HOME DEPOT Reports 0.3% Increase in Revenue and Net Income for the Quarter Ending January 31, 2023

March 6, 2023

Earnings report

HOME DEPOT ($BER:HDI) recently reported its financial results for the quarter ending January 31, 2023. The company saw an increase of 0.3% in total revenue year-over-year to USD 3.4 billion, as reported on February 21, 2023. Not only did the company experience a modest surge in total revenue, but it also saw its net income jump by 0.3% year-over-year to USD 35.8 billion for the same period. These results are a testament to the success of HOME DEPOT in maintaining its financial stability amidst turbulent economic times.

It is encouraging to see a consistent increase in its revenue and net income despite the difficult circumstances. It’s likely that this trend may continue as HOME DEPOT continues to receive recognition and support from its customers, and continues to focus on expanding its services and offerings strategically.

Share Price

On Tuesday, HOME DEPOT reported 0.3% increase in revenue and net income for the quarter ending January 31, 2023. Following the announcement, HOME DEPOT stock opened at €296.9 and closed at €296.9, down by 0.4% from prior closing price of 298.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Home Depot. More…

| Total Revenues | Net Income | Net Margin |

| 157.4k | 17.11k | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Home Depot. More…

| Operations | Investing | Financing |

| 14.62k | -3.14k | -10.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Home Depot. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.44k | 74.88k | 1.27 |

Key Ratios Snapshot

Some of the financial key ratios for Home Depot are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 14.9% | 15.3% |

| FCF Margin | ROE | ROA |

| 7.3% | 1160.2% | 19.7% |

Analysis

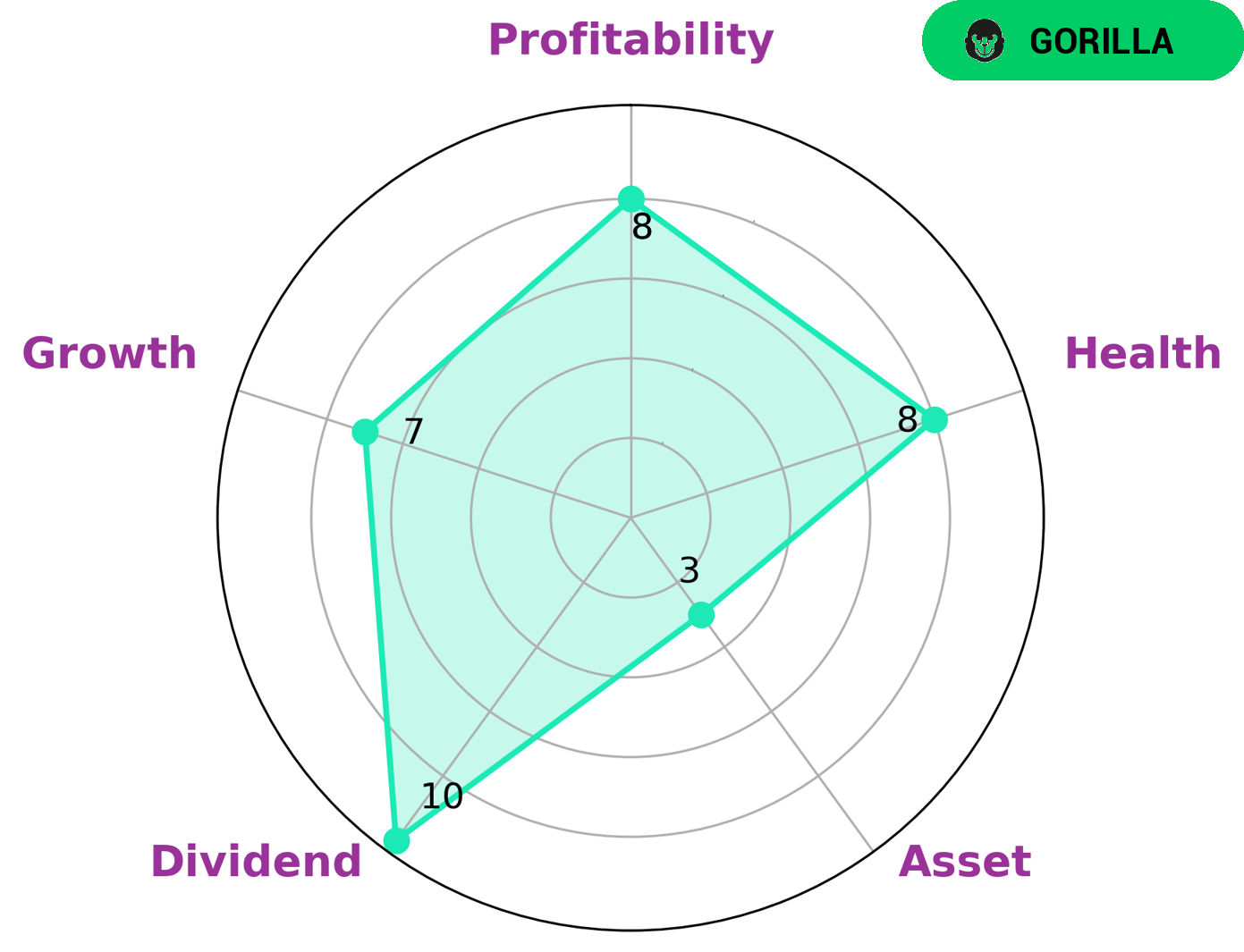

To support this classification, Home Depot scored a strong 8/10 in terms of its cashflows and debt, indicating that it is capable of paying off its debts and funding future operations. An examination of the Star Chart reveals that Home Depot is particularly strong in dividend, growth, and profitability, but weak in asset. With such a reliable profile and solid fundamentals, Home Depot is likely to attract the interest of both value and growth investors. Value investors are likely to appreciate the company’s reliable and consistent income stream from dividends, as well as its strong posture regarding debt repayment. Meanwhile, growth investors will be drawn to Home Depot’s strong performance when it comes to sales and earnings growth. More…

Summary

Home Depot’s fiscal fourth quarter financial results showed good performance for the company. Net income increased 0.3% year-over-year to $35.8 billion for the period ending February 21, 2023. This positive performance can be attributed to the company’s successful implementation of various cost savings and operational strategies, as well as the strong demand for homes and DIY products. Overall, Home Depot remains a top choice for investors looking for value in the retail market.

Recent Posts