BP P.L.C Reports 363.5% Increase in Total Revenue for FY2022 Q4.

February 24, 2023

Earnings Overview

On February 7, 2023, BP P.L.C ($LSE:BP.) reported that their total revenue for the fourth quarter of FY2022, which ended on December 31, 2022, had increased by 363.5% compared to the same period the previous year, reaching USD 10.8 billion. Additionally, the company stated that their net income had also increased by 37.0% year-over-year to USD 69.3 billion.

Stock Price

On Tuesday, BP P.L.C reported a staggering 363.5% increase in total revenue for its fourth quarter of the fiscal year 2022, compared to the same period last year. This news sent their stock prices soaring, as they opened at £4.9 and closed at £5.2, resulting in an 8.0% rise from their last closing price of £4.8. This incredible financial performance was a result of the company’s dedication to its clients and its commitment to providing efficient and effective services. The oil giant was able to capitalize on the rising demand for petroleum products, as well as a strong shift to zero-carbon energy solutions. The impressive financial results have also been attributed to BP P.L.C’s successful cost management initiatives and strategic investments in renewable and clean energy sources.

This has enabled the company to become more competitive in a rapidly changing energy market. The impressive results mark the start of a new era for the company, which is set to continue on its path of growth and sustainability in the coming years. Investors have responded positively to the news, with BP P.L.C’s stock up 8% since Tuesday’s opening. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Bp P.l.c. More…

| Total Revenues | Net Income | Net Margin |

| 241.39k | -2.49k | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Bp P.l.c. More…

| Operations | Investing | Financing |

| 40.93k | -13.71k | -28.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Bp P.l.c. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 288.12k | 205.13k | 3.72 |

Key Ratios Snapshot

Some of the financial key ratios for Bp P.l.c are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | 36.4% | 7.5% |

