DIGITALBRIDGE GROUP Reports 46.8% Increase in Total Revenue for FY2023 Q2

August 8, 2023

☀️Earnings Overview

On August 4 2023, DIGITALBRIDGE GROUP ($NYSE:DBRG) released their financial results for their fiscal year 2023 second quarter ending June 30 2023. The company saw total revenue for the period amount to USD 424.9 million, a 46.8% increase from the same quarter in the previous year. Net income reported for the quarter was USD -8.7 million, an improvement from -21.6 million in the prior year.

Analysis

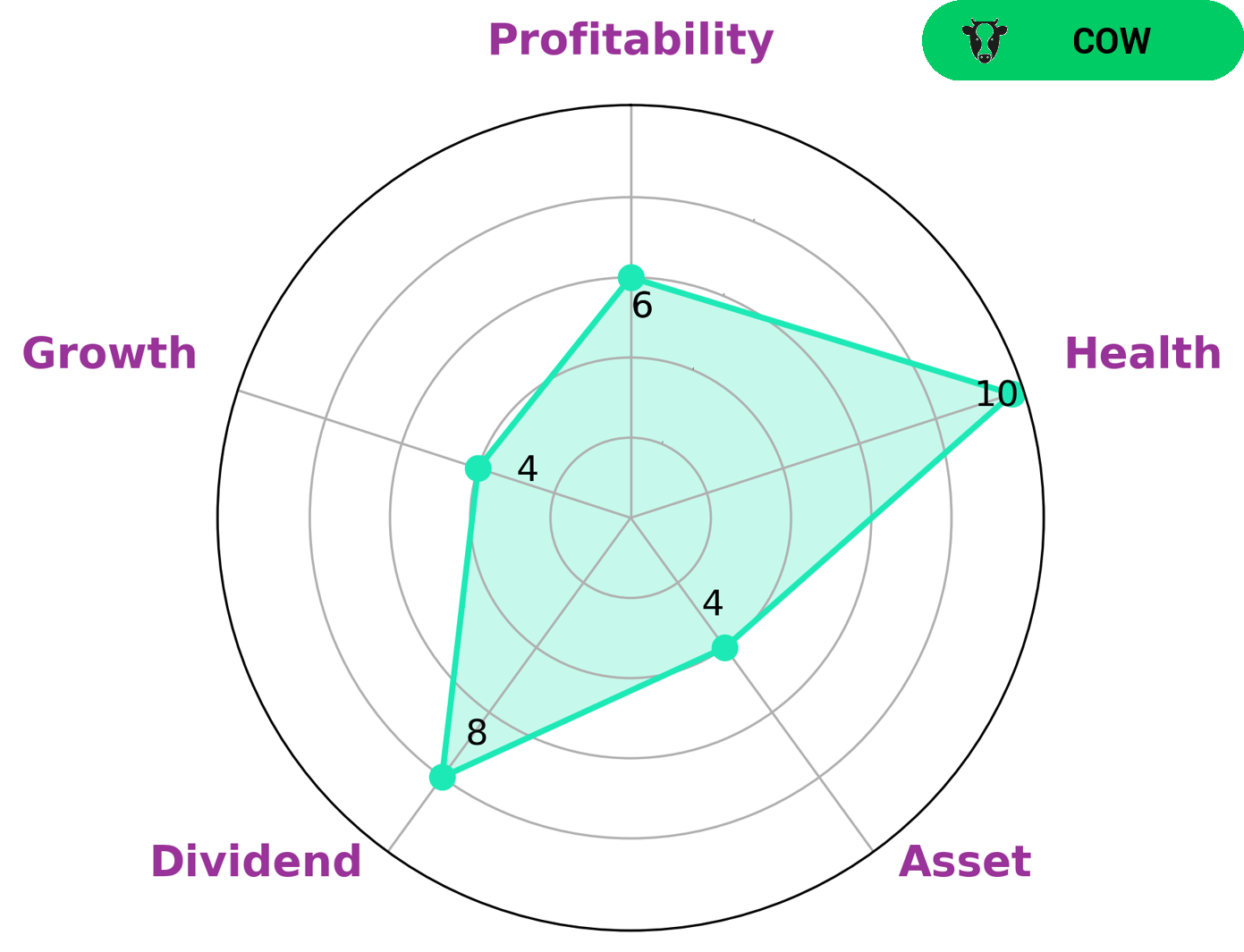

GoodWhale’s analysis of the financials of DIGITALBRIDGE GROUP showed a high health score of 8/10, indicating that the company is capable to sustain future operations in times of crisis. Based on the Star Chart, DIGITALBRIDGE GROUP is strong in its cashflows and debt, medium in growth, profitability and weak in asset and dividend. This results in DIGITALBRIDGE GROUP being classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. The type of investors who may be interested in such a company include those who are looking for a diversified and balanced portfolio, especially in times of economic uncertainty. Such investors may also be looking for companies that are currently in good health and have the potential to weather any further market downturns. DIGITALBRIDGE GROUP with their strong cashflows and debt position could make for an attractive investment for these investors. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Digitalbridge Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.17k | -317.61 | -15.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Digitalbridge Group. More…

| Operations | Investing | Financing |

| 280.72 | -332.56 | 187.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Digitalbridge Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.76k | 6.6k | 8.87 |

Key Ratios Snapshot

Some of the financial key ratios for Digitalbridge Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.5% | -10.2% | -15.0% |

| FCF Margin | ROE | ROA |

| 24.0% | -7.6% | -1.0% |

Peers

Its competitors include Digital Realty Trust Inc, Aspen Digital Inc, and Digital Core REIT.

– Digital Realty Trust Inc ($NYSE:DLR)

Digital Realty Trust Inc is a real estate investment trust that owns, acquires, develops and operates data centers. The company’s market cap as of 2022 is $32.08 billion. Digital Realty’s data centers serve as critical infrastructure for the world’s leading organizations, offering them a secure, reliable and resilient platform from which to operate their businesses.

– Aspen Digital Inc ($OTCPK:ASPD)

As of 2022, Digital Core REIT has a market cap of 683.46M. The company focuses on acquiring, owning, and operating digital infrastructure assets. These assets include data centers, colocation facilities, and other digital infrastructure-related properties.

Summary

Digitalbridge Group reported strong financial results for the second quarter of FY2023, with total revenue reaching USD 424.9 million, representing a year-on-year increase of 46.8%. Net income improved significantly to USD -8.7 million from -21.6 million in the prior year. These results have been encouraging for potential investors, who are bullish on the Group’s prospects for long term growth.

The company’s strong balance sheet and well-managed costs have enabled it to achieve profitability, suggesting that it is well-positioned to capitalize on future opportunities. Investors should keep an eye on Digitalbridge Group for further developments in the coming quarters.

Recent Posts