ENERGIZER HOLDINGS Reports Third Quarter FY2023 Revenue of $699.4 Million, Net Income of $31.8 Million

August 10, 2023

☀️Earnings Overview

For the third quarter of FY2023 ending June 30 2023, ENERGIZER HOLDINGS ($NYSE:ENR) reported total revenue of USD 699.4 million and net income of USD 31.8 million – a decrease of 3.9% and 39.3% respectively compared to the same period in the previous year.

Market Price

Despite the positive news, the stock opened at $31.8 and closed at $32.8, which was a drop of 9.2% from its prior closing price of 36.1. The disappointing stock performance was likely due to the fact that the company had reported slightly lower overall revenues and income than the consensus estimates. Going forward, the company is focused on pushing for further growth through continued investments in new products and technologies. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Energizer Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.94k | -242.1 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Energizer Holdings. More…

| Operations | Investing | Financing |

| 403.5 | -46.7 | -340.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Energizer Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.51k | 4.34k | 2.33 |

Key Ratios Snapshot

Some of the financial key ratios for Energizer Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.9% | 2.3% | -5.2% |

| FCF Margin | ROE | ROA |

| 12.1% | -60.6% | -2.1% |

Analysis

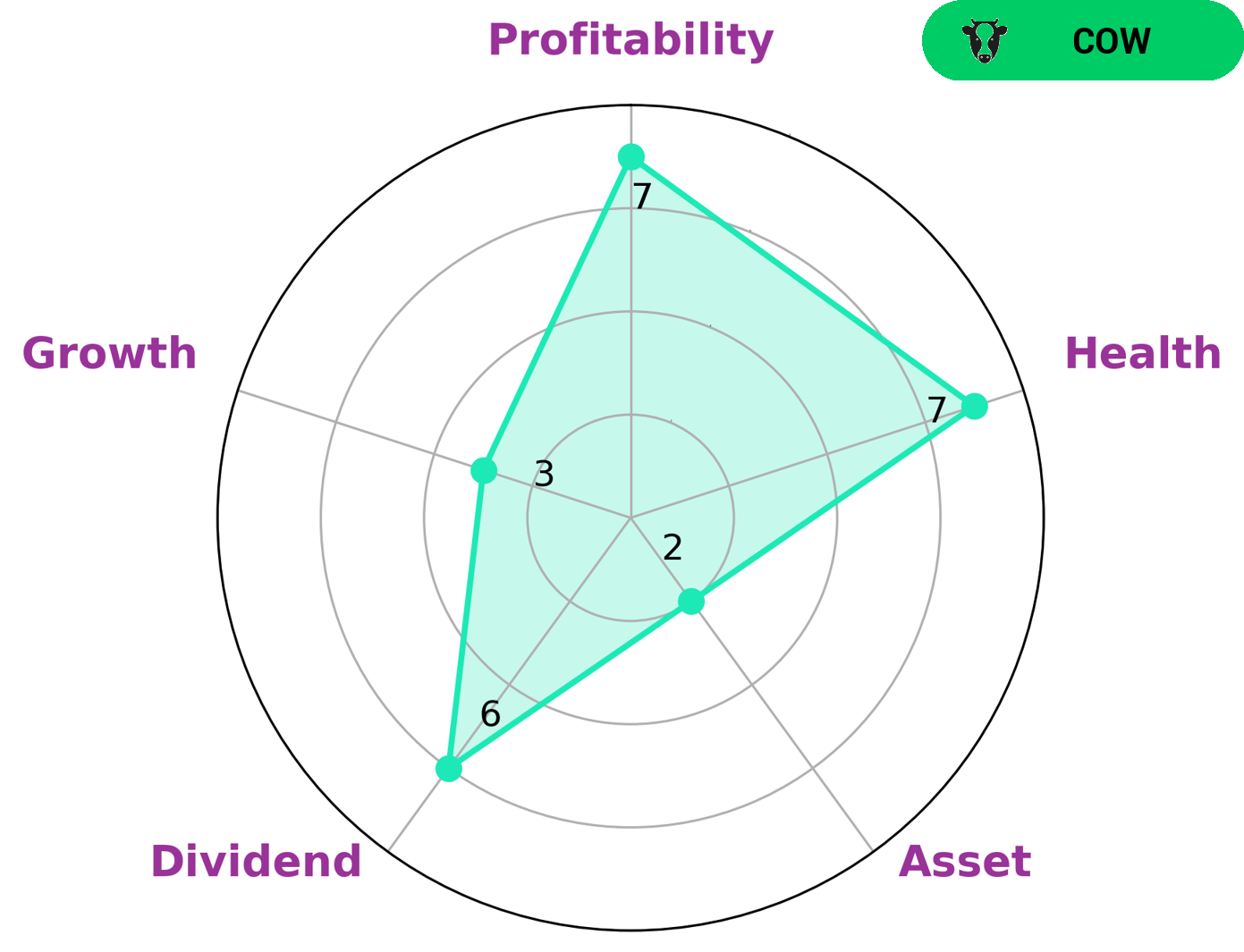

GoodWhale has done an analysis of the fundamentals of ENERGIZER HOLDINGS and based on our Star Chart, we have concluded that the company has an intermediate health score of 6/10. This is because its cashflows and debt are likely to keep it safe from any crisis without the risk of bankruptcy. Furthermore, ENERGIZER HOLDINGS shows strength in dividend and profitability, however, there is a bit of weakness in its asset and growth. We have classified ENERGIZER HOLDINGS as a ‘cow’, which is a type of company that has a track record of paying out consistent and sustainable dividends. This kind of company may be of interest to long-term investors looking for a steady income or those with a low-risk appetite. More…

Peers

Its products are used in a wide range of applications, including electronic devices, power tools, and medical devices. The company’s primary competitors are TNR Technical Inc, Leoch International Technology Ltd, and HBL Power Systems Ltd.

– TNR Technical Inc ($SEHK:00842)

Leoch International Technology Ltd is a Hong Kong-based company principally engaged in the research, development, manufacture and sale of lead-acid batteries and related products. The Company operates its business through three segments. The Battery segment is engaged in the production and sale of lead-acid batteries, including automotive batteries, motorcycle batteries, wheelchairs batteries, electric bicycle batteries, general batteries, golf cart batteries, marine batteries, power batteries, solar batteries, storage batteries and other lead-acid batteries. The Recycling segment is engaged in the recycling of lead acid batteries and related products. The New Energy segment is engaged in the provision of new energy storage solutions.

– Leoch International Technology Ltd ($BSE:517271)

HBL Power Systems Ltd is an Indian engineering company that manufactures a range of products for the power sector, including power generation equipment, power transmission and distribution equipment, and railway electrification equipment. The company has a market cap of 29.44B as of 2022 and a return on equity of 9.55%. HBL Power Systems Ltd is a publicly traded company listed on the Bombay Stock Exchange and the National Stock Exchange of India.

Summary

ENERGIZER HOLDINGS reported a decrease in total revenue and net income for the third quarter of FY2023, compared to the same period in the previous year. Total revenue was USD 699.4 million and net income was USD 31.8 million, representing drops of 3.9% and 39.3% respectively. This news caused the stock price to drop on the same day. Investors considering ENERGIZER HOLDINGS should keep this in mind when evaluating the company’s prospects, as its profitability is now lower than it was before.

Additionally, given the current economic environment, future quarters may prove challenging for the company if revenue and net income don’t improve.

Recent Posts