| FCF Margin | ROE | ROA |

| 12.0% | 18.0% | 3.9% |

Analysis

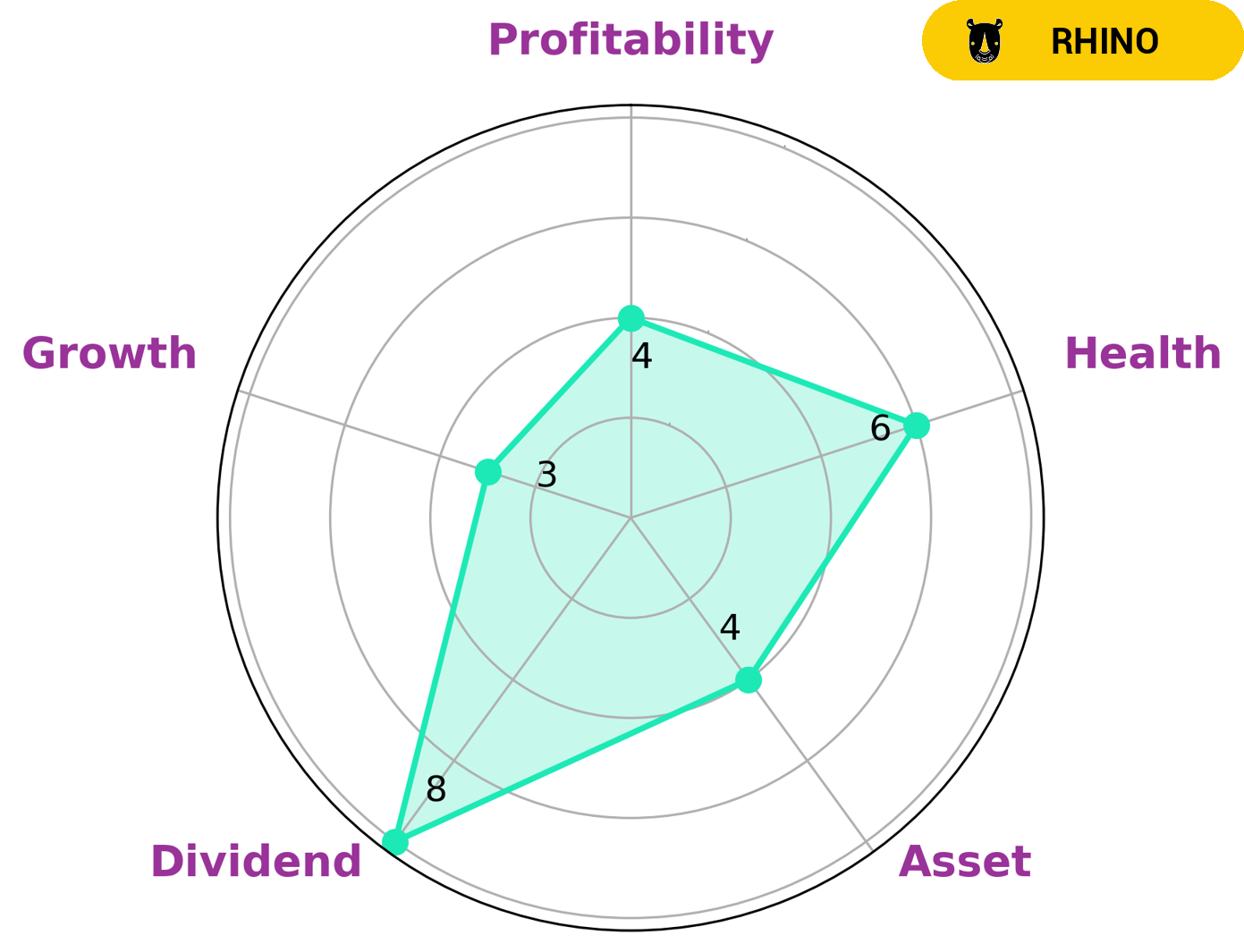

GoodWhale recently conducted an analysis of BP P.L.C‘s wellbeing. Our star chart shows that the company is strong in dividend, medium in asset, profitability and weak in growth. This puts BP P.L.C in the ‘rhino’ category, whereby companies have achieved moderate revenue or earnings growth. Investors considering BP P.L.C should note that it has an intermediate health score of 6/10, indicating that the company is likely to be able to pay off debt and fund future operations based on its cashflows and debt. Moreover, BP P.L.C is also strong in dividend; a point which could prove interesting to investors looking for long-term returns and stability. More…

Peers

The oil and gas industry is highly competitive, with multinational companies such as BP PLC, Eni SpA, Exxon Mobil Corp, TotalEnergies SE battling for market share. The companies are constantly innovating to gain an edge over their competitors, whether it be through new technologies or expanding their operations into new areas.

– Eni SpA ($LTS:0TD2)

Eni SpA is an Italian multinational oil and gas company. It has a market cap of 40.68B as of 2022 and a Return on Equity of 32.67%. Eni is engaged in the exploration, production, transport, and sale of crude oil, natural gas, and LNG. The company also produces and markets refined products, such as gasoline, diesel, and chemicals. Eni operates in more than 70 countries across the globe.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corp is a publicly traded oil and gas company with a market cap of 432.56B as of 2022. The company has a return on equity of 20.07%. Exxon Mobil Corp is engaged in the exploration, production, transportation and sale of crude oil, natural gas and petroleum products. The company has operations in more than 30 countries and employs approximately 75,000 people.

– TotalEnergies SE ($LSE:TTE)

Total Energies SE is a French multinational electric utility company, headquartered in Paris. As of 2022, it has a market capitalization of 133.62 billion euros and a return on equity of 21.39%. The company is engaged in the generation, transmission, distribution, and sale of electricity and gas. It also provides other energy services such as heat, nuclear power, and renewable energy.

Summary

The good news caused the stock price to jump on the same day that the financials were released, making it a lucrative opportunity for shareholders. Overall, BP P.L.C appears to be in a good position, with revenues and profits growing significantly and further gains likely in the future.

Recent Posts