SITEONE LANDSCAPE SUPPLY Reports 103.3% Decrease in Revenue for Fourth Quarter of FY2022 Ending February 15 2023

February 26, 2023

Earnings Overview

SITEONE ($NYSE:SITE): 3 % d e c r e a s e f r o m t h e s a m e p e r i o d a y e a r e a r l i e r . 5 % f r o m t h e s a m e p e r i o d i n t h e p r i o r y e a r.

Transcripts Simplified

Siteone Landscape Supply reported an 11% increase in net sales for the fourth quarter of 2022 to $890 million. For the full year, net sales increased 16% to $4 billion with 252 selling days in fiscal year 2022 and 253 in 2021. Organic daily sales increased by 7% for the quarter and 11% for the full year, primarily driven by price inflation from suppliers. Price inflation was 11-12% for the quarter and up to 18% for the full year.

Price inflation is expected to moderate, with low single-digit price inflation projected for the full year. Volume declined 5% for the quarter and 7% for the year, but still remains above 2019 levels. Organic daily sales of landscaping products increased 8% for the quarter and 12% for the year, while agronomic products increased 5% for the quarter and 7% for the year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SITE. More…

| Total Revenues | Net Income | Net Margin |

| 4.01k | 245.4 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SITE. More…

| Operations | Investing | Financing |

| 217.2 | -284.4 | 43.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SITE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.53k | 1.23k | 29.01 |

Key Ratios Snapshot

Some of the financial key ratios for SITE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.4% | 38.7% | 8.3% |

| FCF Margin | ROE | ROA |

| 4.4% | 15.9% | 8.2% |

Price History

On Wednesday, SITEONE LANDSCAPE SUPPLY reported a 103.3% decrease in revenue in the fourth quarter of fiscal year 2022 ending February 15 2023. The company’s stock opened at $150.2 and closed at $159.1, an increase of 1.8% from the previous closing price of 156.3. The substantial drop in revenue was mainly attributed to challenging weather conditions, coupled with the global pandemic further exacerbating the situation. In the fourth quarter, SITEONE experienced sales declines across all categories, which was primarily driven by a sharp decrease in demand for landscaping and lawn care services. SITEONE management is taking proactive steps to respond to the current market conditions and has implemented several cost-saving measures to mitigate the impact of decreased revenues.

In addition, the company has taken steps to reduce customer acquisition costs and increased its focus on customer retention. Overall, SITEONE management expects the revenue decline experienced in the fourth quarter of FY2022 to continue during the first quarter of FY2023. Despite the decrease in revenue, SITEONE remains committed to providing quality products and services to its customers and continues to be focused on long-term growth and profitability in 2021. Live Quote…

