Grocery Outlet Holding Reports Profits for Second Quarter of FY2023

August 21, 2023

☀️Earnings Overview

On August 8, 2023 GROCERY OUTLET HOLDING ($NASDAQ:GO) reported their results for the second quarter of FY2023; total revenue was at USD 1010.3 million, a 12.5% increase from the same quarter in the previous fiscal year. Additionally, net income rose by 21.8% year over year to USD 24.5 million.

Market Price

On Tuesday, Grocery Outlet Holding (GROCERY) reported its second-quarter financial results for the fiscal year 2023. The stock opened at $33.2 and closed at $33.1, down 0.2% from its prior closing price of $33.2. The company’s cost-cutting initiatives paid off resulting in a lower operating expense and higher gross profit margin. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GO. More…

| Total Revenues | Net Income | Net Margin |

| 3.82k | 71.58 | 2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GO. More…

| Operations | Investing | Financing |

| 257.9 | -162.64 | -91.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.82k | 1.66k | 11.79 |

Key Ratios Snapshot

Some of the financial key ratios for GO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 9.4% | 3.0% |

| FCF Margin | ROE | ROA |

| 2.5% | 6.3% | 2.6% |

Analysis

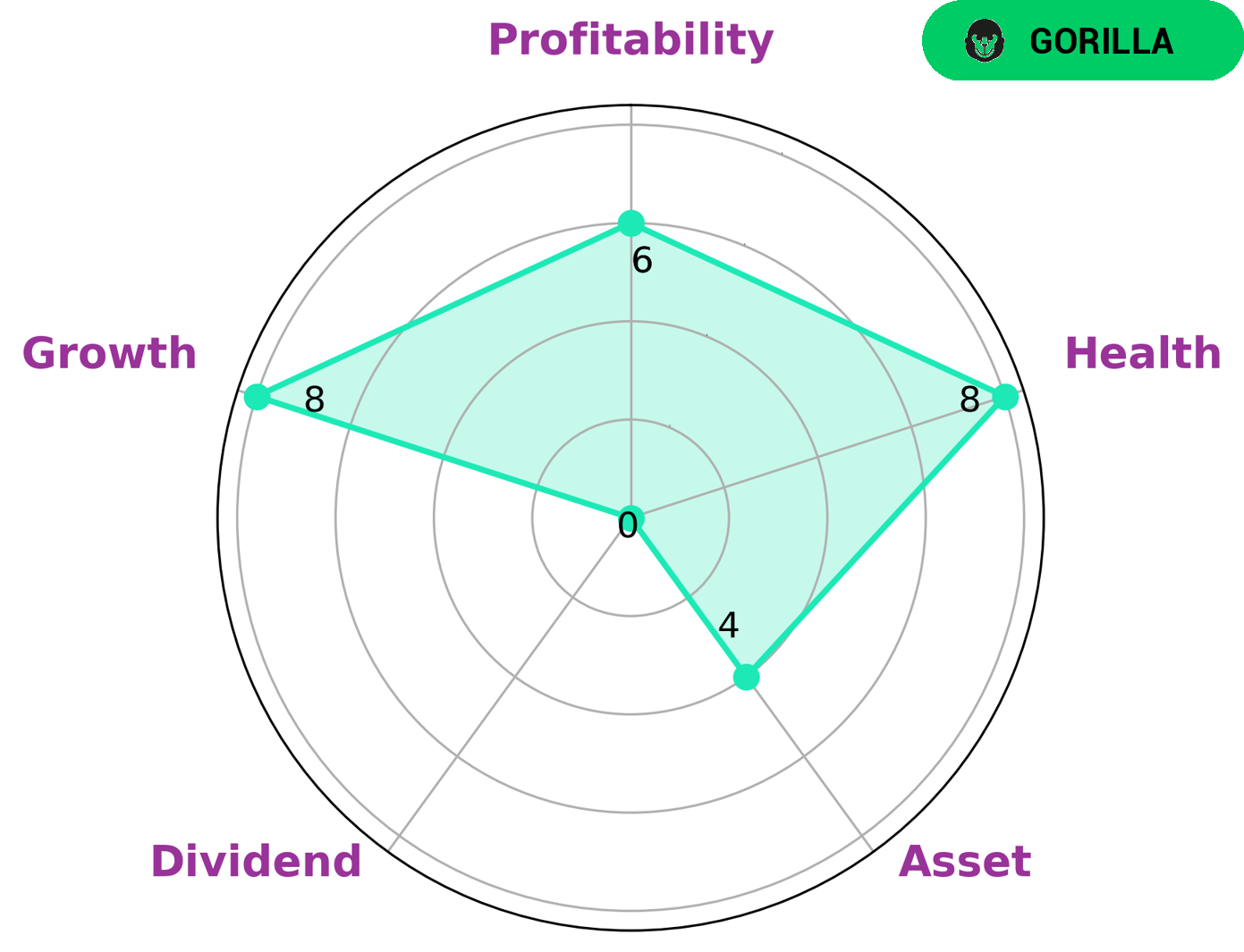

At GoodWhale, we have completed a fundamental analysis of GROCERY OUTLET HOLDING and found it to be a strong company. Our Star Chart shows that it has a health score of 8/10 thanks to its strong cashflows and debt. This allows GROCERY OUTLET HOLDING to pay off debt and fund future operations. Additionally, GROCERY OUTLET HOLDING has a strong growth rate, medium profitability, and weak in terms of assets and dividends. We classify GROCERY OUTLET HOLDING as a gorilla company, meaning that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such companies should look for reliable, long-term growth and be mindful of the potential risks associated with the sector. GROCERY OUTLET HOLDING has well-managed finances and is a strong candidate for those seeking growth with limited risk. More…

Peers

