TransUnion Invests in Bud Financial to Fuel Open Banking and Data Intelligence Growth.

February 1, 2023

Trending News ☀️

TRANSUNION ($NYSE:TRU): TransUnion is a leading global provider of information and risk management services, providing businesses and consumers with data-driven insights to make informed decisions. The company has recently announced an important investment in Bud Financial, an open banking and data intelligence platform, to help drive innovation and growth in the personal finance market. This new investment is part of TransUnion’s open banking initiative, which will allow customers to access financial data from multiple banks, credit unions, and other financial institutions in a secure and efficient manner. Through this initiative, TransUnion aims to provide customers with a better understanding of their financial situation, helping them to make more informed decisions about their money.

However, it is believed that the investment will enable TransUnion to expand its open banking capabilities, allowing customers to access their financial data from a wide range of sources. This will provide customers with greater flexibility, control, and transparency over their finances. With this new investment in Bud Financial, TransUnion plans to expand its existing capabilities and develop new technologies that will revolutionize the way customers interact with their financial data. This will help to ensure that customers have access to the most up-to-date information when making decisions about their money. The company’s investment in Bud Financial is a clear indication of this commitment, and it is expected to have a major impact on the personal finance market in the years to come.

Price History

TransUnion, a credit reporting and analytics company, announced on Tuesday that it has invested in Bud Financial, a UK-based financial technology company that offers open banking and data intelligence services. The media sentiment towards the news is mostly positive, as the stock opened at $69.8 and closed at $71.8, up by 3.1% from its prior closing price of $69.6. The investment signals TransUnion’s commitment to expand its services and capabilities in open banking and data intelligence, which will enable it to better serve its clients.

In addition, TransUnion will be able to leverage Bud Financial’s existing customer base and technology infrastructure to drive further growth and increase its market share. TransUnion is committed to helping its customers make informed decisions and manage their finances more effectively. The investment in Bud Financial will help TransUnion reach a larger and more diverse audience while expanding its service offerings. This move will also help TransUnion remain competitive in the marketplace and continue to be a leader in the credit reporting and analytics industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.6k | 1.24k | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 223.5 | -2.74k | 2.43k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.8k | 7.65k | 21.04 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 1.0% | 15.7% |

| FCF Margin | ROE | ROA |

| -1.2% | 8.7% | 3.0% |

VI Analysis

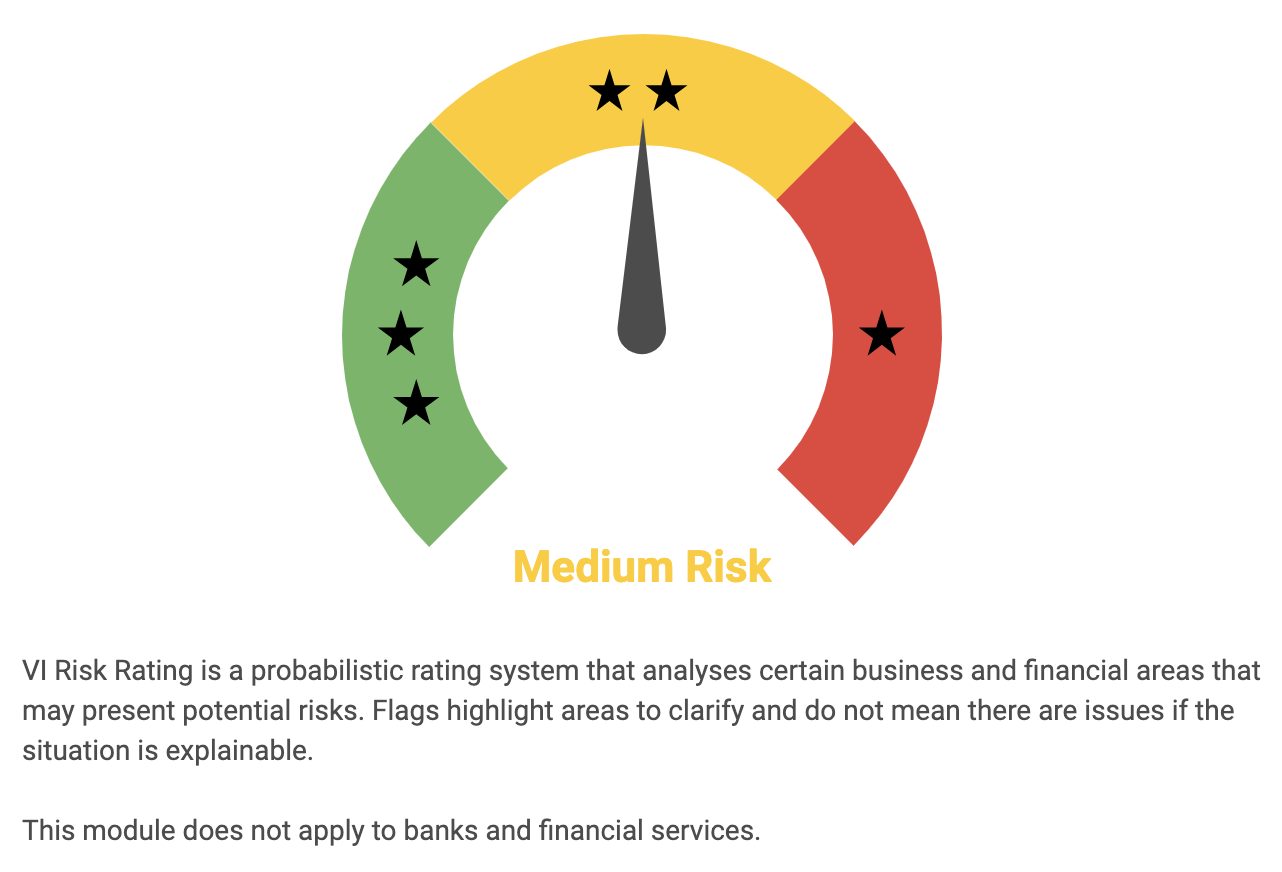

The VI App is a powerful tool for analyzing the long-term potential of TRANSUNION. Using the VI Risk Rating system, it can quickly and easily assess the financial and business aspects of the company, giving investors an indication of the level of risk involved. With this information, investors can make informed decisions as to whether or not to invest in TRANSUNION. The VI Risk Rating system examines various aspects of TRANSUNION, including its balance sheet, cash flow statement, and financial journal. It looks at factors such as the company’s financial performance, debt burden, and liquidity. Based on this analysis, the app assigns a risk rating to TRANSUNION, with medium being the most likely outcome.

In addition to this rating, the VI App also provides investors with three risk warnings that could have an impact on their investment decision. These warnings are based on discrepancies between the balance sheet, cash flow statement, and financial journal. To access these warnings, investors must register with the app and provide certain personal details such as their name, email address, and phone number. Overall, the VI App provides a comprehensive overview of TRANSUNION and its potential for long-term investment. The risk ratings and warnings give investors a clear indication of the level of risk involved and enable them to make informed decisions about their investments.

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

TransUnion is an investment firm that recently invested in Bud Financial to boost open banking and data intelligence growth. The move was widely seen as a positive one and the stock price rose on the news. For investors, this indicates that TransUnion is actively seeking out opportunities to improve their services and invest in new technologies.

As the banking industry continues to expand and evolve, TransUnion is in a prime position to benefit from their investments and increase their presence in the space. With their focus on data intelligence, TransUnion is well-positioned to take advantage of the increasing demand for data-driven financial solutions.

Recent Posts