Analysis

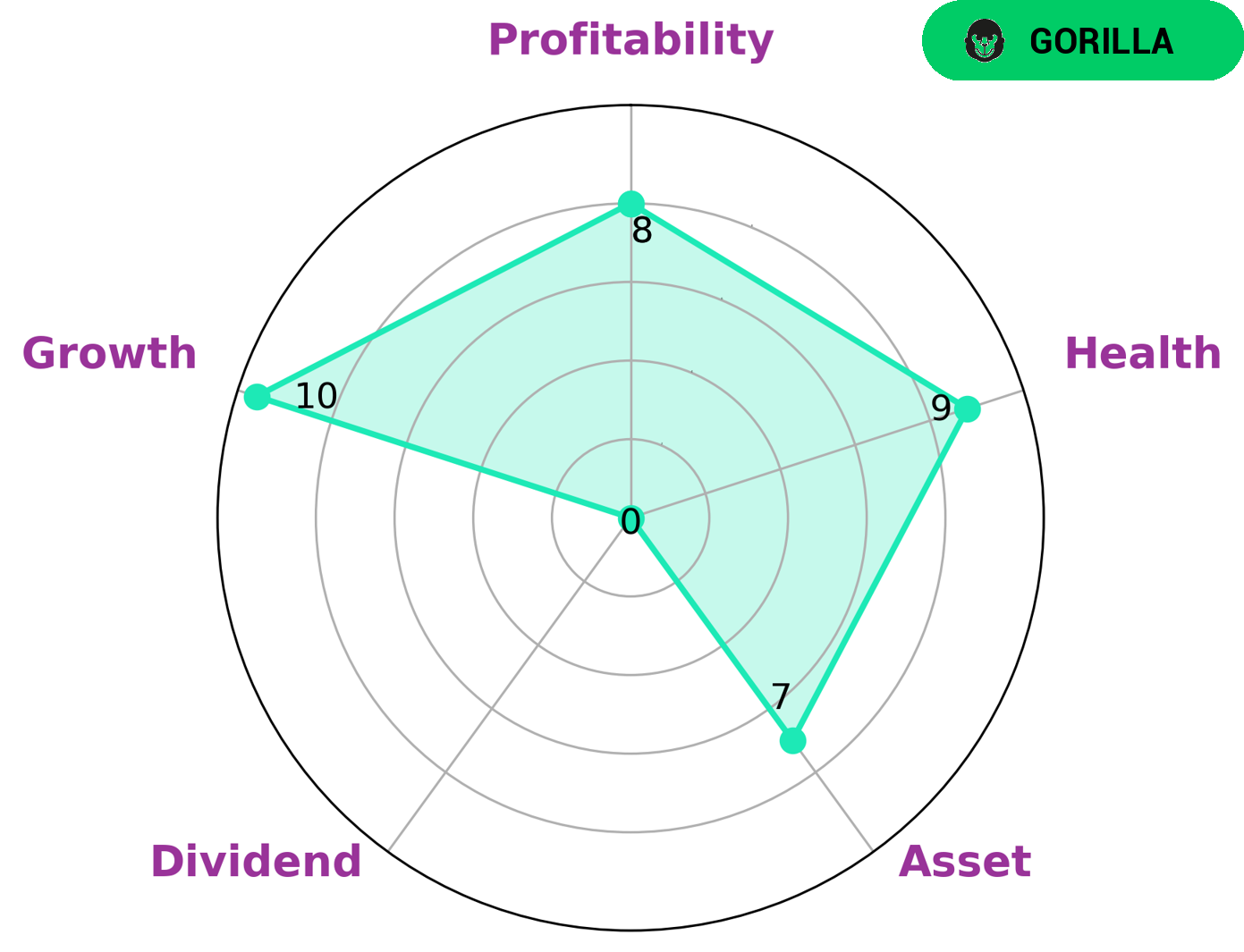

As GoodWhale’s analysis of SITEONE LANDSCAPE SUPPLY’s well-being, we have assessed that the company has been categorized as ‘gorilla’, a type of business which has sustained a significant level of revenue or earning growth through its competitive advantage. Our findings indicate that SITEONE LANDSCAPE SUPPLY is relatively strong in areas such as asset and growth, while the company is weak in dividend. Moreover, the company has a very impressive health score of 9/10 due to its cashflows and debt capabilities, allowing it to sustain operations in times of crisis. In terms of investors, those interested in taking advantage of this company’s strength and earnings growth while also not being heavily dependent on dividends may find SITEONE LANDSCAPE SUPPLY to be an absolute valuable opportunity. Our analysis shows that it is an attractive option for those looking for a good long-term investment. More…

Peers

The company offers a wide range of products, including irrigation supplies, nursery stock, landscape tools and accessories, and more. SiteOne Landscape Supply Inc competes with Hydrofarm Holdings Group Inc, MAX Co Ltd, Thorpe (F W) PLC, and others in the landscape supplies industry.

– Hydrofarm Holdings Group Inc ($NASDAQ:HYFM)

Hydrofarm Holdings Group Inc is a leading manufacturer and distributor of hydroponic equipment and supplies in the United States. The company has a market cap of 102.81M as of 2022 and a Return on Equity of -41.86%. Hydrofarm Holdings Group Inc is a publicly traded company on the NASDAQ stock exchange under the ticker symbol HYFG. The company’s products are used by commercial and hobbyist growers to produce fruits, vegetables, and herbs.

– MAX Co Ltd ($TSE:6454)

As of 2022, Daikin Industries, Ltd. has a market capitalization of 97.87 billion dollars and a return on equity of 7.15%. Daikin is a Japanese multinational air conditioning manufacturing company with headquarters in Osaka. The company makes a wide range of products including air conditioners, refrigerators, and chemicals. It also provides services such as installation, repair, and maintenance.

– Thorpe (F W) PLC ($LSE:TFW)

Thorpe (F W) PLC is a British engineering company. The company is headquartered in Derby, England. Thorpe (F W) PLC designs, manufactures, and supplies equipment and services for the rail, construction, and mining industries. The company’s products and services include locomotives, railway cars, and railway infrastructure. Thorpe (F W) PLC has a market cap of 474.63M as of 2022, a Return on Equity of 10.79%.

Summary

This represents an enormous decrease in revenue of 103.3% compared to the same period the previous year, but an increase in net income of 10.5%. This indicates that SiteOne Landscape Supply still has potential for investors, despite short-term revenue losses, due to its ability to keep costs low and maximize profits. With expected profits and cost efficiency, SiteOne Landscape Supply may offer a strong long-term investment opportunity.

Recent Posts