SPARTANNASH COMPANY Reports 5.2% Increase in Revenue for Second Quarter of FY2023

June 12, 2023

☀️Earnings Overview

For the second quarter of FY2023, SPARTANNASH COMPANY ($NASDAQ:SPTN) reported total revenue of USD 2907.4 million, a 5.2% increase from the same period in the prior fiscal year. Nonetheless, the company’s reported net income for the quarter was USD 11.3 million, a decrease of 41.2% year-on-year. These results were reported on June 1 2023, with figures based on April 30 2023.

Analysis

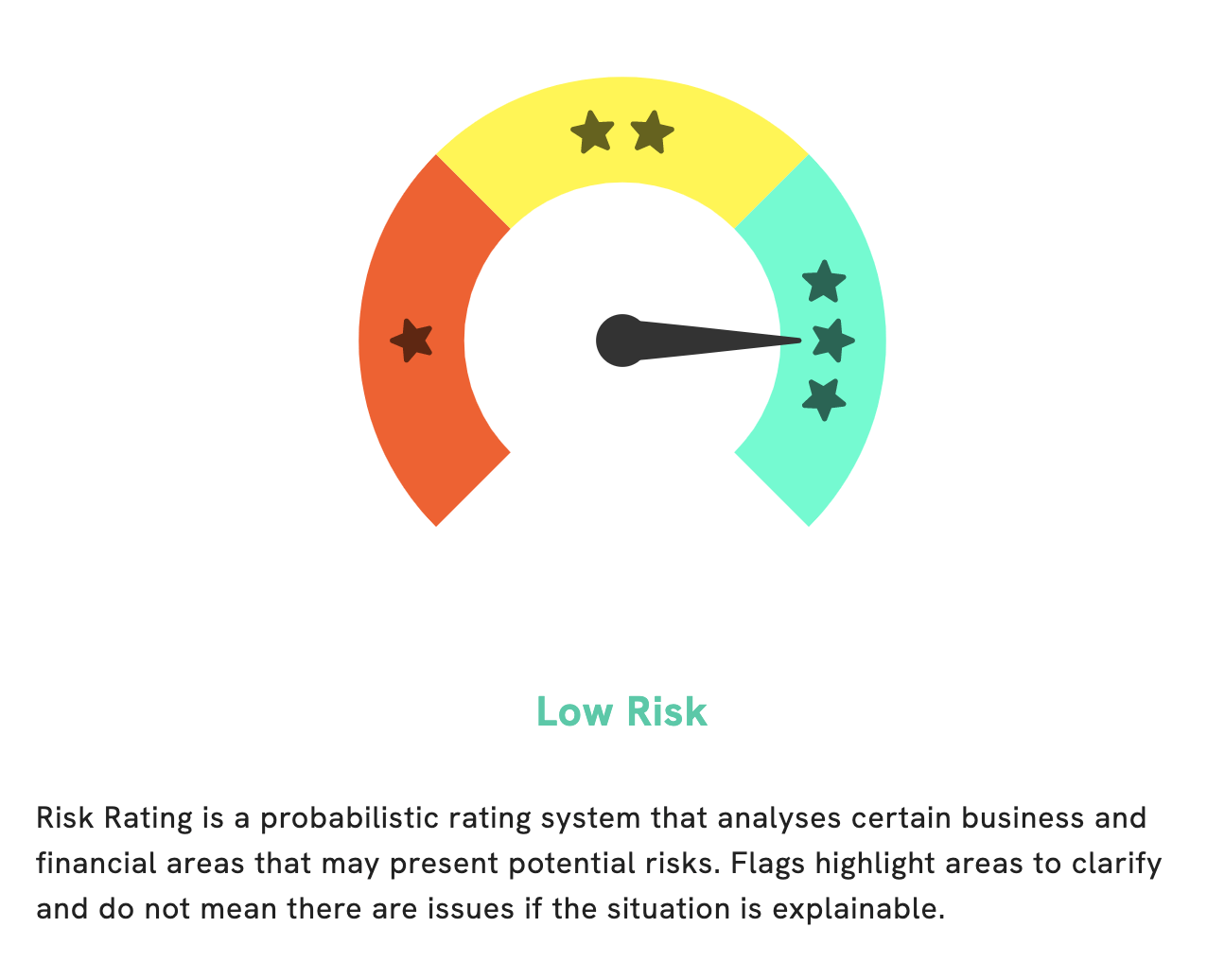

GoodWhale has conducted a thorough analysis into the fundamentals of SPARTANNASH COMPANY and determined that it is a low risk investment in terms of financial and business aspects. Although there is only one risk warning detected in the income sheet, GoodWhale has found that it is not enough to cause concern when investing in this company. The SPARTANNASH COMPANY has been given a Risk Rating of low, confirming that it is an excellent option for investors looking to diversify their portfolio. For more detailed information, GoodWhale encourages potential investors to become registered users to access the full report. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spartannash Company. More…

| Total Revenues | Net Income | Net Margin |

| 9.79k | 26.33 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spartannash Company. More…

| Operations | Investing | Financing |

| 97.67 | -113.28 | 16.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spartannash Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.31k | 1.54k | 21.81 |

Key Ratios Snapshot

Some of the financial key ratios for Spartannash Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.7% | -11.7% | 0.7% |

| FCF Margin | ROE | ROA |

| -0.1% | 5.4% | 1.8% |

Peers

The company operates in the United States and Canada. The company’s competitors include Metcash Ltd, Amcon Distributing Co, and United Natural Foods Inc.

– Metcash Ltd ($ASX:MTS)

Metcash Ltd is a food and grocery distributor in Australia. The company has a market cap of 3.8B as of 2022 and a Return on Equity of 21.5%. Metcash Ltd distributes food and grocery products to independent retailers in Australia. The company offers a range of products including groceries, fresh food, alcohol, and general merchandise. Metcash Ltd also provides logistics and supply chain management services to its customers.

– Amcon Distributing Co ($NYSEAM:DIT)

Amcon Distributing Company is a wholesale distributor of consumer products, including cigarettes, cigars, and other tobacco products; foodservice equipment and supplies; and janitorial, sanitation, and paper products. The company operates in three segments: Cigarettes and Tobacco Products, Foodservice Equipment and Supplies, and Janitorial, Sanitation, and Paper Products. It distributes its products through a network of distribution centers and sales offices in the United States.

– United Natural Foods Inc ($NYSE:UNFI)

UNFI is a leading distributor of natural, organic, and specialty foods in the United States and Canada. The company has a market cap of 2.65B as of 2022 and a ROE of 16.04%. UNFI is a publicly traded company on the Nasdaq Stock Market and is headquartered in Providence, Rhode Island.

Summary

SPARTANNASH COMPANY reported total revenue of USD 2907.4 million for the second quarter of FY2023, an increase of 5.2% compared to the same period in the prior fiscal year.

However, net income for this period decreased by 41.2% from the prior year. On June 1, 2023, following the announcement of these results, the company’s stock price decreased. Investors should consider this financial performance when evaluating the potential of investing in SPARTANNASH COMPANY. They must also consider the company’s background, future prospects, and other factors such as competitive landscape and industry trends before deciding to invest.

Recent Posts