BROWN & BROWN Reports Record Revenue and Net Income for Q4 FY2022

February 5, 2023

Earnings report

BROWN & BROWN ($NYSE:BRO), a publicly traded insurance agency, recently reported its earnings results for the fourth quarter of fiscal year 2022, ending December 31, 2022, on January 24, 2023. The company experienced significant growth in both revenue and net income year-over-year. Total revenue for the quarter was USD 145.2 million, representing an increase of 42.8% from the same period last year. This impressive growth was driven by increases in both commission revenue and other income. Net income reached USD 901.4 million, a 22.2% year-over-year increase. This is the latest in a string of successful quarters for the company, which has seen its stock price increase steadily over the last year.

BROWN & BROWN is a leading provider of insurance services, with a focus on risk management and financial services solutions for both businesses and individuals. The company is a leader in the insurance agency industry and is well-known for its strong customer service, innovative technology, and reliable products. It provides insurance solutions for businesses, individuals, and families on a wide range of topics including property and casualty insurance, health insurance, life insurance, employee benefits, and more. With record revenue and net income reported for the fourth quarter of fiscal year 2022, BROWN & BROWN appears to be well-positioned to continue its strong growth in the coming year. Investors are sure to keep an eye on this successful company as it continues to make gains in the insurance agency industry.

Stock Price

Despite this positive news, the stock market reacted unfavorably to the report, with the stock opening at $61.8 and closing at $58.7 – a 5.2% drop from the previous closing price of $62.0. The company attributes the success in Q4 partially to the growth in their brokerage fee revenue, which increased by 10% compared to the previous year. This was driven by new business acquisitions and organic growth in their existing client base. Furthermore, the company’s expenses were kept under control, allowing for the increased net income. As a result of their strong performance in Q4, BROWN & BROWN is expecting a good fiscal year 2022, with guidance of mid-single-digit revenue growth.

The company will also continue to focus on organic growth and strategic acquisitions as a way to further increase their revenue and profits. Despite this positive news, the stock market reacted negatively to the report, with a 5.2% drop in their stock price. With a focus on organic growth and strategic acquisitions, the company is expecting a good fiscal year 2022 and is confident that their growth will continue. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BRO. More…

| Total Revenues | Net Income | Net Margin |

| 3.57k | 671.8 | 17.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BRO. More…

| Operations | Investing | Financing |

| 881.4 | -1.91k | 1.73k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BRO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.97k | 9.37k | 15.22 |

Key Ratios Snapshot

Some of the financial key ratios for BRO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 19.5% | 28.5% |

