CELLEBRITE DI Sees 22.6% Increase in Total Revenue for 2Q FY 2023, Totaling USD 76.7 Million

August 10, 2023

☀️Earnings Overview

CELLEBRITE DI ($NASDAQ:CLBT) reported a total revenue of USD 76.7 million for Q2 of the fiscal year ending June 30 2023, signifying a 22.6% year-over-year increase. Yet, corresponding net income was USD -32.4 million, down from the 33.2 million reported in Q2 of the year prior. This data was made public on August 8 2023.

Analysis

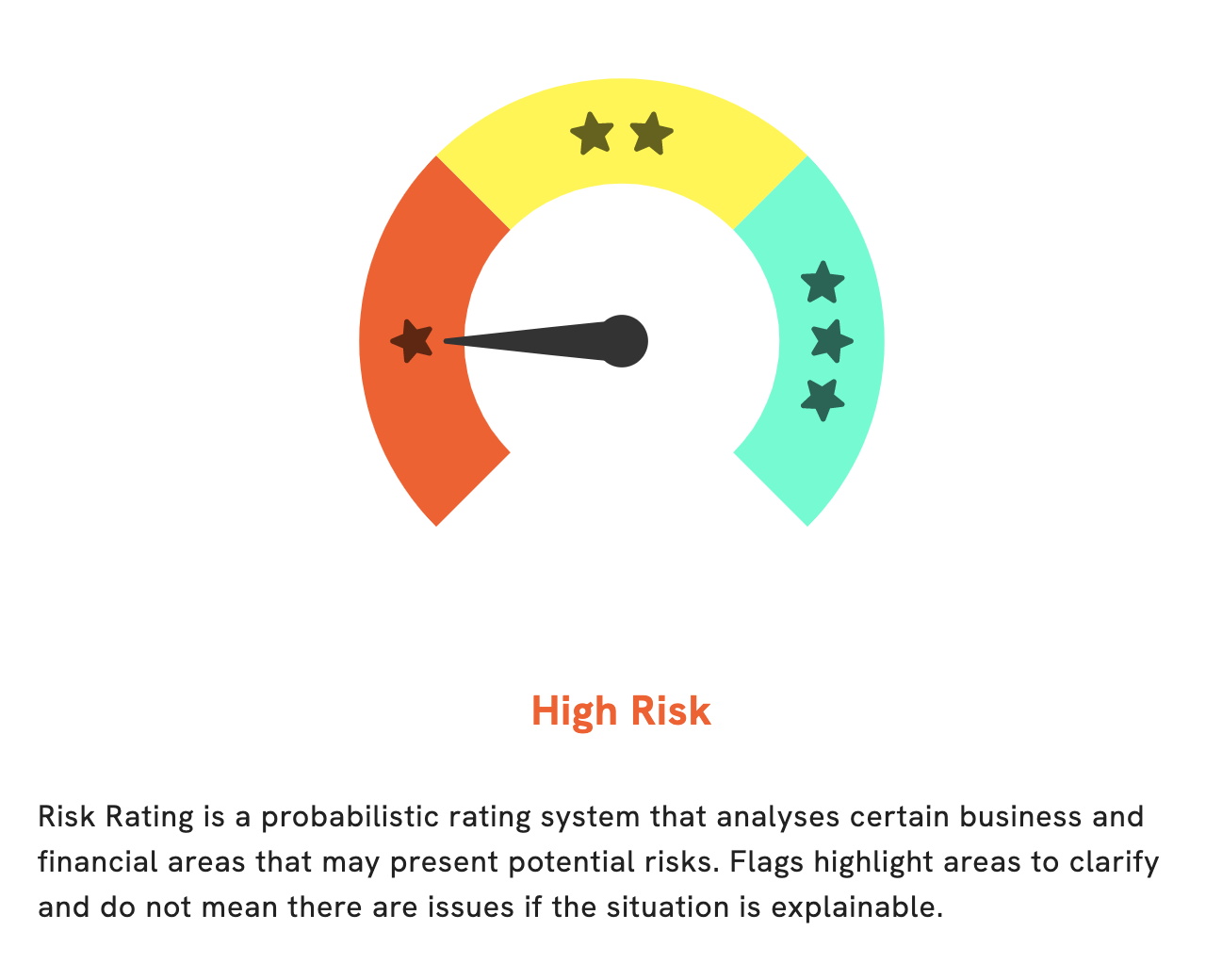

GoodWhale has conducted an extensive analysis of CELLEBRITE DI‘s wellbeing. The results show that, based on Risk Rating, CELLEBRITE DI is a high risk investment in terms of financial and business aspects. GoodWhale has detected two risk warnings in the cashflow statement and financial journal which can be accessed on the GoodWhale website. If investors are considering CELLEBRITE DI, they are encouraged to register on goodwhale.com to view the financial reports, risk warnings, and analysis. GoodWhale can provide a comprehensive view of the company’s situation and equip investors with the necessary information needed to make an informed decision. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cellebrite Di. More…

| Total Revenues | Net Income | Net Margin |

| 293.61 | -45.48 | -14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cellebrite Di. More…

| Operations | Investing | Financing |

| 64.24 | -64.05 | 17.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cellebrite Di. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 425.89 | 408.34 | 0.09 |

Key Ratios Snapshot

Some of the financial key ratios for Cellebrite Di are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.3% | – | 4.5% |

| FCF Margin | ROE | ROA |

| 19.5% | 29.3% | 2.0% |

Peers

The mobile phone forensics market is expected to grow from USD 1.71 billion in 2019 to USD 2.34 billion by 2024, at a CAGR of 6.1% during the forecast period. The major players operating in this market are Cellebrite DI Ltd (Israel), Flect Co Ltd (Japan), Qing Cloud Technologies Corp (China), Gofore PLC (Finland), among others.

– Flect Co Ltd ($TSE:4414)

Flect Co Ltd is a leading provider of information technology services. It has a market cap of 6.36B as of 2022 and a return on equity of 19.11%. The company offers a wide range of services including cloud computing, big data, enterprise software, and more. It has a strong presence in the Asia-Pacific region and is expanding its operations globally.

– Qing Cloud Technologies Corp ($SHSE:688316)

Qing Cloud Technologies Corp is a Chinese cloud computing company with a market cap of 1.42B as of 2022. The company has a Return on Equity of -37.3%. Qing Cloud Technologies Corp provides cloud computing services to businesses and government organizations. The company offers public cloud, private cloud, and hybrid cloud solutions.

– Gofore PLC ($LTS:0CXS)

Gofore Plc is a Finnish consulting company that offers digitalization, enterprise resource planning, and customer relationship management services. Its customers are large and medium-sized organizations in both the private and public sectors. Gofore has a market cap of 332.62M as of 2022 and a Return on Equity of 14.21%. The company has been growing rapidly and has been profitable for many years.

Summary

CELLEBRITE DI experienced a 22.6% increase in total revenue for the second quarter of the fiscal year ending June 30 2023, bringing in USD 76.7 million. Unfortunately, despite the increase in revenue, the company reported a net loss of USD -32.4 million for the quarter, a decrease from the 33.2 million profit reported the same quarter of the previous year. Despite this, investors reacted positively to the news, as the company’s stock price rose on August 8 2023. Investors should consider these results when analyzing CELLEBRITE DI as a potential investment, as the company may have further opportunities for strong growth over the remainder of the fiscal year.

Recent Posts