J.B. Hunt Transport Services Reports 16.9% Decrease in Revenue, But Net Income Up 4.4%, in Q4 FY 2022.

February 2, 2023

Earnings report

J.B. ($NASDAQ:JBHT) Hunt Transport Services, one of the largest transportation and logistics companies in the world, recently reported its earnings results for the fourth quarter of its fiscal year 2022, ending December 31st 2022, on January 18th 2023. Results showed that total revenue for this quarter was USD 201.3 million, a 16.9% decrease from the same period the previous year. Despite this decrease in revenue, reported net income was up 4.4% compared to the same period in the previous year, coming to USD 3649.6 million. J.B. Hunt Transport Services is a trucking and logistics company that provides freight transportation and logistics services throughout North America and Europe. The company operates through four segments: Intermodal, Dedicated Contract Services, Integrated Capacity Solutions, and Truck.

However, the company has managed to remain profitable despite these challenges, posting a 4.4% increase in reported net income compared to the same period in the previous year. Going forward, J.B. Hunt Transport Services is well-positioned to continue growing its business despite the ongoing economic challenges. With its strong network and innovative services, J.B. Hunt Transport Services is well-positioned to remain a leader in the transportation and logistics industry for years to come.

Market Price

On Wednesday, J.B. Hunt Transport Services reported a 16.9% decrease in revenue for the fourth quarter of fiscal year 2022, but net income increased by 4.4%. This was compared to the same period in the previous fiscal year. Stock prices also saw a positive increase, with the stock opening at $177.0 and closing at $185.0 – up 5.0% from the previous closing price of 176.3. The company attributed the decrease to lower fuel surcharges, as well as higher operating costs associated with the new government regulations that went into effect.

This was attributed to the company’s focus on cost reduction initiatives and improved efficiency throughout its operations. Overall, J.B. Hunt Transport Services reported mixed results for the fourth quarter of fiscal year 2022, with a decrease in revenue but an increase in net income and return on equity. While this may not be ideal given the current market conditions, investors were still pleased with the results and pushed the stock prices up 5.0%. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JBHT. More…

| Total Revenues | Net Income | Net Margin |

| 14.81k | 969.35 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JBHT. More…

| Operations | Investing | Financing |

| 1.61k | -877.02 | -304.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JBHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.74k | 4.08k | 30.11 |

Key Ratios Snapshot

Some of the financial key ratios for JBHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | 22.0% | 9.0% |

