DYNAVAX TECHNOLOGIES Reports 76.5% Decrease in Revenue for Q2 2023

August 9, 2023

🌥️Earnings Overview

For the second quarter of its 2023 fiscal year ending June 30, 2023, DYNAVAX TECHNOLOGIES ($NASDAQ:DVAX) reported total revenue of USD 60.2 million, a 76.5% decrease compared to the same period in the previous year. Net income for the quarter also decreased 97.3% to USD 3.4 million compared to the same period in the year prior.

Analysis

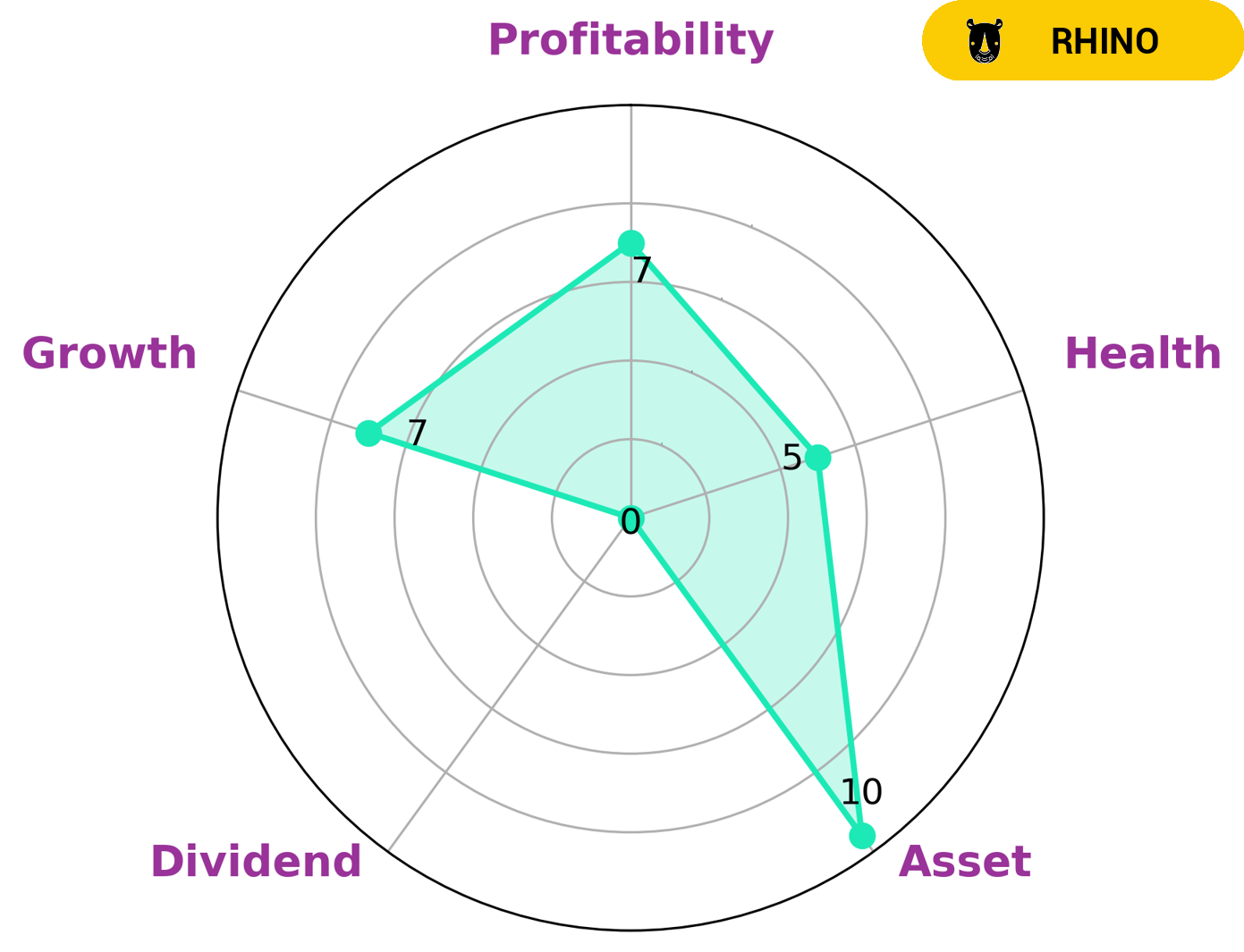

GoodWhale has conducted an analysis of DYNAVAX TECHNOLOGIES‘ fundamentals, and concluded that it is strong in asset, growth, and profitability, but weak in dividend according to our Star Chart. DYNAVAX TECHNOLOGIES is classified as a ‘rhino’ type of company, meaning it has achieved moderate revenue or earnings growth. Given this information, investors interested in DYNAVAX TECHNOLOGIES may be seeking companies that are not heavily dependent on dividends, but are still growing and showing strong returns. Additionally, DYNAVAX TECHNOLOGIES has an intermediate health score of 5/10 with regard to its cash flows and debt, suggesting that it may be able to sustain future operations in times of crisis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dynavax Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 459.4 | 110.67 | 26.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dynavax Technologies. More…

| Operations | Investing | Financing |

| 152.18 | -179.63 | 4.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dynavax Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 936.43 | 359.23 | 4.49 |

Key Ratios Snapshot

Some of the financial key ratios for Dynavax Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 136.5% | – | 26.0% |

| FCF Margin | ROE | ROA |

| 32.1% | 13.1% | 8.0% |

Peers

The market for Dynavax Technologies Corp is quite competitive. The company’s main competitors are Foresee Pharmaceuticals Co Ltd, Aeolus Pharmaceuticals Inc, and Kala Pharmaceuticals Inc. All of these companies are vying for a share of the market, and each has its own strengths and weaknesses. Dynavax Technologies Corp must keep an eye on all of its competitors in order to stay ahead in the market.

