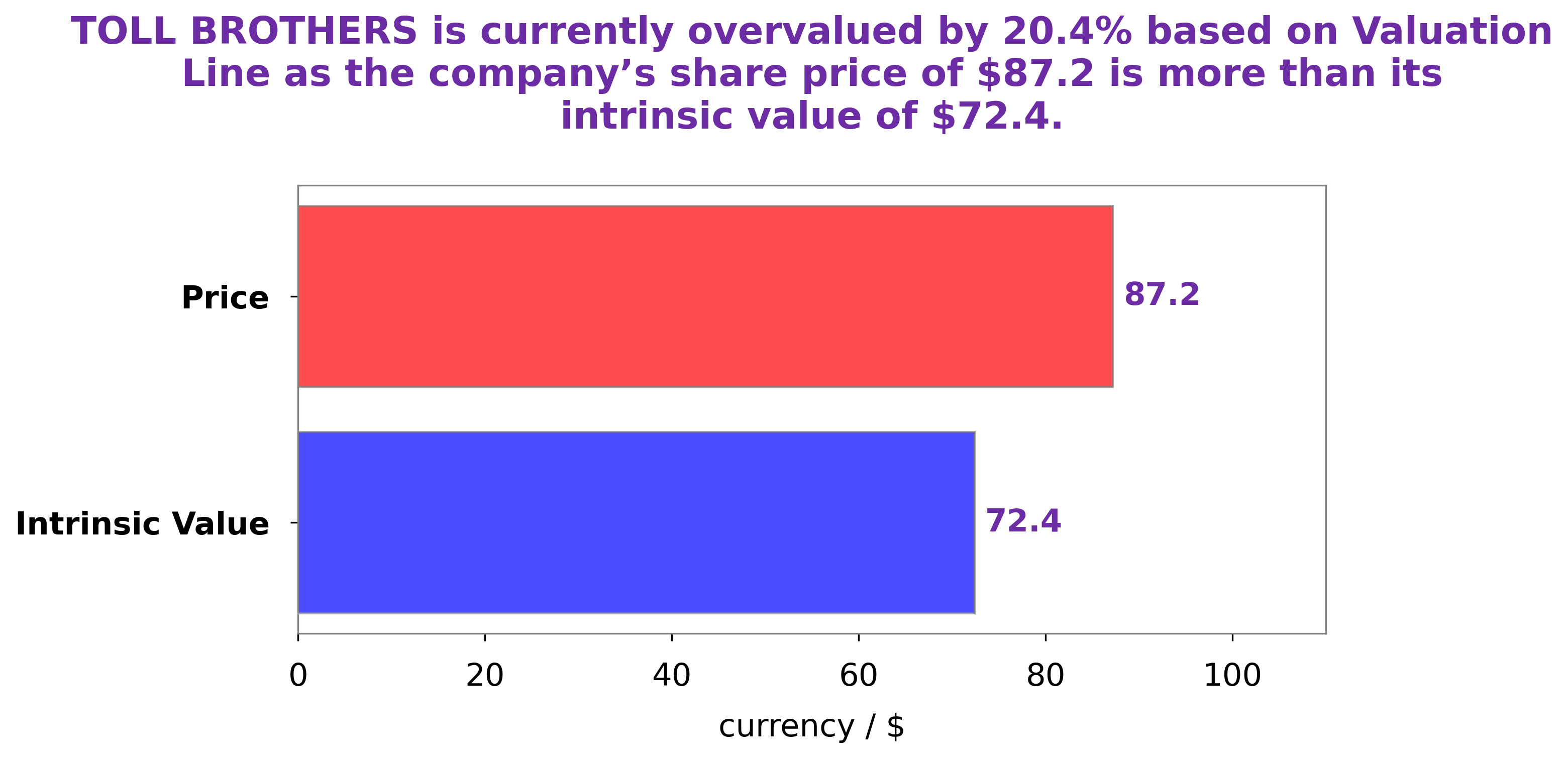

GoodWhale’s analysis of TOLL BROTHERS‘s fundamentals has revealed a fair value of $72.5 for its stock. This was calculated using the company’s proprietary Valuation Line, which takes into account factors such as revenue growth, debt levels, and operating performance. Currently, TOLL BROTHERS’s stock is being traded at $75.9, meaning it is overvalued by 4.7%. Investors should be aware of this potential overvaluation and consider whether it is sensible to purchase shares at this price. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toll Brothers. More…

| Total Revenues | Net Income | Net Margin |

| 10.69k | 1.57k | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toll Brothers. More…

| Operations | Investing | Financing |

| 1.34k | -153.18 | -1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toll Brothers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.35k | 5.64k | 61.22 |

Key Ratios Snapshot

Some of the financial key ratios for Toll Brothers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.6% | 53.4% | 19.2% |

| FCF Margin | ROE | ROA |

| 11.8% | 19.6% | 10.4% |

Peers

The company is headquartered in Horsham, Pennsylvania, and operates in 22 states. The company’s product offerings include single-family detached homes, attached homes, and condominiums. The company’s competitors include D.R. Horton Inc, Redbubble Ltd, and PulteGroup Inc.

– D.R. Horton Inc ($NYSE:DHI)

D.R. Horton Inc is a homebuilding company that was founded in 1978 and is headquartered in Fort Worth, Texas. As of 2022, the company had a market capitalization of 28.86 billion and a return on equity of 25.26%. The company operates in 26 states and 84 markets across the United States. D.R. Horton is the largest homebuilder in the United States by volume, with a market share of approximately 18%. The company builds single-family detached homes, townhomes, and condominiums.

– Redbubble Ltd ($ASX:RBL)

Redbubble Ltd has a market cap of 168.95M as of 2022 and a Return on Equity of -12.32%. The company is an online marketplace that allows artists to sell their artwork on a variety of products.

– PulteGroup Inc ($NYSE:PHM)

PulteGroup Inc is one of the largest homebuilders in the United States. The company has a market cap of 9.97 billion as of 2022 and a return on equity of 24.61%. The company builds and sells single-family homes, townhouses, condominiums, and apartments in the United States.

Summary

TOLL BROTHERS reported strong financial results for the third quarter of their fiscal year ending July 31, 2023, with total revenue increasing by 7.7% and net income growing by 51.7%. These results indicate that TOLL BROTHERS has been able to capitalize on current market conditions and achieve a successful quarter. Investors should consider long-term investing in TOLL BROTHERS, as the company’s strong financial performance indicates potential for continued growth.

Recent Posts