Spectrum Brands Intrinsic Value Calculation – Spectrum Brands Reports 10.1% Decrease in Total Revenue for FY2023 Q3

August 21, 2023

🌥️Earnings Overview

On August 11 2023, SPECTRUM BRANDS ($NYSE:SPB) reported its FY2023 Q3 earnings results, showing a total revenue of USD 735.5 million for the quarter ending June 30 2023, a decrease of 10.1% from the same period in the prior year. Net income was USD 1859.2 million, an increase of 5761.5% year-over-year.

Analysis – Spectrum Brands Intrinsic Value Calculation

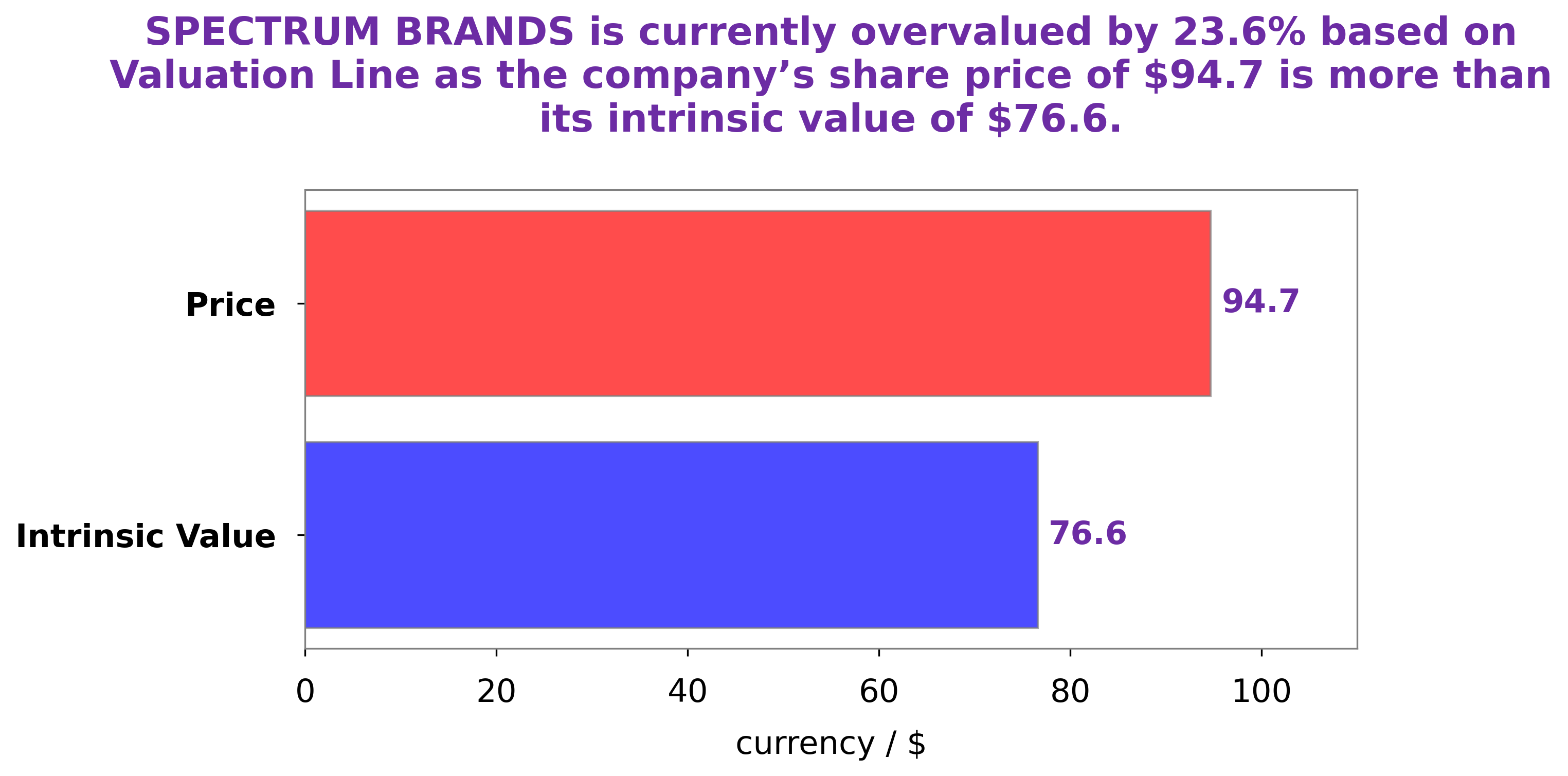

GoodWhale has conducted an in-depth analysis of SPECTRUM BRANDS‘s financials and have concluded that the fair value of SPECTRUM BRANDS share is around $74.1. This number was determined by using our proprietary Valuation Line. In the current market, SPECTRUM BRANDS stock is being traded at a price of $77.3 – this places the stock at a fair price which is overvalued by 4.3%. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spectrum Brands. More…

| Total Revenues | Net Income | Net Margin |

| 2.93k | 1.8k | -3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spectrum Brands. More…

| Operations | Investing | Financing |

| 188.9 | 4.26k | -1.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spectrum Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 3.79k | 71.67 |

Key Ratios Snapshot

Some of the financial key ratios for Spectrum Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -59.6% | -7.1% |

| FCF Margin | ROE | ROA |

| 4.3% | -6.9% | -2.0% |

Peers

Despite the intense competition, Spectrum Brands Holdings Inc has been able to remain a top player in the industry by focusing on innovation, customer service, and providing high-quality products at competitive prices.

– Godrej Consumer Products Ltd ($BSE:532424)

Godrej Consumer Products Ltd is a leading Indian fast-moving consumer goods company, headquartered in Mumbai. It manufactures and markets a wide range of products across food, personal care, and home care segments. The company has a market cap of 937.97B as of 2023, which is indicative of its strong performance in the market. Its Return on Equity (ROE), which is an indicator of how effectively the company uses its shareholders’ equity to generate profits, is 10.44%. This high ROE reflects the company’s ability to generate profits for its shareholders.

