G. WILLI-FOOD INTERNATIONAL Reports 28.2% Increase in Total Revenue for First Quarter of FY2023.

May 27, 2023

Earnings Overview

G. WILLI-FOOD INTERNATIONAL ($NASDAQ:WILC) reported total revenue of ILS 151.4 million for the first quarter of FY2023 ending on March 31 2023, a 28.2% rise year over year. Unfortunately, despite the revenue growth, net income had a 20.5% decrease compared to the same period in the prior year, falling to ILS 10.8 million.

Analysis

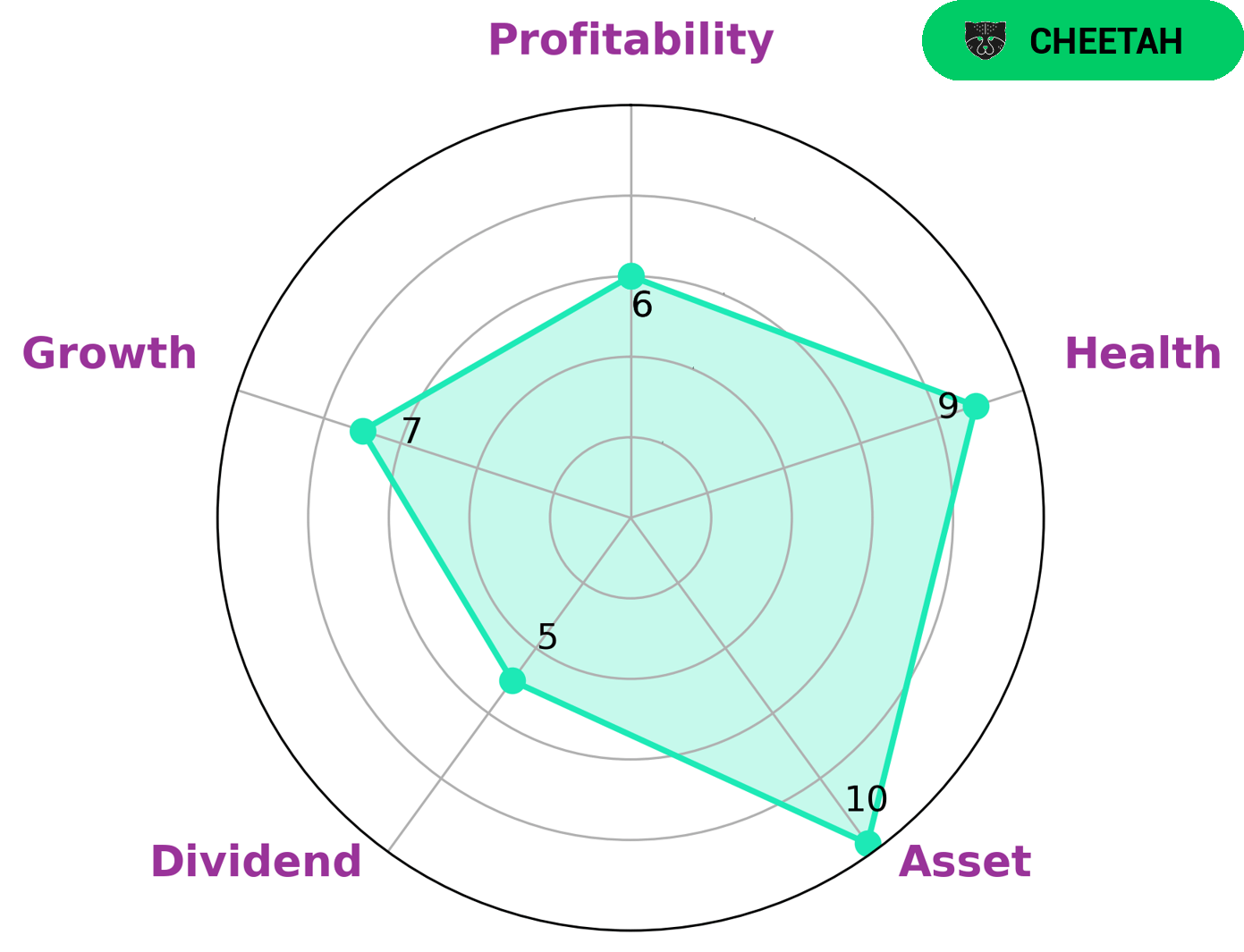

GoodWhale has conducted an analysis of G. WILLI-FOOD INTERNATIONAL’s wellbeing and based on its Star Chart classification as a ‘cheetah’, a type of company with high revenue or earnings growth but lower profitability and stability. This suggests that investors interested in a higher return but with a higher risk would be attracted to G. WILLI-FOOD INTERNATIONAL. The company’s strong asset and growth scores, along with its medium rating in terms of dividend and profitability make this a viable option for such investors. Furthermore, G. WILLI-FOOD INTERNATIONAL’s high health score of 9/10 with regard to its cashflows and debt suggests that it is capable to sustain future operations in times of crisis. Thus, G. WILLI-FOOD INTERNATIONAL has potential to attract investors interested in a higher return investment with some risk. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WILC. More…

| Total Revenues | Net Income | Net Margin |

| 531.61 | 38.77 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WILC. More…

| Operations | Investing | Financing |

| -9.24 | 4.08 | -57.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WILC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 621.7 | 80.94 | 39 |

Key Ratios Snapshot

Some of the financial key ratios for WILC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | -3.4% | 10.6% |

| FCF Margin | ROE | ROA |

| -5.1% | 6.4% | 5.7% |

Peers

It faces competition from Nascent Wine Co Inc, Shineroad International Holdings Ltd, and Cool Link (Holdings) Ltd, all of which are prominent players in the food industry. Despite the competitive landscape, G. Willi-Food International Ltd has managed to maintain its leading position through its innovative products, excellent customer service, and commitment to quality.

– Nascent Wine Co Inc ($OTCPK:NCTW)

