ADVANCE AUTO PARTS Reports USD 2686.1 Million in Revenue for FY2023 Q2, Down 21.4% Year-Over-Year

August 29, 2023

🌥️Earnings Overview

For FY2023 Q2, ADVANCE AUTO PARTS ($NYSE:AAP) reported total revenue of USD 2686.1 million, a 21.4% decline compared to the same period in the previous year. In contrast, net income rose 100.1% year over year to USD 85.4 million. The quarter ended on June 30 2023.

Analysis

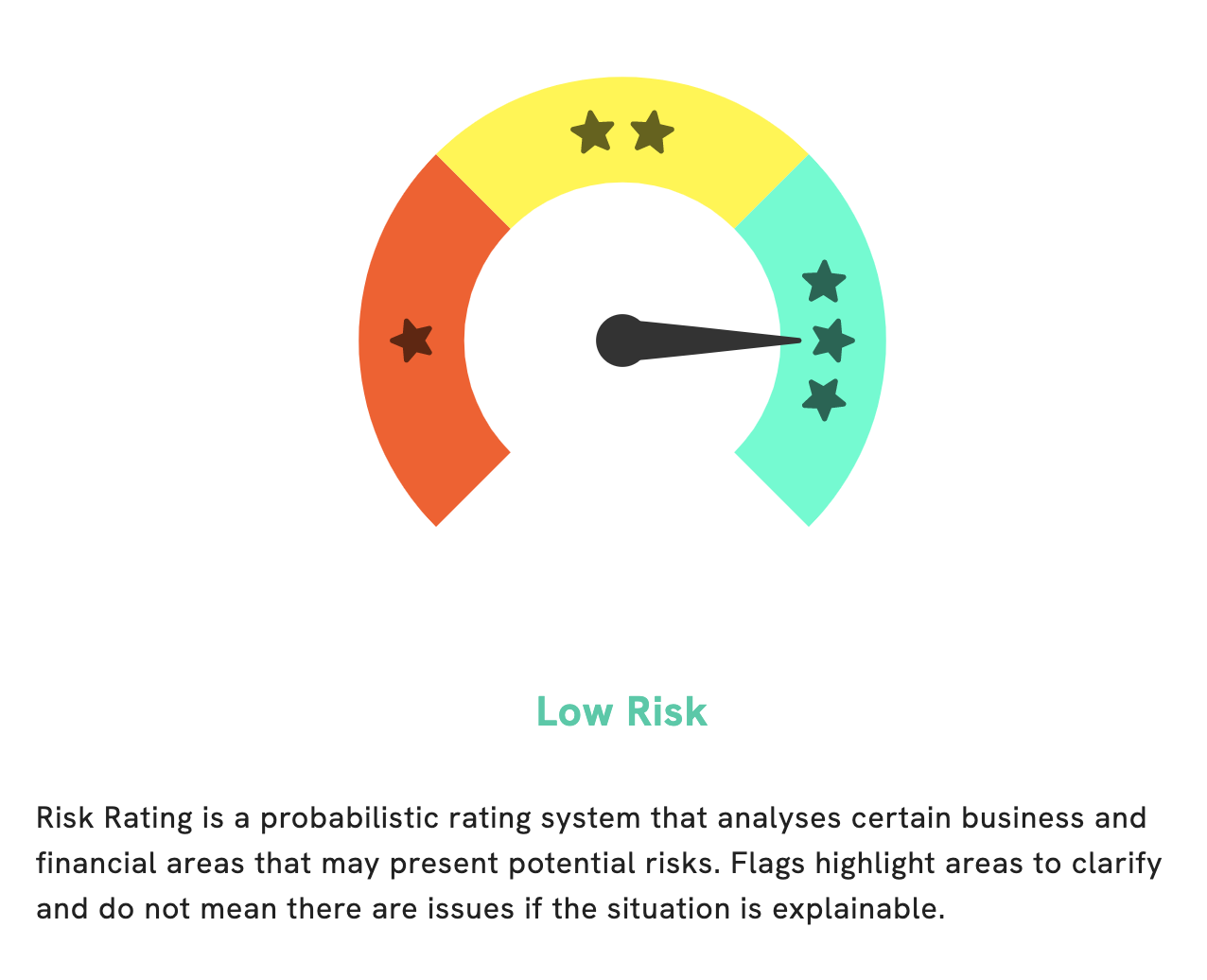

ADVANCE AUTO PARTS has been analyzed by GoodWhale in terms of its fundamentals. GoodWhale has determined that ADVANCE AUTO PARTS is a low risk investment both financially and in terms of business aspects. Although this is the overall assessment, GoodWhale has identified 1 risk warning from the balance sheet. To get more detailed insight, users will need to register with the GoodWhale platform. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AAP. More…

| Total Revenues | Net Income | Net Margin |

| 11.22k | 345.69 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AAP. More…

| Operations | Investing | Financing |

| 249.12 | -357.41 | 159.26 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AAP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.3k | 9.58k | 45.8 |

Key Ratios Snapshot

Some of the financial key ratios for AAP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | -5.9% | 4.7% |

| FCF Margin | ROE | ROA |

| -1.0% | 12.2% | 2.7% |

Peers

Advance Auto Parts Inc is an American automotive aftermarket parts retailer. Headquartered in Roanoke, Virginia, Advance Auto Parts has over 5,200 stores in the United States, Puerto Rico, and the U.S. Virgin Islands. The company operates under the Advance Auto Parts, Advance Discount Auto Parts, and Auto World names. Genuine Parts Co is an American service organization engaged in the distribution of automotive and industrial replacement parts and products, operating under the NAPA Auto Parts, NAPA Home & Business Solutions, and Worldpac brands. CarParts.com Inc is an American online retailer of aftermarket car parts and accessories, headquartered in Carson, California. O’Reilly Automotive Inc is an American retailer specializing in the sale of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States.

– Genuine Parts Co ($NYSE:GPC)

