Plug Power Intrinsic Value – PLUG POWER Reports 5.3% Increase in Revenue for Q3 of Financial Year 2023

November 21, 2023

☀️Earnings Overview

For the third quarter of its year ending September 30 2023, PLUG POWER ($NASDAQ:PLUG) reported total revenue of USD 198.7 million, which was a 5.3% increase compared to the same period in the prior year.

Analysis – Plug Power Intrinsic Value

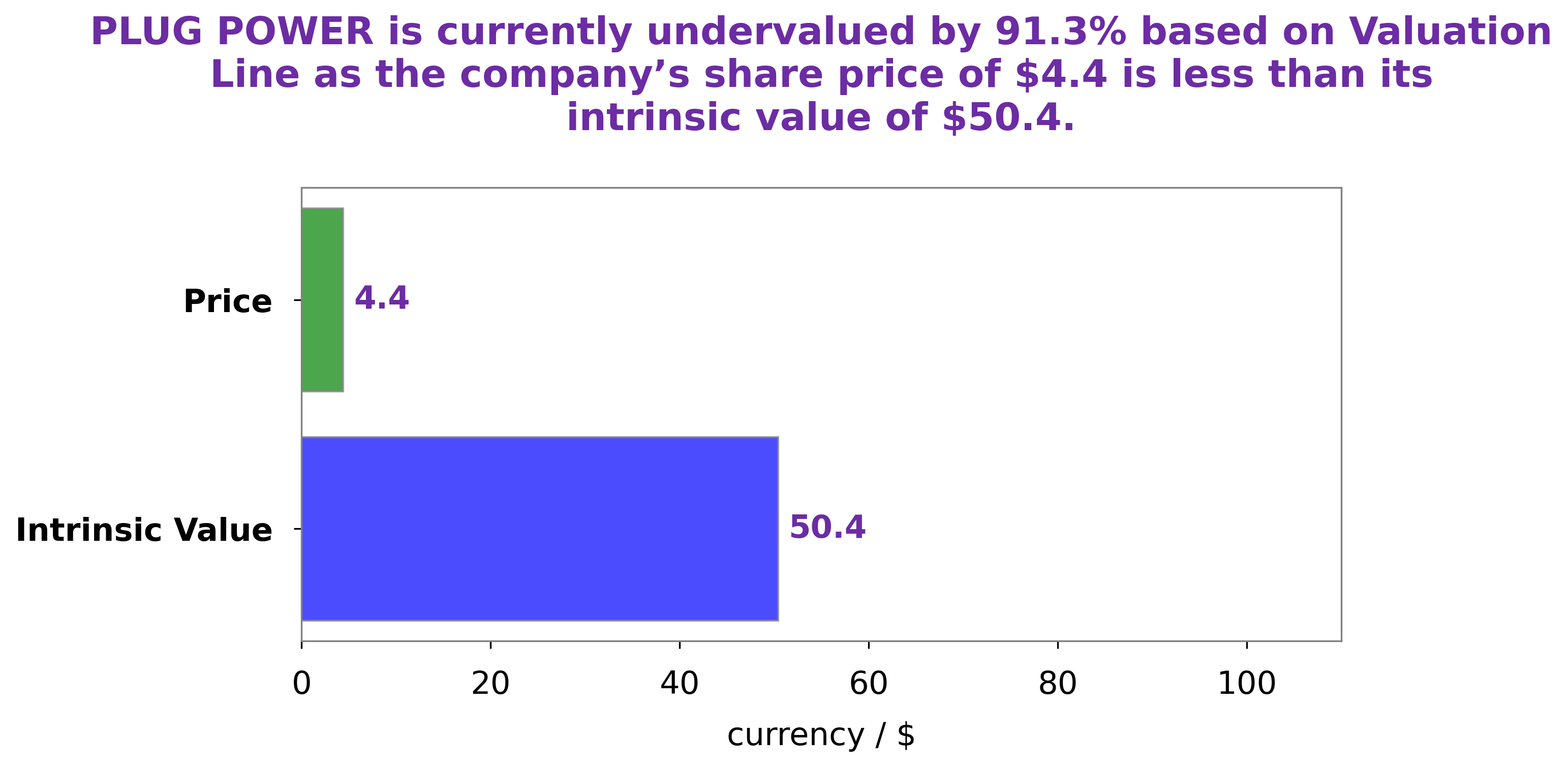

GoodWhale’s financial analysis of PLUG POWER has revealed an intrinsic value of $69.8 per share, calculated using our proprietary Valuation Line. This indicates that the current share price of $5.9 is undervalued by 91.5%, presenting a unique opportunity for investors to purchase at a discounted rate. GoodWhale’s financial analysis provides an independent look into the company’s true worth, revealing how much of a bargain the stock is right now. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plug Power. More…

| Total Revenues | Net Income | Net Margin |

| 889.92 | -949.9 | -100.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plug Power. More…

| Operations | Investing | Financing |

| -1.17k | -198.23 | -21.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plug Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.45k | 1.94k | 5.8 |

Key Ratios Snapshot

Some of the financial key ratios for Plug Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 42.5% | – | -102.7% |

| FCF Margin | ROE | ROA |

| -202.7% | -15.8% | -10.5% |

Peers

Plug Power Inc. is a leading provider of energy solutions that enable its customers to power their operations with clean, reliable energy. The company’s products and services include fuel cells, hydrogen refueling, and power management systems. Plug Power Inc. competes with Loop Energy Inc, AFC Energy PLC, and Greenchek Technology Inc in the provision of energy solutions.

– Loop Energy Inc ($TSX:LPEN)

As of 2022, Loop Energy Inc has a market cap of 60.66M. The company has a Return on Equity of -31.52%. Loop Energy Inc is a company that provides fuel cells and hydrogen fuel cell electric vehicles. The company’s products are used in a variety of applications, including automotive, transportation, stationary power, and portable power.

– AFC Energy PLC ($LSE:AFC)

AFC Energy PLC is a company that focuses on providing alternative energy solutions. The company has a market capitalization of 143.44 million as of 2022 and a return on equity of -24.64%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate future returns. The company’s focus on alternative energy solutions makes it a unique player in the market and gives it a potential growth opportunity in the future.

– Greenchek Technology Inc ($OTCPK:GCHK)

Greenchek Technology Inc is a publicly traded company that engages in the design, manufacture, and sale of electronic test and measurement equipment. The company has a market cap of 35.51k as of 2022 and a return on equity of 2.93%. Greenchek Technology Inc’s products are used in a variety of industries, including telecommunications, aerospace, defense, and semiconductor. The company’s products are sold worldwide through a network of distributors and resellers.

Summary

PLUG POWER is a leading provider of fuel cell solutions, and its latest financial results for the third quarter of 2023 show that total revenue increased by 5.3% year-on-year, reaching USD 198.7 million. Unfortunately, net income decreased from -170.8 million in the previous year to -283.5 million, indicating that profitability is a concern for investors. Many analysts are now recommending caution when investing in PLUG POWER, as the company will need to continue to improve its performance in order to meet shareholder expectations.

Recent Posts