| FCF Margin | ROE | ROA |

| 23.2% | 14.3% | 4.6% |

Analysis

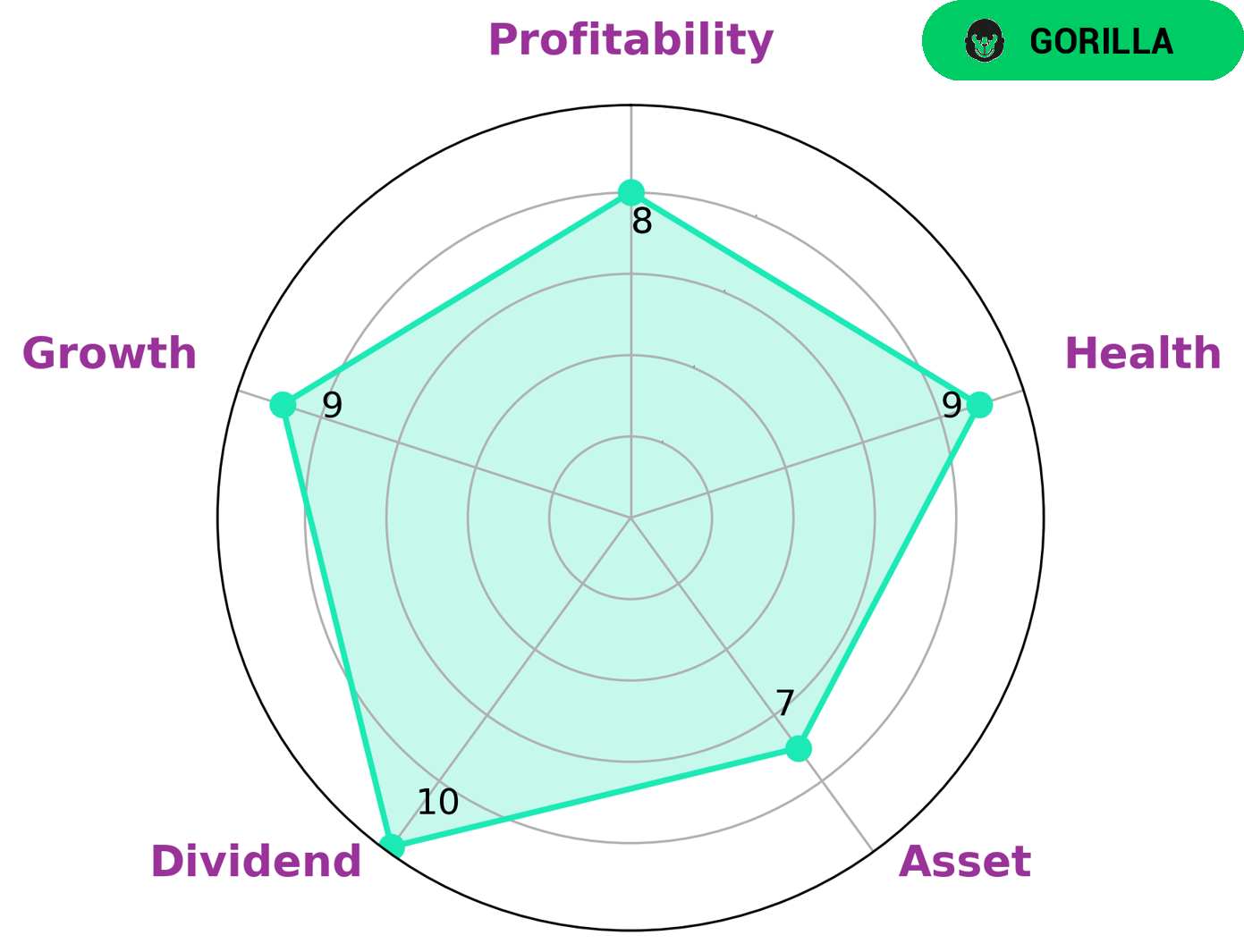

Analyzing the financials of BROWN & BROWN provided by GoodWhale, it is clear that the company has a strong financial health. According to the Star Chart, BROWN & BROWN has a high health score of 9/10 considering its cashflows and debt, making the company capable of safely riding out any crisis without the risk of bankruptcy. The company is strong in asset, dividend, growth, and profitability. Additionally, BROWN & BROWN is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. For investors looking for a stable and growing company with a strong competitive advantage, BROWN & BROWN is an ideal option. The company is well-positioned to ride out any economic downturns due to its strong financial health and robust assets. Additionally, the company’s dividend yield is attractive to those looking for steady income in addition to capital appreciation. Furthermore, long-term investors are likely to benefit from the company’s steady track record of profitability and consistent revenue growth. In conclusion, investors looking for a safe bet with potential capital growth and dividends should consider investing in BROWN & BROWN. The company’s strong financial health, robust asset base, and attractive dividend yield make it an attractive option for those seeking to diversify their portfolios with a reliable and growing company. More…

Peers

Brown & Brown, Inc. is an American insurance brokerage firm. Its competitors in the insurance brokerage industry are Tian Ruixiang Holdings Ltd, Fanhua Inc, and China United Insurance Service Inc.

– Tian Ruixiang Holdings Ltd ($NASDAQ:TIRX)

Tian Ruixiang Holdings Ltd is a Chinese holding company with investments in a range of businesses, including real estate, education, and healthcare. The company has a market cap of 6.97M as of 2022 and a Return on Equity of -5.01%. Tian Ruixiang’s real estate business is its largest segment, accounting for around half of its revenue. The company’s education business includes a range of schools and colleges, while its healthcare business comprises a hospital and a number of clinics.

– Fanhua Inc ($NASDAQ:FANH)

Fanhua Inc. is a provider of financial services in China. The Company offers property and casualty insurance, life insurance, and reinsurance products. It also provides auto financing, rural financing, and other services. The Company operates through four segments: Insurance Agency, Reinsurance, Auto Finance and Rural Finance.

– China United Insurance Service Inc ($OTCPK:CUII)

54.82M

China United Insurance Service Inc is an insurance company that focuses on providing insurance services to businesses and individuals in China. The company has a market cap of $54.82M and a ROE of 29.69%. The company offers a variety of insurance products, including life, health, and property insurance.

Summary

Brown & Brown reported strong earnings results for the fourth quarter of FY2022, with total revenue increasing 42.8% year-over-year and net income increasing 22.2%. Despite this positive news, the stock price dropped on the same day. Investors should look closely at the company’s fundamentals in order to make an informed investment decision. Brown & Brown has a strong balance sheet, with low debt and a healthy cash position. The company has also been making strategic acquisitions and investments, which have helped to fuel growth.

Additionally, the company’s focus on delivering value for its customers gives it a competitive edge in the marketplace. Overall, Brown & Brown appears to be a solid long-term investment option. The company is well-positioned to capitalize on opportunities in the industry, and its strong financial performance in the fourth quarter indicates that it is on track to continue its growth trajectory in the future. With its solid fundamentals and robust business model, Brown & Brown is an attractive option for investors looking to add a stable, profitable company to their portfolios.

Recent Posts