Nascent Wine Co Inc is a leading producer and distributor of fine wines from around the world. The company has been in business since 1997 and has built a strong reputation for producing high-quality wines. As of 2023, Nascent Wine Co Inc has a market capitalization of 131.33k, giving it a relatively small size compared to other major wine companies. The company also has a negative Return on Equity (ROE) of -56.08%. This suggests that the company has not been able to generate profits as efficiently as its peers, which is concerning for potential investors. Despite this, Nascent Wine Co Inc remains a respected player in the wine industry and continues to offer quality wines to its customers.

– Shineroad International Holdings Ltd ($SEHK:01587)

Shineroad International Holdings Ltd is a Hong Kong-based company engaged in the importing and exporting of goods and services. The company has a market cap of 408 million as of 2023, which puts it among the more prominent players in the industry. Additionally, Shineroad International Holdings Ltd has an impressive return on equity of 9.39%. This measure of profitability shows that the company is using its shareholders investments to create value and generate returns. This bodes well for investors who are looking for strong returns on their investments.

– Cool Link (Holdings) Ltd ($SEHK:08491)

Cool Link (Holdings) Ltd is a company that provides a range of mobile data services and products. Its market capitalization stands at 55.67M as of 2023. This represents the total value of the company’s outstanding shares. Additionally, its Return on Equity (ROE) ratio stands at -36.91%. This is a measure of profitability and can be used to compare the performance of the company to that of its peers. It indicates that the company is not doing well financially and may need to improve its operations in order to increase profitability.

Summary

G. WILLI-FOOD INTERNATIONAL reported strong revenue growth in the first quarter of FY2023, with total revenue increasing by 28.2%. Despite this, net income declined by 20.5% compared to the same period the prior year. Investors should take this into consideration when evaluating the company’s performance and outlook.

Furthermore, further scrutiny should be placed on the company’s strategies and operations to determine potential causes of the decline in net income and what steps can be taken to reverse it. Ultimately, investors should use caution when considering an investment in G. WILLI-FOOD INTERNATIONAL.

Recent Posts