SOFTBANK GROUP Reports Huge Decrease in Total Revenue for Q3 Fiscal Year 2023

March 19, 2023

Earnings Overview

SOFTBANK GROUP ($TSE:9984) reported total revenue of JPY -783.4 billion for its fiscal year 2023’s third quarter, which concluded on December 31, 2022, a significant decrease of 2796.8% compared to the same quarter in the prior year. However, net income saw a 6.0% year-over-year increase to JPY 1693.3 billion. The company made this announcement on February 10, 2023.

Market Price

Their stock opened at JP¥5950.0, and then closed at JP¥5878.0 after a 1.2% decrease from the prior closing price of 5949.0. This decrease in total revenue has caused investors to worry, as it indicates the company may be struggling to remain profitable in the current market conditions. The company attributes the decrease to several factors, such as a decline in sales in their telecom services and asset management services, as well as an increase in overall operating expenses due to investments in new businesses. The drop in total revenues comes after several years of steady growth for SOFTBANK GROUP, and analysts are now concerned about the company’s future outlook.

Furthermore, the company has also announced that it plans to reduce its workforce by 10%, in order to improve their efficiency and reduce costs. Despite their recent setbacks, SOFTBANK GROUP remains determined to continue its growth trajectory and is working to diversify its business model by investing in new ventures such as artificial intelligence technology and renewable energy. They also remain committed to offering shareholders value through dividends and stock buybacks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Softbank Group. More…

| Total Revenues | Net Income | Net Margin |

| 6.52M | -3.01M | -13.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Softbank Group. More…

| Operations | Investing | Financing |

| 1.04M | 288.12k | -584.69k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Softbank Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.34M | 31.75M | 6.16k |

Key Ratios Snapshot

Some of the financial key ratios for Softbank Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.9% | -28.9% | -28.6% |