– Foresee Pharmaceuticals Co Ltd ($TPEX:6576)

Foresee Pharmaceuticals Co Ltd is a pharmaceutical company with a market cap of 8.77B as of 2022. The company has a Return on Equity of -22.28%. The company focuses on the development and commercialization of innovative drugs for the treatment of cancer and other diseases. The company’s products include F-76, a phase III clinical candidate for the treatment of ovarian cancer; and F-288, a phase II clinical candidate for the treatment of solid tumors. Foresee Pharmaceuticals Co Ltd was founded in 2007 and is headquartered in Taipei, Taiwan.

– Aeolus Pharmaceuticals Inc ($OTCPK:AOLS)

Aeolus Pharmaceuticals Inc is a pharmaceutical company that focuses on the development of treatments for a variety of conditions. The company’s market cap is $167.29k and its ROE is -383.62%. Aeolus Pharmaceuticals Inc’s main product is a treatment for a condition called idiopathic pulmonary fibrosis. The company is also developing treatments for other conditions, including cancer and Alzheimer’s disease.

– Kala Pharmaceuticals Inc ($NASDAQ:KALA)

Kala Pharmaceuticals Inc is a biopharmaceutical company focused on the development and commercialization of therapies for the treatment of eye diseases. The company’s lead product candidate, KPI-121, is a topical ocular formulation of loteprednol etabonate in development for the treatment of pain and inflammation associated with ocular surgery. Kala Pharmaceuticals Inc has a market cap of 7.69M as of 2022, a Return on Equity of 435.55%. The company’s focus on the development and commercialization of therapies for the treatment of eye diseases makes it a promising investment for those interested in the healthcare sector.

Summary

Investors should be cautious of DYNAVAX TECHNOLOGIES, as the company has reported a significant decrease in revenue and net income for the second quarter of its 2023 fiscal year. Total revenue was USD 60.2 million, a 76.5% decrease from the same period in the previous year, and net income was USD 3.4 million, a 97.3% decline from the year prior. Despite the short-term decline, investors should consider the long-term potential of the company’s operations and products.

Recent Posts