Endeavor Group Stock Fair Value – ENDEAVOR GROUP Reports 10.1% Increase in Revenue, But 690% Decrease in Net Income for Third Quarter of FY2023

November 21, 2023

☀️Earnings Overview

For the third quarter ending September 30th 2023, ENDEAVOR GROUP ($NYSE:EDR) reported a USD 1344.4 million total revenue and a USD -69.2 million net income, a 10.1% growth in revenue compared to the same quarter of the previous year and a 690% decrease in net income.

Analysis – Endeavor Group Stock Fair Value

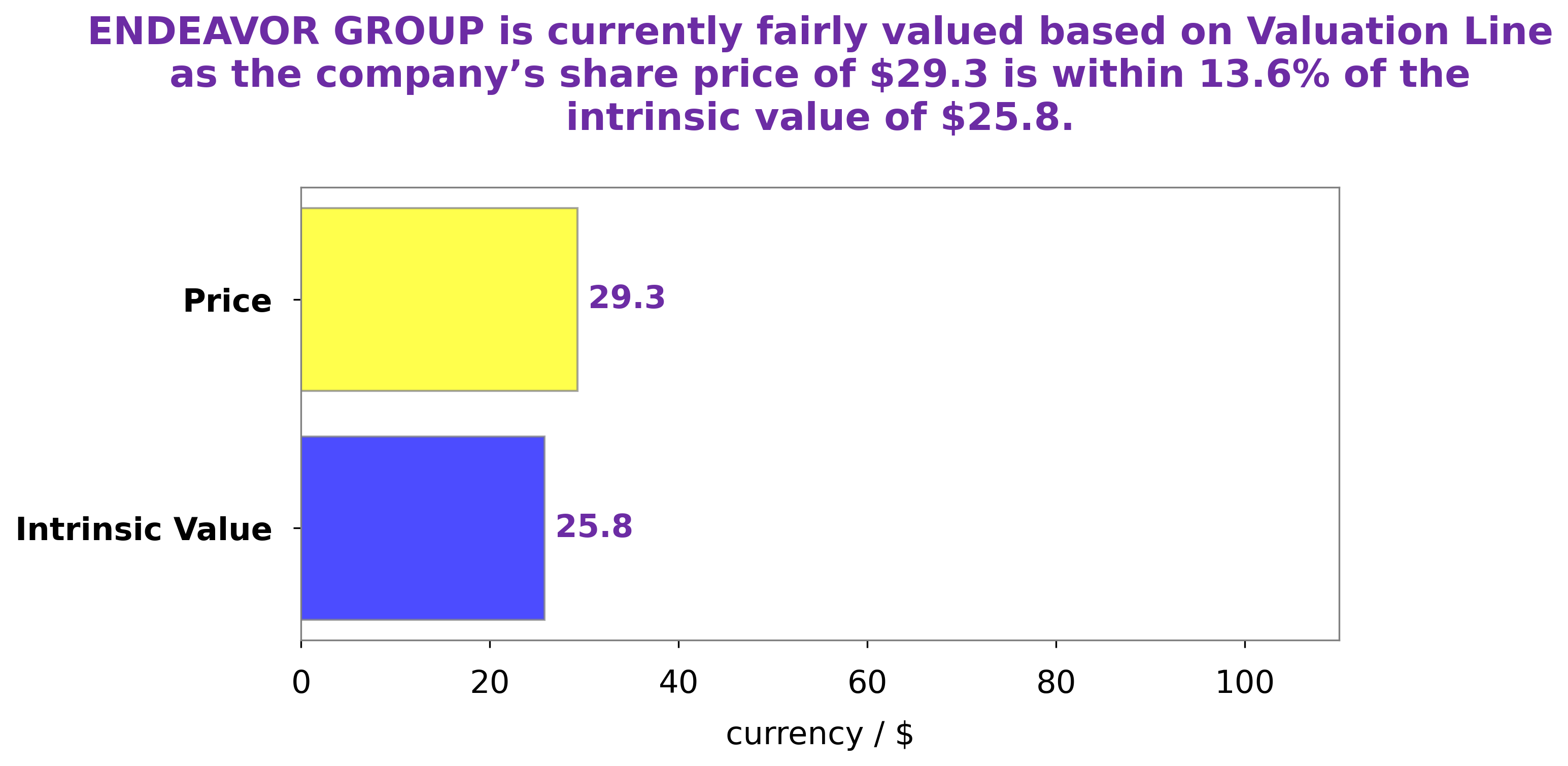

GoodWhale has conducted an analysis of ENDEAVOR GROUP‘s financials, and have concluded that the fair value of their stock is around $24.7, which was computed using our proprietary Valuation Line. This provides investors the opportunity to buy ENDEAVOR GROUP’s stock at a bargain, while still offering potential for capital gains in the future. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Endeavor Group. More…

| Total Revenues | Net Income | Net Margin |

| 5.64k | 129.02 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Endeavor Group. More…

| Operations | Investing | Financing |

| 385.61 | 759.82 | -771.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Endeavor Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.9k | 10.03k | 15.85 |

Key Ratios Snapshot

Some of the financial key ratios for Endeavor Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | 39.4% | 6.5% |

| FCF Margin | ROE | ROA |

| 3.0% | 6.3% | 1.0% |

Peers

In the entertainment industry, there is always competition between companies to be the best and most successful. This is especially true for Endeavor Group Holdings Inc, which competes with companies such as Eline Entertainment Group Inc, Beijing HualuBaina Film & TV Co Ltd, and Lingerie Fighting Championships Inc. While all of these companies are vying for the top spot, Endeavor Group Holdings Inc has the advantage of experience and a strong track record of success. This, combined with its innovative approach to the entertainment industry, gives Endeavor Group Holdings Inc a strong chance of coming out on top.

– Eline Entertainment Group Inc ($OTCPK:EEGI)

Eline Entertainment Group Inc is a media and entertainment company. The company has a market capitalization of $3.93 billion and a return on equity of -0.04%. The company produces and distributes films, television programs, and other entertainment content. The company’s operations are conducted through its subsidiaries, which include Eline Productions, Eline Studios, and Eline Distribution.

– Beijing HualuBaina Film & TV Co Ltd ($SZSE:300291)

Beijing HualuBaina Film & TV Co Ltd is a film and television production company based in Beijing, China. The company has a market cap of 3.83B as of 2022 and a return on equity of 0.69%. Beijing HualuBaina Film & TV Co Ltd produces a variety of film and television content, including feature films, television series, and documentaries. The company has a long history in the film and television industry, and has produced a number of well-known Chinese films and television series.

– Lingerie Fighting Championships Inc ($OTCPK:BOTY)

Lingerie Fighting Championships Inc is a company that produces mixed martial arts events that feature women in lingerie as the competitors. The company was founded in 2011 and is based in Las Vegas, Nevada.

Lingerie Fighting Championships Inc has a market cap of 2.47M as of 2022. The company has a Return on Equity of -63.67%.

The company produces mixed martial arts events that feature women in lingerie as the competitors. The company was founded in 2011 and is based in Las Vegas, Nevada.

Summary

The ENDEAVOR GROUP reported its third quarter of FY2023 financials ending September 30, 2023, showing a 10.1% year-over-year increase in total revenue to USD 1344.4 million compared to the same quarter in the prior year. However, their net income was significantly lower, with a 690% decrease to USD -69.2 million. This highlights the need for investors to consider the company’s long-term prospects and ability to generate sustainable profits before investing in ENDEAVOR GROUP.

Recent Posts