COSTAR GROUP Reports Impressive Fourth Quarter FY2022 Financial Results with 33.9% Revenue Increase and 13.1% Year-Over-Year Net Income Growth.

March 7, 2023

Earnings report

COSTAR GROUP ($NASDAQ:CSGP) recently reported its financial results for the fourth quarter of FY2022, ending December 31, 2022. The company’s highlighted performance was impressive, with total revenue coming in at USD 124.4 million, which is an increase of 33.9% year-over-year.

Additionally, net income for the quarter was reported at USD 573.3 million, a 13.1% year-over-year growth. These impressive figures demonstrate the company’s continued focus on operational excellence and financial discipline, despite the ongoing turbulence of the global market. At the same time, COSTAR GROUP has been able to pursue strategic priorities, execute on organic growth opportunities and launch partnerships that reinforce the longevity of its platform. All of these moves have contributed to the company’s impressive fourth quarter results and put it in a prime position to succeed in the coming quarters. Overall, the fourth quarter of FY2022 has shown that COSTAR GROUP is well-poised to continue growing in the future and make a significant impact on the global market. This steady growth will likely continue throughout the year as the company continues to explore new opportunities for growth and expansion.

Stock Price

COSTAR GROUP released their financial results for the fourth quarter of the fiscal year 2022, reporting strong figures with a 33.9% increase in revenue year-over-year and 13.1% growth in net income. On Tuesday, the company’s stock opened at $77.1 but closed at $76.0, representing a decline of 2.0% from the previous closing price of $77.6. The decrease in stock prices was not indicative of the profound financial results reported by COSTAR GROUP as they successfully maintained their financial footing despite the various challenges posed by the current economic and market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costar Group. More…

| Total Revenues | Net Income | Net Margin |

| 2.18k | 369.45 | 16.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costar Group. More…

| Operations | Investing | Financing |

| 478.62 | -69.06 | 733.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costar Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.4k | 1.53k | 16.89 |

Key Ratios Snapshot

Some of the financial key ratios for Costar Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 7.4% | 20.7% |