The company was founded in 1946 and is headquartered in Emeryville, California. Grocery Outlet Holding Corp operates through two segments: Grocery Outlet and Bargain Market. The Grocery Outlet segment offers a variety of food and household products at discounts of up to 50% off traditional grocery store prices. The Bargain Market segment offers a selection of closeout, overstocked, and irregular merchandise at discounts of up to 70% off traditional retail prices. The company competes with Veroni Brands Corp, The Kroger Co, and Ollie’s Bargain Outlet Holdings Inc.

– Veroni Brands Corp ($OTCPK:VONI)

As of 2022, Veroni Brands Corp has a market cap of 47.4M. The company’s return on equity is 98.41%. Veroni Brands Corp is a food and beverage company that manufactures and markets a variety of food and beverage products. The company’s products include pasta, sauces, snacks, and desserts. Veroni Brands Corp is headquartered in New York, New York.

– The Kroger Co ($NYSE:KR)

The Kroger Co has a market cap of 33.33B as of 2022, a Return on Equity of 23.61%. The company is a leading grocery store chain in the United States with over 2,800 stores in 35 states. The company offers a wide variety of products and services including grocery, health and beauty, and general merchandise. Kroger also has a strong online presence with a website and mobile app that offer convenient shopping options for customers.

– Ollie’s Bargain Outlet Holdings Inc ($NASDAQ:OLLI)

Ollie’s Bargain Outlet Holdings Inc is a publicly traded company with a market cap of 3.37B as of 2022. The company operates a chain of closeout retail stores in the United States. As of February 2021, the company operated 259 stores in 27 states. The company was founded in 1982 and is headquartered in Harrisburg, Pennsylvania.

Summary

GROCERY OUTLET HOLDING reported strong second-quarter results for FY2023, with total revenue up 12.5% year-over-year and net income up 21.8%. These results are encouraging and suggest that the company is well-positioned for further growth. Investors should take note of GROCERY OUTLET HOLDING’s impressive performance and analyze the company’s fundamentals to determine if it is a suitable investment opportunity. Key metrics to consider include cash flow, debt-to-equity ratio, and return on equity.

Additionally, investors should research the company’s competitive landscape and potential risk factors to make a more informed decision.

Recent Posts