| FCF Margin | ROE | ROA |

| 1.0% | 26.7% | 10.7% |

Analysis

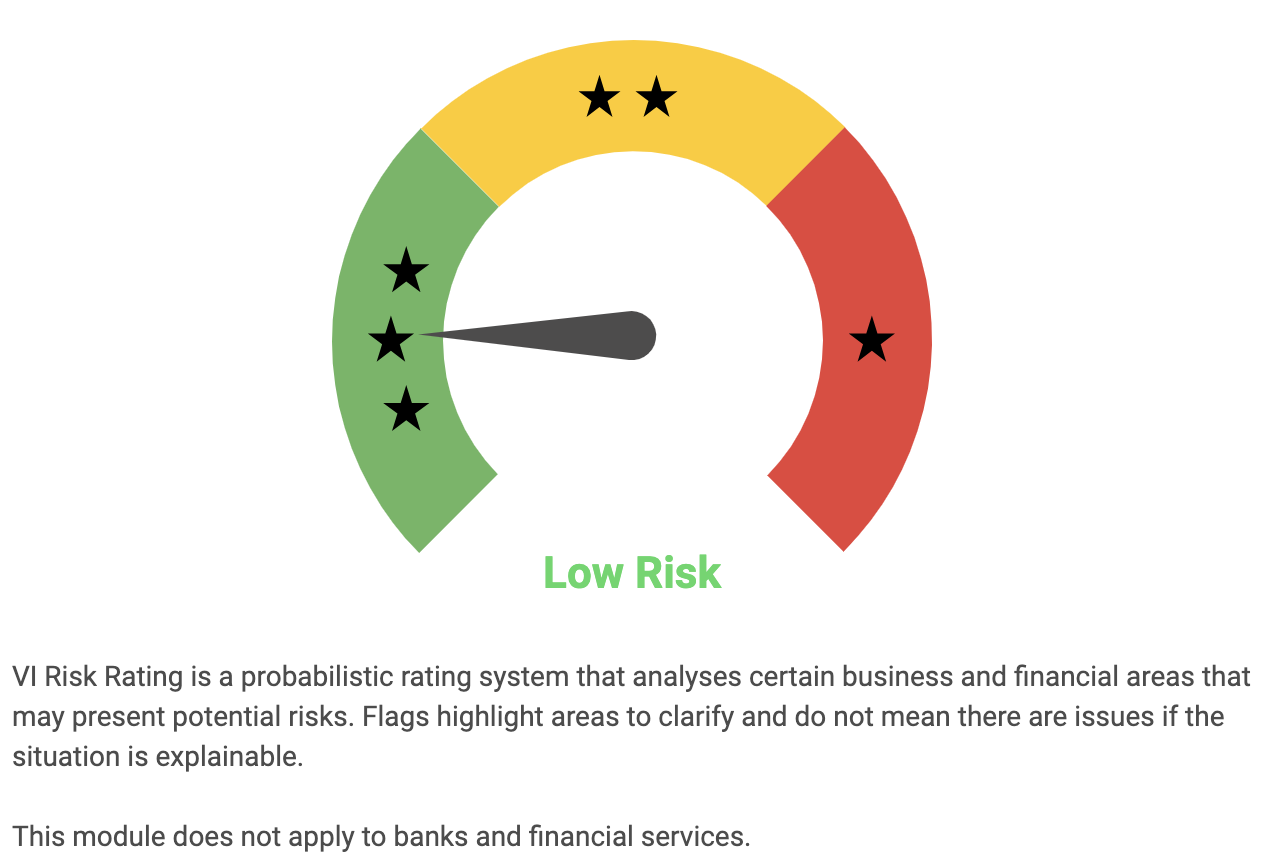

J.B. HUNT TRANSPORT SERVICES is a transportation and logistics company offering transportation services to customers in the United States, Canada, and Mexico. GoodWhale provides an analysis of the company’s fundamentals to help investors make informed decisions. According to GoodWhale’s Risk Rating, J.B. HUNT TRANSPORT SERVICES is a low risk investment in terms of financial and business aspects. GoodWhale has detected 1 risk warning in the balance sheet associated with the company, but users must register on the website to access further details. GoodWhale also performs a Credit Rating of the company, which measures its ability to pay back its financial commitments. The credit rating for J.B. HUNT TRANSPORT SERVICES is “Excellent”, which indicates a good financial standing. Additionally, GoodWhale provides an Operating Performance Rating which is an assessment of the company’s management performance and operational efficiency. The rating for J.B. HUNT TRANSPORT SERVICES is “Very Good”, indicating that the company is managing its operations well and is efficiently executing its strategies. Overall, GoodWhale provides investors with a comprehensive analysis of the fundamentals of J.B. HUNT TRANSPORT SERVICES to help them make informed decisions. The analysis reveals that the company is performing well in terms of financial and business aspects, making it a relatively low risk investment. More…

Peers

JB Hunt Transport Services Inc is a leading transportation provider in North America. The company operates in four segments: Intermodal (JBHT), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), and Truck (JBT). The company has a fleet of over 16,000 trucks and more than 48,000 trailers. JBHT offers a wide range of transportation services including intermodal, dedicated contract, and truckload. The company has a strong market position in the United States and Canada.

JBHT competes with Hub Group Inc, Yang Ming Marine Transport Corp, Rinko Corp, and other transportation companies in the United States and Canada. The company has a strong market position and a large fleet of trucks and trailers. JBHT offers a wide range of transportation services. The company has a strong financial position and is expected to grow at a fast pace in the coming years.

– Hub Group Inc ($NASDAQ:HUBG)

Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. Hub Group’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

As of 2022, Hub Group’s market cap is $2.59 billion. The company’s return on equity is 21.81%. Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. The company’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

– Yang Ming Marine Transport Corp ($TWSE:2609)

As of 2022, Yang Ming Marine Transport Corp has a market cap of 220B and a Return on Equity of 62.35%. The company is a leading provider of international ocean transportation services. It operates a modern fleet of container vessels and provides integrated logistics services. The company has a strong market position in the Far East, Europe, and the Middle East.

– Rinko Corp ($TSE:9355)

Rinko Corp is a Japanese company that manufactures and sells construction materials. The company has a market cap of 3.82B as of 2022 and a return on equity of 4.29%. Rinko Corp is a well-established company with a strong financial position. The company’s products are in high demand, and its products are used in a wide variety of applications. Rinko Corp has a strong market presence and is a market leader in its industry.

Summary

J.B. Hunt Transport Services reported strong financial results for the fourth quarter of fiscal year 2022, ending December 31st 2022. Revenue decreased by 16.9% compared to the same period the previous year, but net income was up 4.4% year over year. The stock price of J.B. Hunt Transport Services moved up following this news, indicating that investors are optimistic about the company’s future prospects. Analysts have pointed to J.B. Hunt’s ability to manage costs during this difficult period and its focus on delivering high-quality customer service as reasons for investors to remain confident in its prospects.

Additionally, the company has been able to capitalize on the increasing demand for online shopping, which is likely to remain strong in the coming years. J.B. Hunt’s strong financial performance and focus on innovation make it an attractive investment option for those looking for long-term growth potential. Though the company is exposed to the volatility of the transportation industry, its diversified revenue streams and commitment to operating efficiency provide a measure of security. As long as J.B. Hunt continues to deliver quality service and remain responsive to changing market conditions, investors can expect continued solid returns from their investment in the company.

Recent Posts