Enersys Reports USD 908.6 Million in Revenue for FY2024 Q1, Up 1.1% From Previous Year

August 12, 2023

🌥️Earnings Overview

ENERSYS ($NYSE:ENS) reported its FY2024 Q1 earnings results as of June 30 2023 on August 9 2023, with total revenue of USD 908.6 million, a 1.1% increase compared to the same period of the prior year. Net income for the period amounted to USD 66.8 million, a 115.6% increase year over year.

Analysis

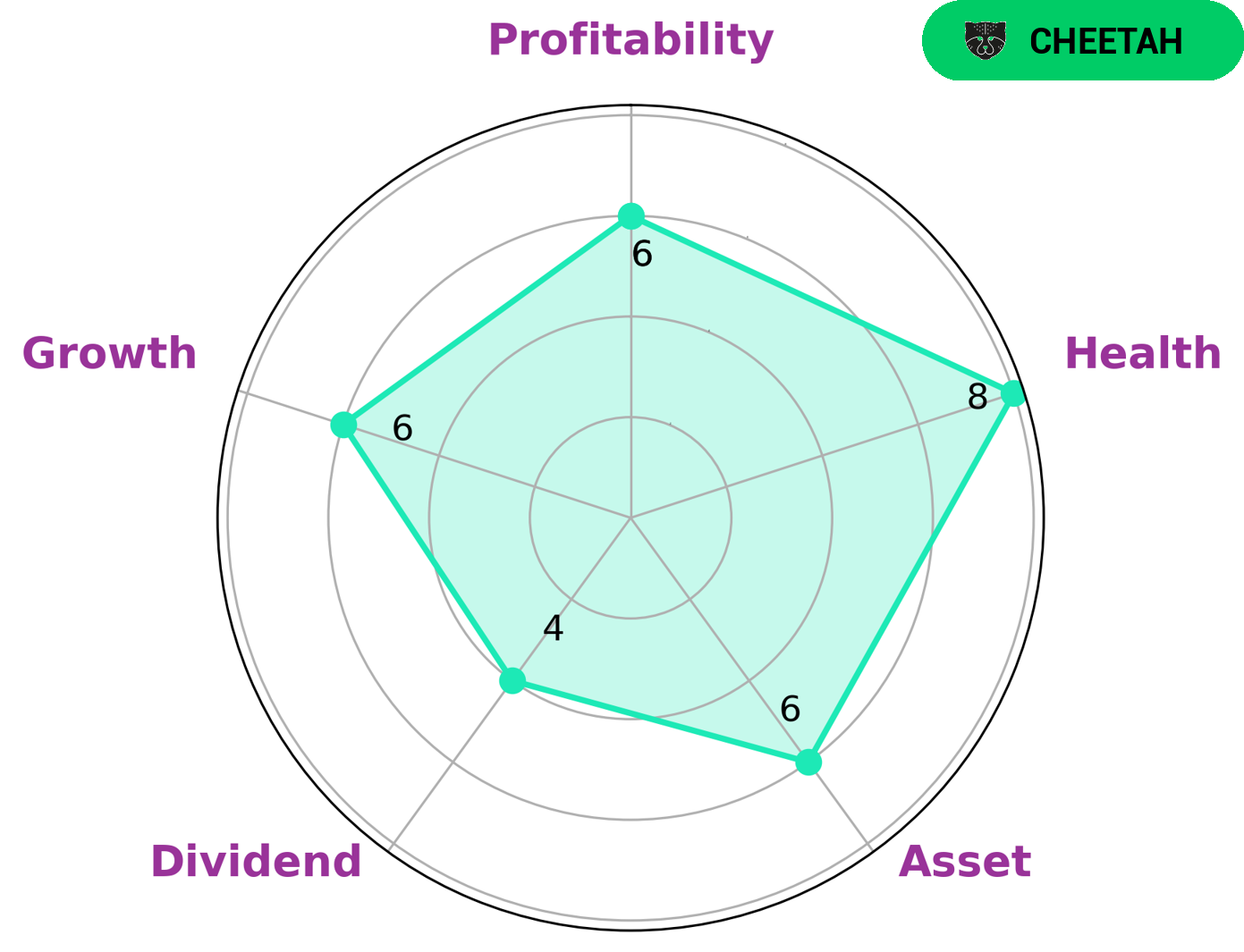

GoodWhale has conducted an analysis of ENERSYS’s wellbeing and based on the Star Chart, the company has a health score of 8/10. This implies that ENERSYS can sustain operations through times of crisis due to its healthy cash flows and debts. Moreover, ENERSYS is classified as a ‘cheetah’ type of company, which typically means that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors that may be interested in such a company may include those who are looking for capital gains over dividends, since ENERSYS is strong in profitability and medium in asset, growth and weak in dividend. Furthermore, those investors who are willing to take on more risk in exchange for higher potential returns are likely to be interested in investing in a company like ENERSYS. In conclusion, with a high health score and being a cheetah-type of company, ENERSYS is an attractive option for investors who are willing to take on more risk for potentially higher returns. Enersys_Reports_USD_908.6_Million_in_Revenue_for_FY2024_Q1_Up_1.1_From_Previous_Year”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enersys. More…

| Total Revenues | Net Income | Net Margin |

| 3.72k | 211.63 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enersys. More…

| Operations | Investing | Financing |

| 426.77 | -46.25 | -503.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enersys. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.48k | 1.8k | 41.01 |

Key Ratios Snapshot

Some of the financial key ratios for Enersys are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 11.6% | 8.4% |

| FCF Margin | ROE | ROA |

| 9.3% | 11.8% | 5.6% |

Peers

The company competes with ESS Tech Inc, Shandong Sacred Sun Power Sources Co Ltd, Eos Energy Enterprises Inc, among others. EnerSys has a diversified product portfolio and a strong market position. The company’s products are used in a variety of applications including material handling, oil and gas, power generation, transportation, and other industrial applications.

– ESS Tech Inc ($NYSE:GWH)

Founder and CEO of the company is Jean-luc Roy. The company provides software for the management and analysis of data. The company went public in May of 2017. The company’s market cap as of December of 2020 was $525.68 million. The company’s ROE as of December of 2020 was -188.29%.

– Shandong Sacred Sun Power Sources Co Ltd ($SZSE:002580)

Shandong Sacred Sun Power Sources Co Ltd is a leading manufacturer of solar panels and related products. The company has a market cap of 4.97B as of 2022 and a return on equity of 4.18%. The company’s products are used in a variety of applications, including solar power plants, residential and commercial rooftops, and portable solar power systems.

– Eos Energy Enterprises Inc ($NASDAQ:EOSE)

Eos Energy Enterprises Inc is a publicly traded company with a market capitalization of 86.7 million as of 2022. The company has a return on equity of 163.71%. Eos Energy Enterprises Inc is engaged in the business of developing and commercializing energy storage solutions based on zinc-air batteries.

Summary

ENERSYS recently reported strong financials for FY2024 Q1, ending June 30 2023. Total revenue grew 1.1%, while net income rose 115.6% year over year. This indicates the company is performing well and is likely to continue to be a strong investment opportunity. Investors should consider ENERSYS for its potential long-term dividends and capital appreciation.

ENERSYS has a competitive edge in the market and is well positioned to capitalize on industry trends and achieve growth. The financial performance of the company provides further evidence that ENERSYS is a sound investment option.

Recent Posts