SOFI TECHNOLOGIES Reports 64.0% Increase in Revenue and 59.9% Increase in Net Income for FY2022 Fourth Quarter.

March 29, 2023

Earnings Overview

For the fourth quarter of FY2022, SOFI TECHNOLOGIES ($BER:6B0) reported a total revenue of USD 40.0 million and net income of USD 456.7 million – marking an increase of 64.0% and 59.9% year-over-year, respectively. The quarter ended on December 31 2022.

Share Price

As a result, the stock opened at €5.7 and closed at €6.2, soaring by 12.4% from the last closing price of €5.5. For example, their investments in artificial intelligence-driven automation and cloud-based solutions have allowed them to increase operational efficiency and product scalability.

Additionally, their customer success initiatives and focus on customer experience have enabled them to develop a loyal customer base. These results paint an optimistic outlook for SOFI TECHNOLOGIES’ future performance. The company’s strong financial results are a nice boost for the stock, which could continue to rise as investors get more confident in the company’s ability to deliver sustained growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sofi Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | -360.83 | -19.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sofi Technologies. More…

| Operations | Investing | Financing |

| -7.26k | -106.33 | 8.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sofi Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.01k | 13.48k | 5.92 |

Key Ratios Snapshot

Some of the financial key ratios for Sofi Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 52.6% | – | – |

| FCF Margin | ROE | ROA |

| -467.7% | -3.6% | -1.0% |

Analysis

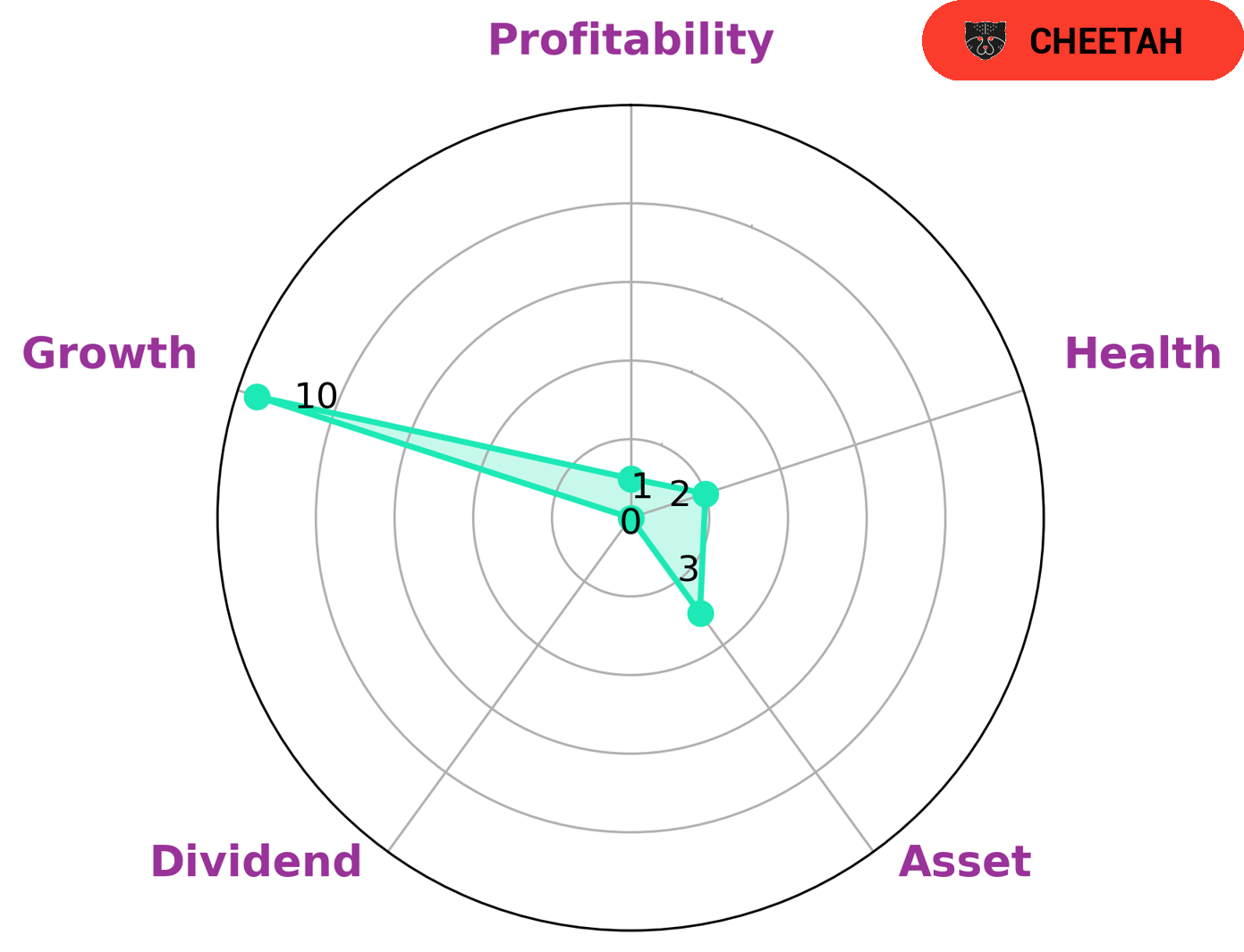

GoodWhale has conducted an analysis of SOFI TECHNOLOGIES‘ wellbeing. According to our Star Chart, SOFI TECHNOLOGIES is strong in growth, but weak in asset, dividend, and profitability. This is reflected in the company’s low health score of 2/10 with regard to its cashflows and debt, making it less likely to safely ride out any crisis without the risk of bankruptcy. As SOFI TECHNOLOGIES is classified as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability, this assessment is to be expected. The type of investor that may be interested in a company such as SOFI TECHNOLOGIES is likely to be one with a higher appetite for risk. They may be looking for potential rapid growth, but also be prepared for the potential for a loss of their investment if the company does not prove as stable as anticipated. More…

Summary

SOFI Technologies‘ fourth quarter financial results for FY2022 saw a significant year-over-year increase in both total revenue and net income. Total revenue rose 64.0% to USD 40.0 million and net income rose 59.9% to USD 456.7 million. This strong performance was reflected in the stock price, which increased the same day.

The impressive growth in net income and revenue makes the company an attractive investment option for investors looking for stability and growth potential. With healthy finances, SOFI Technologies looks set to continue performing well.

Recent Posts