Howard Hughes Reports USD 223.3 Million in Revenue for Q2 2023, 19.3% Lower YoY

August 14, 2023

🌧️Earnings Overview

On August 8, 2023, Howard Hughes ($NYSE:HHC) reported total revenue of USD 223.3 million for FY2023 Q2 ending June 30, 2023, which was 19.3% lower than the same period in the previous year. Net income was reported at USD -19.1 million compared to 21.6 million in the prior year.

Analysis

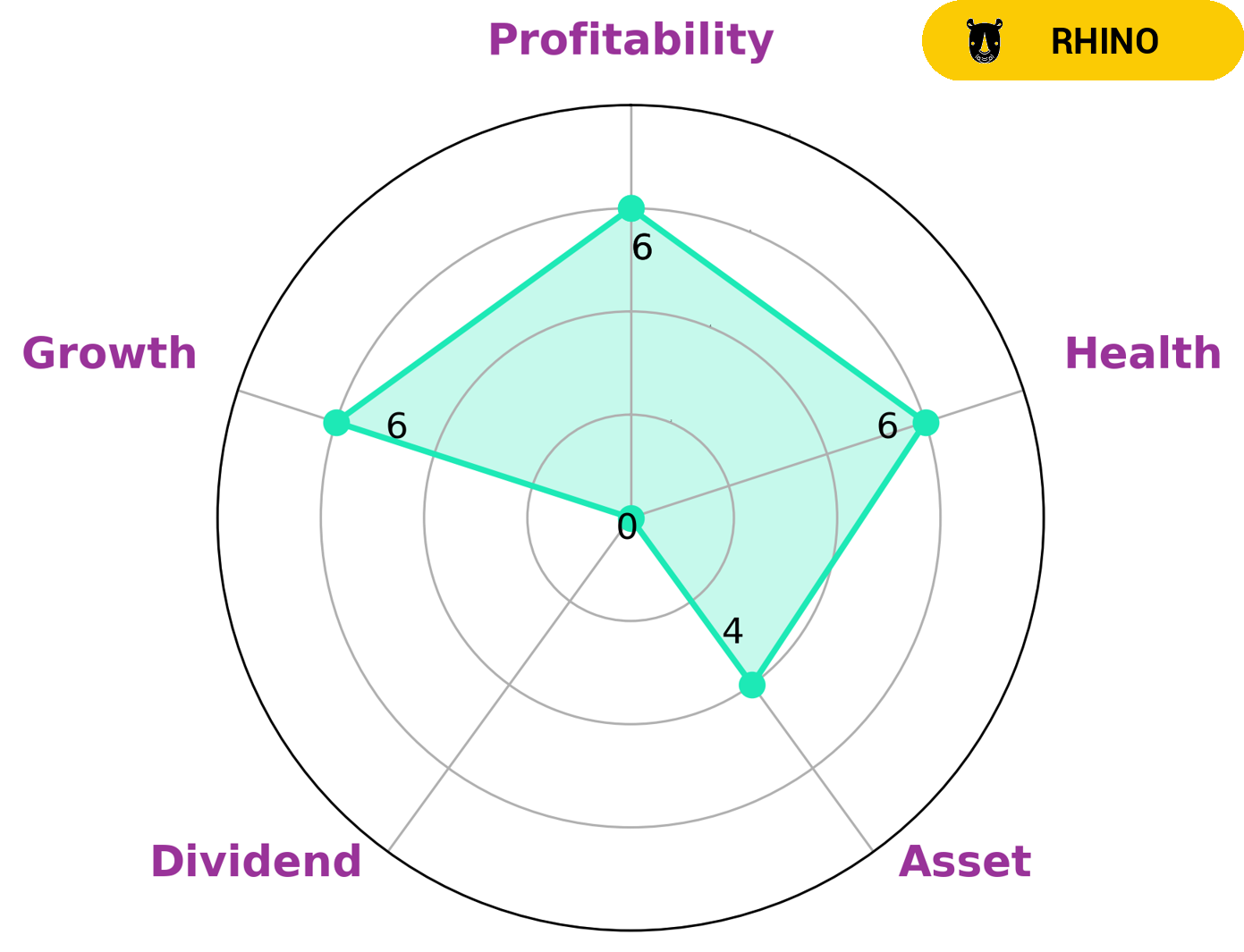

GoodWhale recently conducted an analysis of Howard Hughes‘ financials and the results have been released. According to Star Chart, Howard Hughes has an intermediate health score of 6/10 with regards to cash flows and debt, suggesting that the company may have enough financial resources to pay off its debt and fund future operations. When it comes to the four core financial metrics, Howard Hughes is strong in liquidity, medium in asset, growth, and profitability and weak in dividend. Based on these metrics, GoodWhale has classified Howard Hughes as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given that Howard Hughes has an intermediate health score with only moderate growth, it may be more attractive to investors who are looking for long-term value or stability rather than short-term gains. These investors may seek out companies with a strong balance sheet, such as Howard Hughes, as a safe investment option. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Howard Hughes. More…

| Total Revenues | Net Income | Net Margin |

| 1.54k | 118.96 | 6.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Howard Hughes. More…

| Operations | Investing | Financing |

| 170.12 | -380.44 | 130.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Howard Hughes. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.77k | 6.2k | 70.07 |

Key Ratios Snapshot

Some of the financial key ratios for Howard Hughes are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.1% | 38.4% | 18.3% |

| FCF Margin | ROE | ROA |

| 10.7% | 5.0% | 1.8% |

Peers

It was created on November 15, 2010, when General Growth Properties spun off its subsidiary, The Howard Hughes Corporation. The new company is traded on the New York Stock Exchange under the ticker symbol HHC. The Howard Hughes Corporation owns, operates, and develops commercial, residential, and mixed-use real estate properties in the United States. Eco Depot Inc is a publicly traded Canadian home improvement retailer that operates stores in Canada and the United States. The company was founded in 1986, and is headquartered in Boucherville, Quebec. Eco Depot Inc has more than 400 stores, and employs more than 27,000 people. Gould Investors LP is a privately held investment firm that manages a portfolio of investments in public and private companies. Gould Investors LP was founded in 1977, and is headquartered in New York, New York. Nexity SA is a French real estate company that focuses on the development, construction, and management of residential and commercial properties. Nexity SA was founded in 1948, and is headquartered in Paris, France.

– Eco Depot Inc ($OTCPK:ECDP)

Eco Depot Inc is a company that provides environmental solutions. It offers products and services that help businesses and individuals protect the environment. The company has a market cap of 1.52M as of 2022.

– Gould Investors LP ($OTCPK:GDVTZ)

Nexity SA is a French real estate company with a market cap of 1.29B as of 2022. The company has a Return on Equity of 8.57%. Nexity SA is involved in the development, sale, and management of real estate assets in France. The company also provides real estate services, such as property management, rental management, and construction management.

Summary

Howard Hughes Corporation reported a total revenue of USD 223.3 million for the second quarter of 2023, ending June 30 2023, which was 19.3% lower than the same period in the previous year. Net income dropped to USD -19.1 million from 21.6 million in the prior year. This indicates a decrease in both revenue and profits for Howard Hughes Corporation, which could be cause for concern for investors. Looking into the company’s operations going forward can help investors determine how to adjust their investments accordingly and make more informed decisions.

Recent Posts