Hong Kong And dividend – Hong Kong and China Gas Co Ltd Announces 0.23 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, Hong Kong and China Gas Co Ltd announced a 0.23 HKD cash dividend per share. This dividend is a result of the company’s consistent dividend per share of 0.35 HKD for the past three years, resulting in a 3.54% dividend yield between 2022 and 2023. The ex-dividend date for this cash dividend has been set for June 9 2023, so be sure to keep that date in mind if you’re considering investing in this stock. With its reliable dividend yields and impressive track record, HONG KONG AND CHINA GAS ($SEHK:00003) has become one of the most sought-after dividend stocks available on the market.

Market Price

On the same day, the stock opened at HK$7.1 and closed at the same price, up 0.3% from the previous closing price. It also serves as a sign of confidence in the company’s performance and stability, as it demonstrates that the firm is well-equipped to continue providing dividends in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hong Kong And. More…

| Total Revenues | Net Income | Net Margin |

| 60.95k | 5.25k | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hong Kong And. More…

| Operations | Investing | Financing |

| 9.64k | -6.76k | 354.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hong Kong And. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 168.47k | 93.33k | 3.41 |

Key Ratios Snapshot

Some of the financial key ratios for Hong Kong And are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.5% | 6.0% | 16.3% |

| FCF Margin | ROE | ROA |

| 2.1% | 9.6% | 3.7% |

Analysis

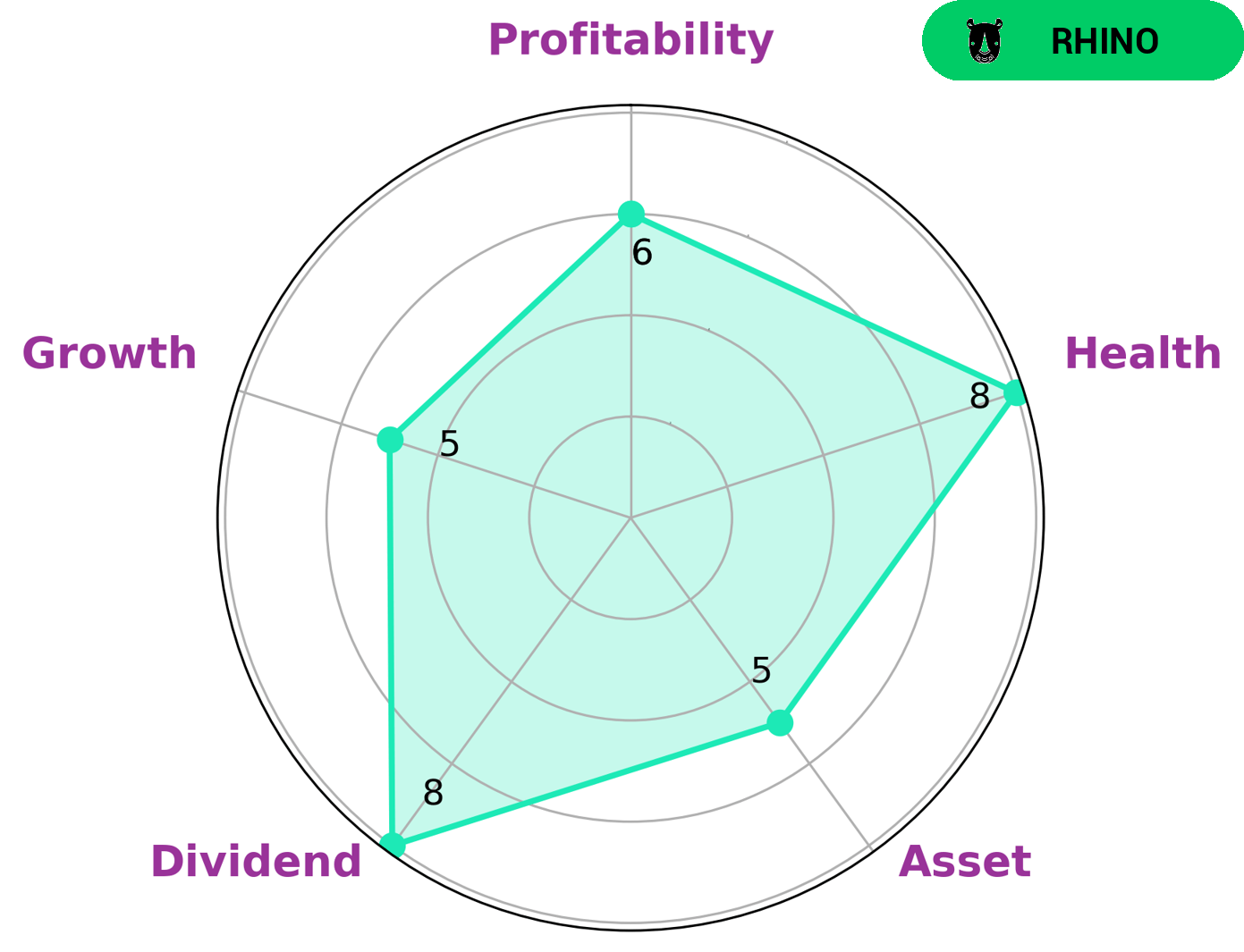

GoodWhale has performed an analysis of HONG KONG AND CHINA GAS’s fundamentals and the Star Chart shows that it has a high health score of 8/10. This score takes into account the company’s cashflows and debt, indicating that it is capable to pay off debt and fund future operations. We classify HONG KONG AND CHINA GAS as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. HONG KONG AND CHINA GAS is strong in dividend and medium in asset, growth, and profitability, making it an attractive option for value-oriented investors. Those looking for growth may find the moderate growth potential of HONG KONG AND CHINA GAS appealing. Ultimately, investors should assess their own investment objectives to determine if this stock is suitable for their portfolio. More…

Peers

Hong Kong and China Gas Co Ltd (Hong Kong Gas) is the largest gas utility in Hong Kong. The company is engaged in the business of natural gas supply, distribution and sale in Hong Kong. Hong Kong Gas also has a presence in the Mainland China gas market through its majority-owned subsidiary, China Gas Holdings Limited (China Gas).

Hong Kong Gas’s major competitors in the Hong Kong gas market are CLP Holdings Limited (CLP) and Beijing Gas Blue Sky Holdings Limited (Beijing Gas). Both CLP and Beijing Gas are engaged in the business of gas supply, distribution and sale in Hong Kong. In addition, both companies have a significant presence in the Mainland China gas market.

