KUAISHOU TECHNOLOGY Reports Profits for FY2023 Q1, Ending March 31 2023

May 29, 2023

Earnings Overview

KUAISHOU TECHNOLOGY ($SEHK:01024) released their earnings report for the first quarter of FY2023 on May 22 2023, showing revenues of CNY 25217.0 million – a 19.7% increase from last year’s corresponding period. Net income also experienced a dramatic improvement from CNY -6254.4 million to CNY -873.0 million, over the same period.

Stock Price

Monday was a profitable day for KUAISHOU TECHNOLOGY, as the tech giant reported a profitable first quarter of fiscal year 2023, ending on March 31, 2023. At the start of the trading day, KUAISHOU TECHNOLOGY stock opened at HK$50.5 and closed at HK$53.5, a 6.9% increase from its prior closing price of HK$50.0. The successful quarter can largely be attributed to the company’s innovative product offerings and strong performance in the Chinese market. The company continued to push the boundaries with its new product lines, including the long-awaited arrival of the KUAISHOU AI-enabled camera. This advanced device is capable of recognizing objects in its environment in real-time, and is already being praised as a game changer in the consumer camera industry.

KUAISHOU TECHNOLOGY has also been actively expanding its presence in the international markets. Over the past quarter, they have announced partnerships with several leading companies across Europe and North America, which will help to drive further growth for the company. Overall, KUAISHOU TECHNOLOGY appears to be on track for another successful year, with its innovative products and strong market presence providing a solid foundation for growth in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kuaishou Technology. More…

| Total Revenues | Net Income | Net Margin |

| 98.33k | -8.31k | -7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kuaishou Technology. More…

| Operations | Investing | Financing |

| 7.18k | -6.01k | -4.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kuaishou Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 85.6k | 45.87k | 9.2 |

Key Ratios Snapshot

Some of the financial key ratios for Kuaishou Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.0% | – | -8.1% |