Genuine Parts Co is a distributor of automotive and industrial replacement parts in the U.S., Canada, Mexico, Australasia, and Africa. It operates through the following segments: Automotive, Industrial, Electrical, and Office Products Group. The Automotive segment offers original equipment and aftermarket products for light and heavy duty vehicles. The Industrial segment supplies replacement parts for various industries, including material handling, transportation, construction, food and beverage, and others. The Electrical segment provides replacement parts for the electrical distribution industry. The Office Products Group segment comprises of office products and office furniture. Genuine Parts was founded by Erskine Henderson on May 13, 1928 and is headquartered in Atlanta, GA.

– CarParts.com Inc ($NASDAQ:PRTS)

CarParts.com Inc has a market cap of 301.17M as of 2022, a Return on Equity of 1.06%. The company is an online retailer of automotive parts and accessories. CarParts.com offers a wide range of parts for all makes and models of vehicles.

– O’Reilly Automotive Inc ($NASDAQ:ORLY)

O’Reilly Automotive Inc is a specialty retailer of automotive aftermarket parts, tools, supplies, equipment and accessories in the United States. As of 2022, it had a market cap of 51.63B and a ROE of -159.26%. The company operates through four segments: Retail Stores, Wholesale Parts, Professional Customer and eCommerce. It offers products under the following brands: O’Reilly Auto Parts, AutoZone, Advance Auto Parts, NAPA Auto Parts and Carquest Auto Parts.

Summary

ADVANCE AUTO PARTS reported total revenue of USD 2686.1 million for FY2023 Q2, a 21.4% decrease compared to the same period in the previous year.

However, net income increased 100.1% to USD 85.4 million. This strong financial performance saw the stock price of ADVANCE AUTO PARTS rise on the same day, suggesting that it could be a good investment opportunity. Investors should consider the fact that this company is facing a challenging macroeconomic environment and its revenue is likely to remain under pressure in the near term. Nevertheless, its current financial position suggests that this company is well positioned to take advantage of any market upturn.

Recent Posts