– Ontex Group NV ($OTCPK:ONXYY)

Ontex Group NV is a leading global hygiene company with over 20 years of experience in the hygiene and personal care market. It is headquartered in Belgium and serves markets in Europe, Africa, Latin America, the Middle East, and Asia Pacific. The company’s market cap as of 2023 stands at 593.34M, indicating a strong financial standing in the market. Its Return on Equity (ROE) is -7.25%, which is a measure of how efficient the company utilizes its assets to generate profits. Ontex Group NV is engaged in the production, distribution and marketing of products such as baby diapers, adult incontinence products, feminine care products, and wet wipes.

– Henkel AG & Co KGaA ($OTCPK:HENOY)

Henkel AG & Co KGaA is a multinational consumer goods company based in Düsseldorf, Germany. It specializes in the production of laundry detergents, beauty care products, and adhesives, among other products. As of 2023, the company’s market capitalization was 28.76 billion euros. This figure reflects the company’s success in increasing shareholder value over the past year. Henkel’s return on equity (ROE) was 4.84%, which indicates that the company is efficiently utilizing its assets to generate a return. Henkel’s strong financial performance is testament to its business model and commitment to innovation.

Summary

Spectrum Brands reported its FY2023 Q3 earnings results on August 11 2023, revealing total revenue of USD 735.5 million for the quarter ending June 30 2023, a decrease of 10.1% from the previous year.

However, net income skyrocketed to USD 1859.2 million, an increase of 5761.5% from the same period last year. The news sent the stock price up on the same day. From an investing perspective, Spectrum Brands appears to be a solid long-term investment with strong growth potential. With a robust bottom line and revenue trending in the right direction, investors may find Spectrum Brands a worthwhile pick for their portfolio.

Recent Posts