| FCF Margin | ROE | ROA |

| 2.6% | -12.5% | -5.8% |

Analysis

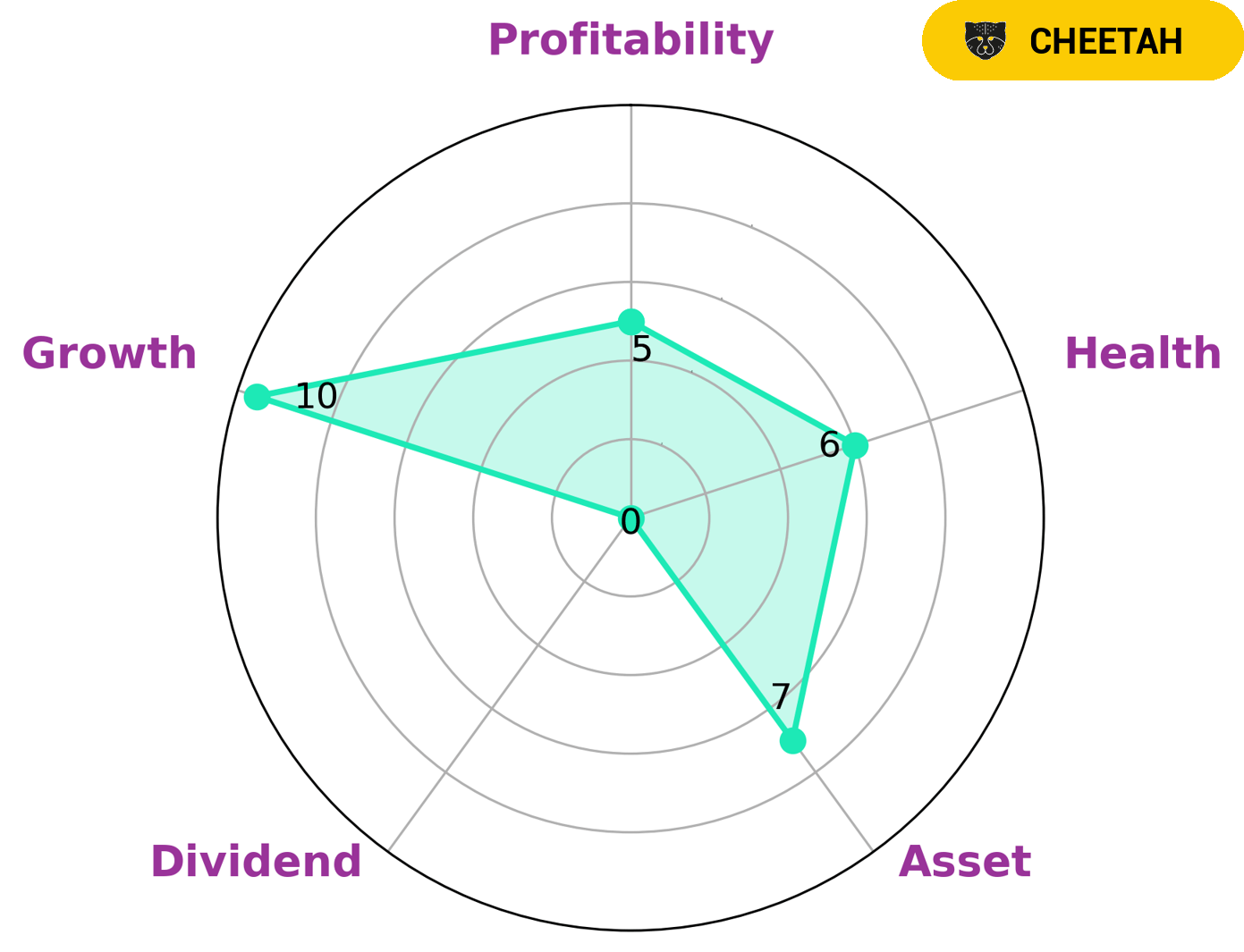

GoodWhale has examined the financials of KUAISHOU TECHNOLOGY and our Star Chart shows that it is classified as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Based on this, we would expect that the company would be of interest to those looking for higher risk investments with potentially higher returns. KUAISHOU TECHNOLOGY has an intermediate health score of 6/10 with regard to its cash flows and debt, which indicates that it is likely to safely ride out any crisis without the risk of bankruptcy. While the company is strong in asset and growth, medium in profitability, and weak in dividend, investors should be mindful of the risks associated with such an investment. Nonetheless, KUAISHOU TECHNOLOGY can be a lucrative option for investors who are comfortable with taking higher risks in exchange for potentially higher returns. More…

Peers

With its focus on short-form videos, Kuaishou Technology is a major competitor to Lizhi Inc, Creatd Inc, and IndiaMART InterMESH Ltd. All four companies have their own unique offerings in the market and are constantly striving for innovation and disruption.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc is a leading online audio entertainment platform in China, providing music, audio, and video content for its users. As of 2023, the company has a market capitalization of 41.49M, positioning it as one of the major players in the industry. Furthermore, Lizhi Inc boasts a Return on Equity of 16.22%, indicating that the company is effectively managing its resources. With innovative solutions and a commitment to providing quality content, Lizhi Inc is well-positioned to capitalize on the growing demand for online audio entertainment in the years to come.

– Creatd Inc ($BSE:542726)

IndiaMART InterMESH Ltd is a leading B2B e-commerce company in India that caters to the needs of small and medium businesses. With a market cap of 170.18B and a Return on Equity of 12.05%, the company is well-positioned to take advantage of the growth opportunities in the Indian market. The company, which has been in business for more than twenty years, offers a wide range of services, including online marketplace, online payments, and digital marketing. IndiaMART InterMESH Ltd also hosts a wide variety of products, from apparel and accessories to industrial machinery and electronics. Its strong market cap and ROE are evidence of the company’s financial strength and potential for continued growth.

Summary

KUAISHOU TECHNOLOGY‘s Q1 earnings results for FY2023 show a 19.7% increase in total revenue compared to the same period last year, along with a significant improvement in net income. This sent the stock price up on the same day. Investing in KUAISHOU TECHNOLOGY could be a smart move due to its solid performance in the current quarter and potential for further growth.

Analysts suggest that investors take a look at this developing company and its financials before committing to an investment. The company’s long-term success will depend on its ability to maintain and increase its revenue and profits, which would make it a viable option for long-term investors.

Recent Posts