PT Perusahaan Gas Negara Tbk (PGN) is another major competitor of Hong Kong Gas in the Southeast Asia gas market. PGN is an integrated gas company that is engaged in the upstream, midstream and downstream segments of the gas value chain. The company has a strong presence in Indonesia, which is the largest gas market in Southeast Asia.

– CLP Holdings Ltd ($SEHK:00002)

As of 2022, CLP Holdings Ltd has a market cap of 136.93B. The company has a ROE of -0.64%. CLP Holdings Ltd is an investment holding company. Through its subsidiaries, the Company develops, invests, owns and operates power plants and electricity generation businesses. It operates through the following segments: Hong Kong, Mainland China, Taiwan, India, Southeast Asia and Australia. The company was founded in 1901 and is headquartered in Central, Hong Kong.

– Beijing Gas Blue Sky Holdings Ltd ($OTCPK:BJGBF)

Since its establishment in 2008, Beijing Gas Blue Sky Holdings Ltd. has been devoted to the development of a clean and efficient energy supply system. The company is the largest city gas distributor in Beijing, China. It also engages in the sale of liquefied petroleum gas, compressed natural gas, and other related products. As of December 31, 2020, the company operated a city gas distribution network of 12,371 kilometers serving 3.72 million customers in Beijing.

– PT Perusahaan Gas Negara Tbk ($IDX:PGAS)

Perusahaan Gas Negara Tbk is an Indonesian state-owned gas company and one of the largest in Southeast Asia. It has a market capitalization of US$43.88 billion as of 2022 and a return on equity of 21.18%. The company is engaged in the exploration, production, transportation, and distribution of natural gas. It has operations in Indonesia, Malaysia, Singapore, Thailand, Vietnam, and Australia.

Summary

Investing in Hong Kong and China Gas (HK & CG) requires careful analysis. Investors should assess the company’s financials, business model, competitive advantages, and potential future growth. Analysts should consider the company’s financial performance, including sales, profit margins, and cash flows. They should also consider HK & CG’s competitive position in the energy sector in Asia, and the potential for growth in the future. Furthermore, investors should look at the regulatory environment in China and Hong Kong, and assess how it affects HK & CG’s operations and profitability.

Additionally, investors should consider the company’s risk profile and management team to ensure that they are investing in a stable long-term business. Finally, investors should focus on HK & CG’s dividend policy and stock market performance to determine if it is a good investment. By carefully analyzing these factors, investors can make an informed decision on whether to invest in HK & CG.

Recent Posts