| FCF Margin | ROE | ROA |

| 6.1% | -11.1% | -2.7% |

Analysis

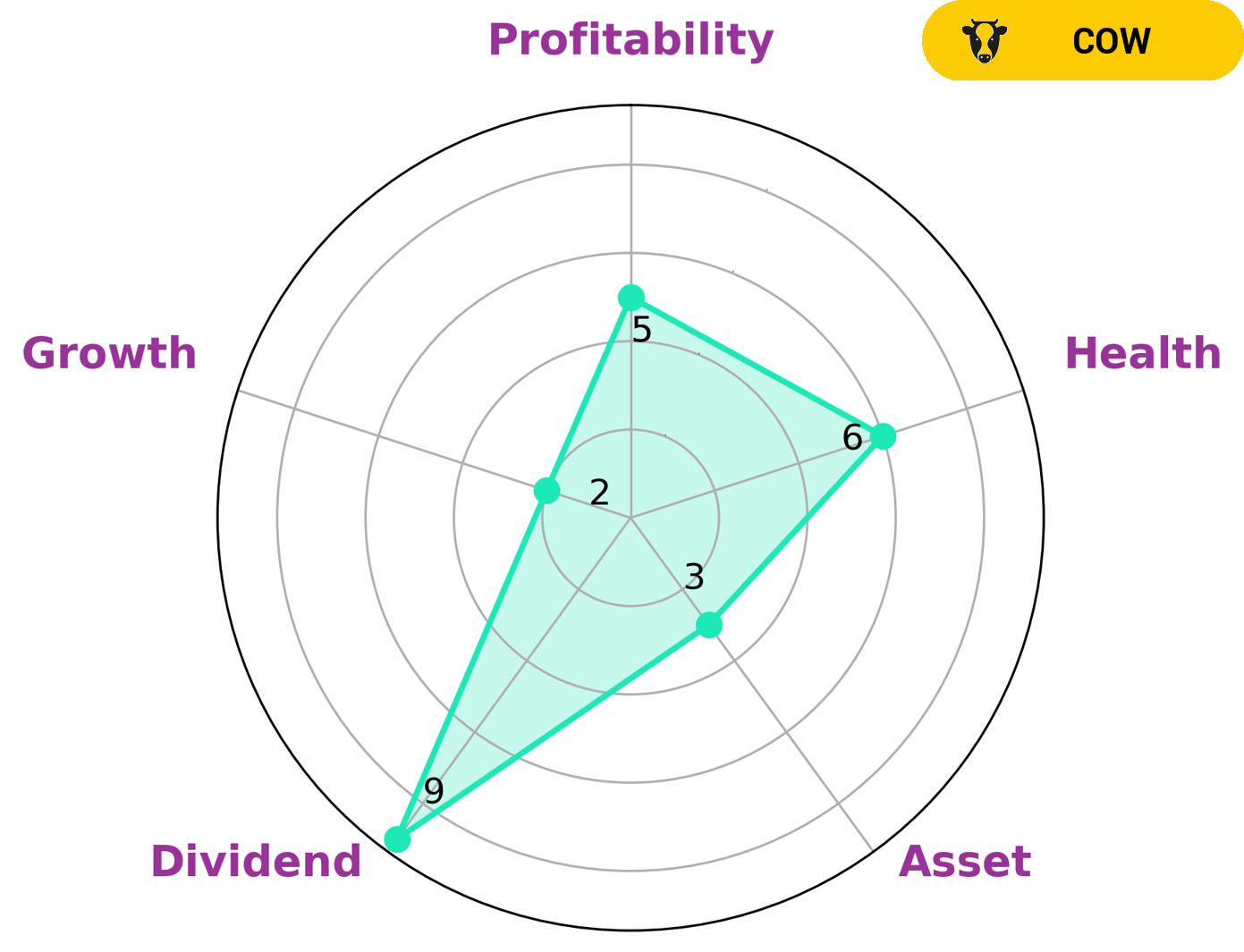

GoodWhale recently conducted an analysis of SOFTBANK GROUP‘s wellbeing. Our Star Chart analysis found that SOFTBANK GROUP is strong in dividends, medium in profitability, and weak in asset and growth. GoodWhale’s health score for SOFTBANK GROUP is 6/10, which indicates that the company is likely to have enough cash flows and is managing its debt well enough to be able to pay off its debt and fund future operations. After further research, we classified SOFTBANK GROUP as a “cow”, which is a type of company that has a track record of paying out consistent and sustainable dividends. Investors who are interested in low-risk investments may be particularly interested in this type of company. SOFTBANK GROUP’s cash flows and manageable debt make it an attractive option for those looking for steady returns over long periods of time. Furthermore, its track record of consistent dividend payments makes it an appealing choice for those who are looking for regular income. More…

Peers

It competes with other Japanese technology companies such as Benefit Japan Co Ltd, Internet Initiative Japan Inc, and Nippon Telegraph & Telephone Corp. All of these companies are dedicated to providing innovative technology solutions to their customers and delivering exceptional services.

– Benefit Japan Co Ltd ($TSE:3934)

Benefit Japan Co Ltd is a Japanese company specializing in the manufacturing and sale of pet products. The company has a market cap of 7.19B as of 2023, indicating it is a large and stable company in the industry. The Return on Equity for the company is 9.57%, which is much higher than the average for companies in the same industry. This demonstrates that the company is able to effectively manage its finances and make sound investments.

– Internet Initiative Japan Inc ($TSE:3774)

Initiative Japan Inc (IIJ) is a leading Japanese telecommunications and Internet service provider that has been in business since 1992. As of 2023, IIJ has a market cap of 429.89B, making it one of the largest companies in Japan. IIJ provides a wide array of services, including broadband access, hosting services, networking and security services, and cloud-based services. The company has a return on equity (ROE) of 15.72%, indicating that it has been able to effectively manage its assets and generate returns for its shareholders. IIJ’s market cap and ROE demonstrate the company’s success in the telecommunications and internet service industry.

– Nippon Telegraph & Telephone Corp ($TSE:9432)

Nippon Telegraph & Telephone Corp (NTT) is a leading telecommunications and information technology company based in Tokyo, Japan. As of 2023, NTT has a market cap of 12.86T and a Return on Equity (ROE) of 13.7%. NTT provides a wide range of services such as mobile, fixed line and internet services, cloud computing, data centers and other IT services. It is one of the largest telecom companies in the world with operations in more than 190 countries. NTT’s market cap is among the highest in the world and its ROE indicates a healthy profitability. The company’s strong financial position is also reflected in its dividend payments, which have been steadily increasing over the past few years.

Summary

SoftBank Group‘s financial performance in the third quarter of 2023 showed a significant decrease in revenue year-over-year.

However, net income was up 6%, indicating that management has been successful in adapting to the challenging environment. This bodes well for investors, who should consider potential long-term opportunities in the company. The profitability of SoftBank Group is likely to remain strong and continue to provide returns to investors over time.

Additionally, the company’s vast resources and existing market presence make it an attractive investment prospect.

Recent Posts