Arista Networks Revenues Soar 38.7% in Q2 2023

August 13, 2023

🌥️Earnings Overview

ARISTA NETWORKS ($NYSE:ANET) reported total revenue of 1458.9 million USD for the quarter ending June 30 2023, a 38.7% increase from the same quarter of the previous fiscal year. Net income for the period rose 64.5%, to 491.9 million USD.

Analysis

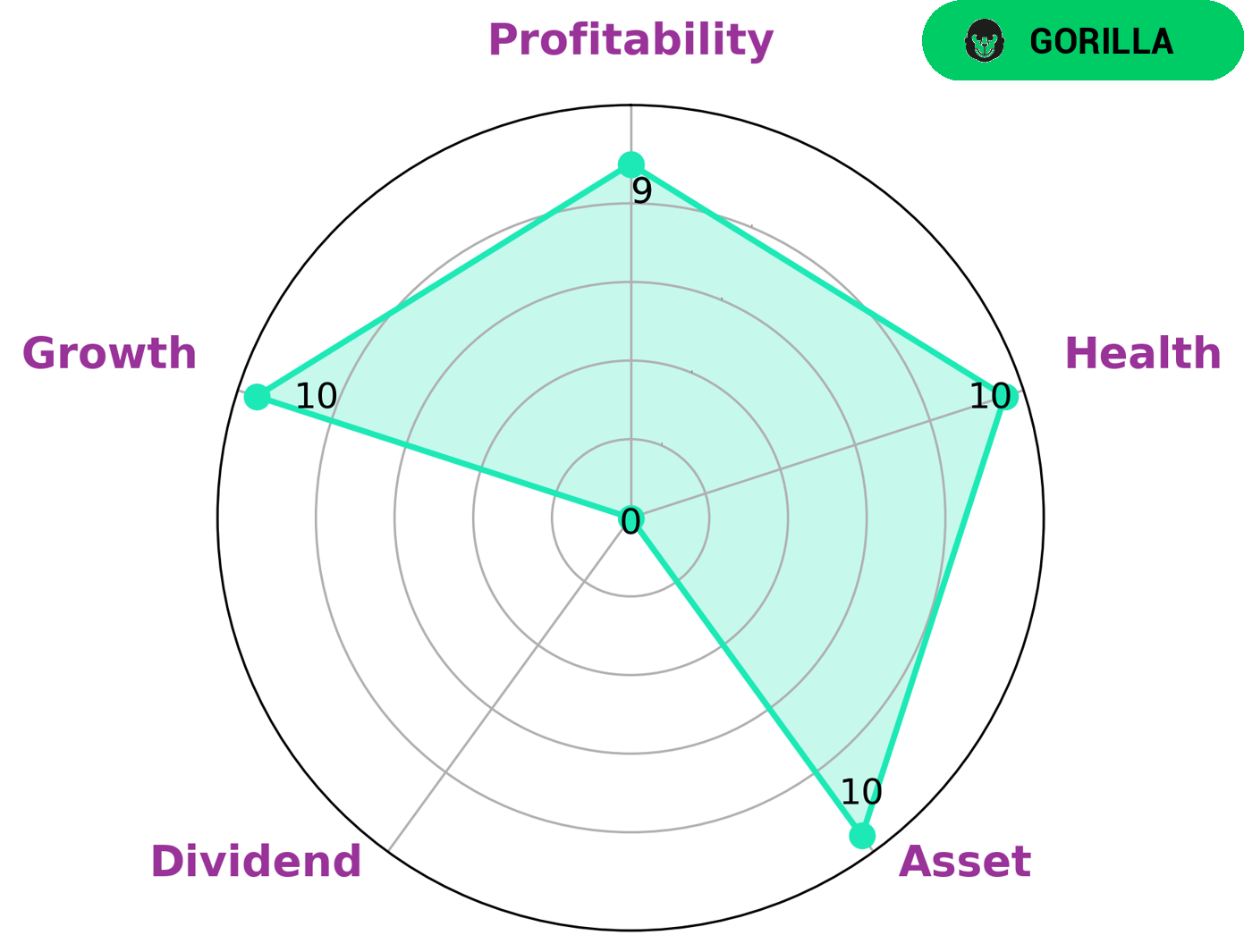

ARISTA NETWORKS is a company classified by GoodWhale as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. For such a company, the type of investors that are likely to be interested are those looking for strong long-term growth potential. ARISTA NETWORKS is strong in asset growth, profitability, and has a high health score of 10/10 regarding cashflows and debt, which indicates that the company is well-equipped to sustain future operations in times of crisis. However, ARISTA NETWORKS is weak when it comes to dividends, something that may be a turn-off for some investors. Overall, ARISTA NETWORKS is an attractive investment opportunity for those looking for potential capital appreciation and growth over time. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arista Networks. More…

| Total Revenues | Net Income | Net Margin |

| 5.26k | 1.71k | 32.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arista Networks. More…

| Operations | Investing | Financing |

| 983.15 | -81.28 | -136.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arista Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.19k | 2.33k | 19 |

Key Ratios Snapshot

Some of the financial key ratios for Arista Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.3% | 38.1% | 36.1% |

| FCF Margin | ROE | ROA |

| 18.0% | 21.2% | 14.5% |

Peers

The telecommunications industry is highly competitive, with Arista Networks Inc competing against Ciena Corp, Eutelsat Communications, Novra Technologies Inc, and others. Arista Networks Inc has a strong product portfolio and a history of innovation, which has helped it to maintain a leading position in the market.

– Ciena Corp ($NYSE:CIEN)

Ciena is a network specialist that provides equipment, software, and services that support the transport, switching, aggregation, and management of voice, video, and data traffic on communications networks. The company has a market cap of $6.08B as of 2022 and a ROE of 6.6%. Ciena’s products are used in a variety of network architectures, including point-to-point, metro, and core networks.

– Eutelsat Communications ($LTS:0JNI)

Eutelsat Communications is a French-based company that provides satellite communication services to broadcasters, content providers, Internet service providers, mobile operators, and business and government customers. As of 2022, the company had a market cap of 1.93 billion and a return on equity of 9.77%. Eutelsat Communications operates a fleet of 38 satellites that provide coverage over Europe, the Middle East, Africa, Asia-Pacific, and the Americas. The company also provides ground infrastructure and teleport services.

– Novra Technologies Inc ($TSXV:NVI)

Novra Technologies Inc is a publicly traded company with a market capitalization of 3.01 million as of 2022. The company has a return on equity of 28.3%. Novra Technologies Inc is a technology company that specializes in the development and commercialization of products and solutions for the satellite and cable television markets. The company’s products and solutions are used by broadcasters, network operators, and content providers to distribute video, audio, and data signals.

Summary

Arista Networks has reported impressive financial results for the quarter ending June 30th 2023. Total revenue increased 38.7%, to 1458.9 million USD, while net income grew by 64.5%, to 491.9 million USD. These results demonstrate the company’s strong performance and suggest that it is well positioned for continued growth.

Investors should consider the current financials when assessing the potential of any investment in Arista Networks. The company has a track record of success, and its future growth prospects appear bright.

Recent Posts