| FCF Margin | ROE | ROA |

| 19.2% | 4.2% | 3.4% |

Analysis

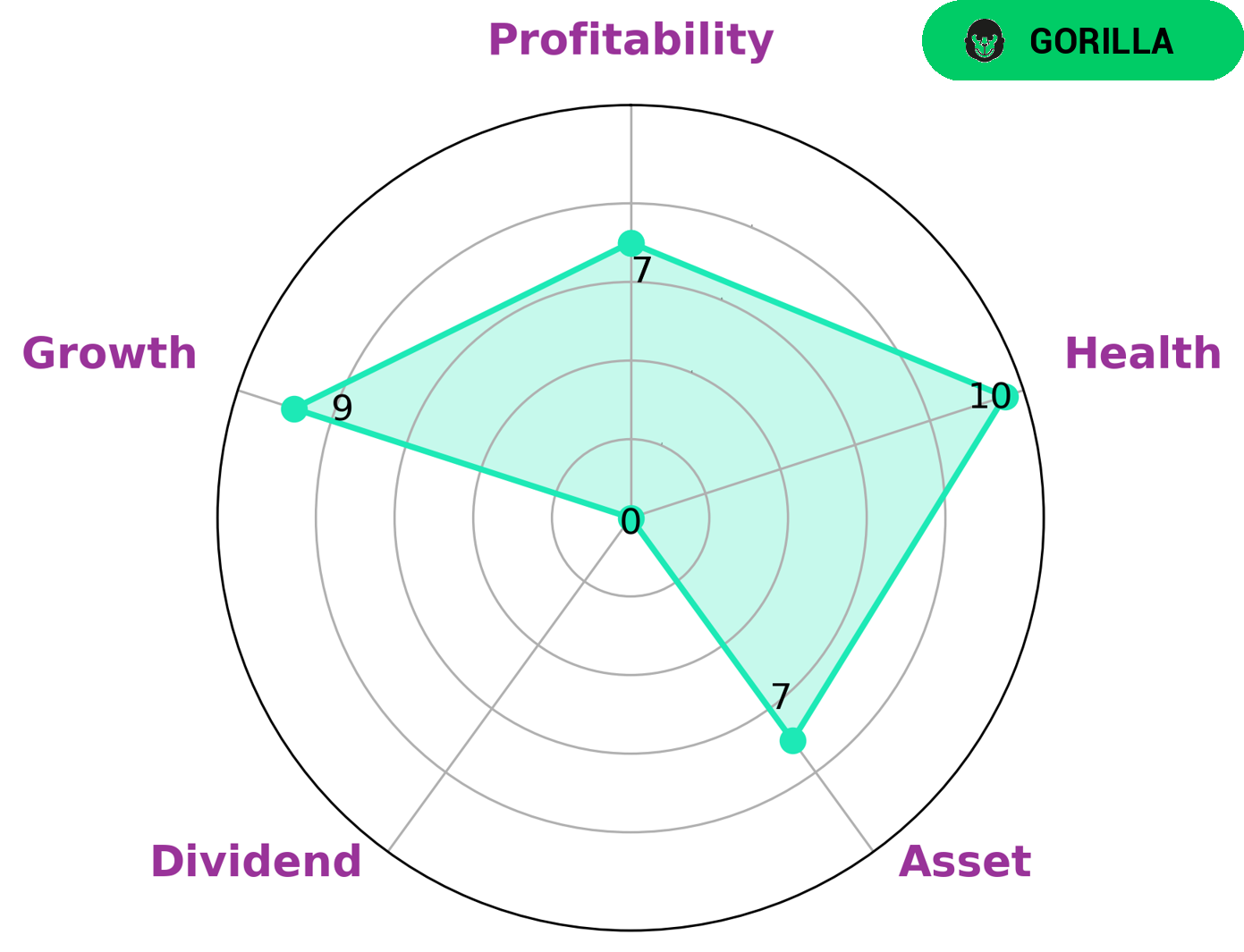

GoodWhale has conducted an analysis of COSTAR GROUP‘s fundamentals and the results are clear. According to our Star Chart, COSTAR GROUP is strong in terms of asset, growth, and profitability. However, it is weak in terms of dividend. On the other hand, COSTAR GROUP has a high health score of 10/10 with regard to its cashflows and debt, allowing it to easily pay off debt and fund future operations. We have also classified COSTAR GROUP as a ‘gorilla’, a type of company that consistently achieves stable and high revenue or earning growth due to its strong competitive advantage. We believe that investors who are looking for sustainable growth with minimal risk would be interested in such a company. Investors who are looking for companies with strong competitive advantages and consistent cashflow would also find COSTAR GROUP an attractive investment option. More…

Peers

CoStar Group Inc is a commercial real estate information and analytics company. Its competitors are Altus Group Ltd, Aroundtown SA, and Belpointe PREP LLC.

– Altus Group Ltd ($TSX:AIF)

Altus Group is a leading provider of independent advisory services, software and data solutions to the global commercial real estate industry. Our integrity, innovative technology and comprehensive data and analytics enable us to help our clients make informed decisions and drive business value. We have a deep understanding of the forces shaping the commercial real estate industry and a proven track record of helping our clients achieve their business objectives.

– Aroundtown SA ($LTS:0RUH)

The company’s market capitalization is $2.75 billion and its return on equity is 7.46%. The company is a real estate investment trust that owns, operates, and develops properties in Germany.

– Belpointe PREP LLC ($NYSEAM:OZ)

As of 2022, Belpointe PREP LLC has a market cap of 302.88M and a Return on Equity of -1.62%. The company is a provider of educational services. It offers a variety of services to its students, including academic advising, tutoring, and college counseling. Belpointe PREP LLC is committed to providing its students with the skills and knowledge necessary to succeed in their academic pursuits.

Summary

Total revenue increased 33.9% to USD 124.4 million compared to the same period a year ago, driven primarily by increased demand for products and services in the online real estate market. Net income grew 13.1% to USD 573.3 million, implying a healthy underlying profitability. Together with the increasing revenues and net income, Costar Group is well-positioned to deliver solid returns to its investors this quarter.

Recent Posts