Dzs Inc Intrinsic Value Calculator – DZS INC Projected Revenue for FY23 Lower Than Expected at $400 Million

May 10, 2023

Trending News 🌧️

The company has recently released its financial report for the fiscal year 2023, which has predicted its revenues to be at around $400 million. Despite the lower projected revenue for FY23, DZS has been able to maintain its competitive edge in the telecom industry and is expected to remain a major player in the sector. The company has also made a number of strategic investments in various technologies that are expected to give it an advantage in the market going forward.

Additionally, DZS has been able to leverage its existing customer base and increase its reach through international expansion. In conclusion, although DZS INC ($NASDAQ:DZSI) has projected lower revenue for FY23 than previously expected, the company is still well positioned to remain competitive in the telecom industry. With its strategic investments and international expansion, DZS will be able to continue to be a major player in the telecom sector.

Earnings

In the earning report of FY2022 Q4 as of December 31, 2022, DZS INC reported a total revenue of 100.18M USD and a net income loss of 14.56M USD. The company is working on strategies and initiatives to close the gap and increase their revenue for FY23.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dzs Inc. More…

| Total Revenues | Net Income | Net Margin |

| 375.69 | -37.43 | -9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dzs Inc. More…

| Operations | Investing | Financing |

| -50.9 | -28.01 | 64.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dzs Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 385.01 | 242.28 | 4.61 |

Key Ratios Snapshot

Some of the financial key ratios for Dzs Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | – | -9.0% |

| FCF Margin | ROE | ROA |

| -14.8% | -16.8% | -5.5% |

Price History

This announcement caused the company’s stock to open at $6.7 and close at $6.6, a slight increase of 0.3% from the prior closing price of $6.6. Investors were not pleased with the news, as it was lower than their anticipated estimates for the company’s future growth. The company is now facing a difficult task of recovering from this news and restoring market confidence in their products and services. Live Quote…

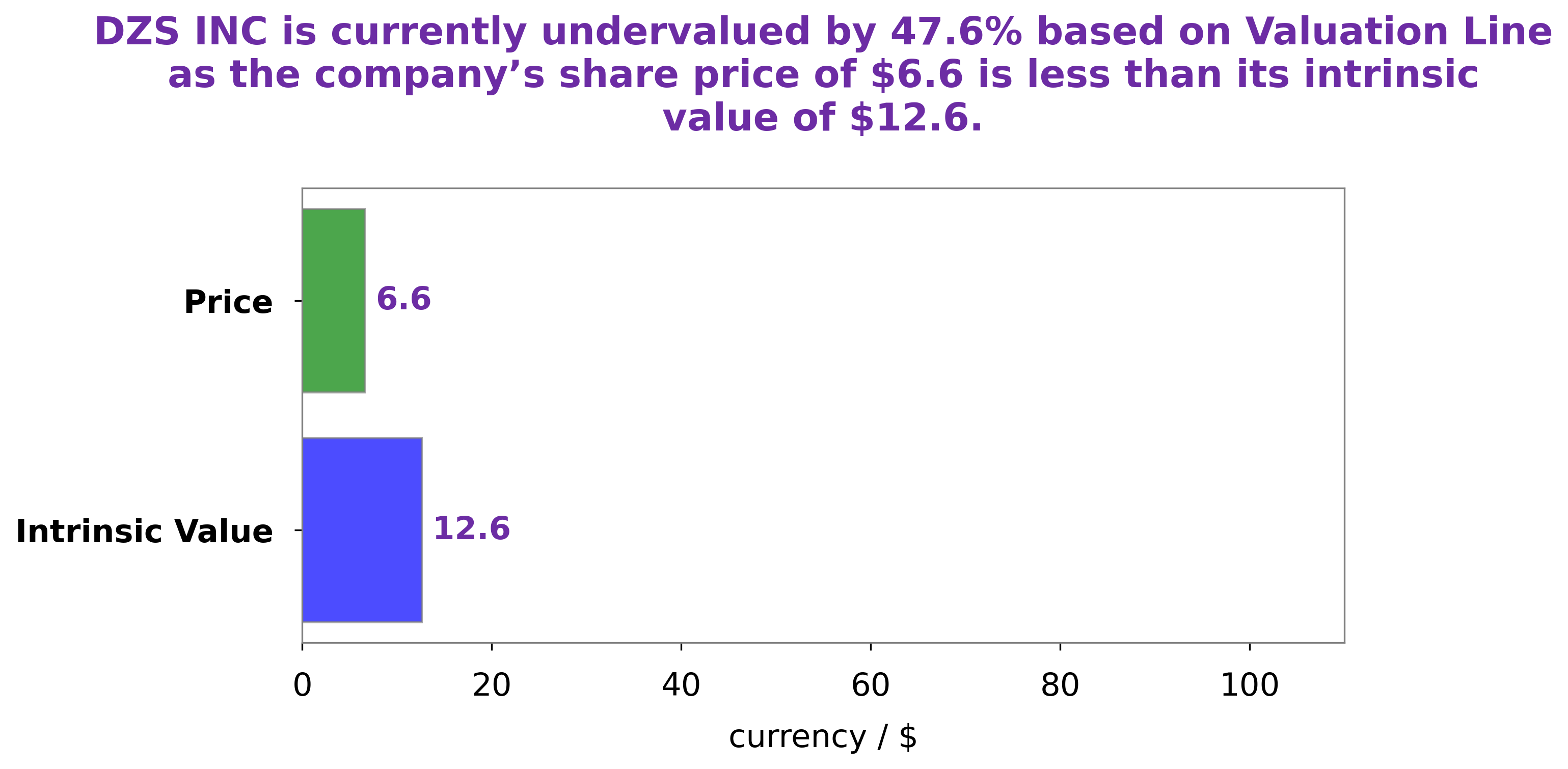

Analysis – Dzs Inc Intrinsic Value Calculator

GoodWhale has conducted a financial analysis of DZS INC and have determined that the intrinsic value of the company’s shares is around $12.6. This was calculated using our proprietary Valuation Line model, which takes into account multiple factors such as historical performance, industry trends, and market conditions. Currently, DZS INC stock is trading at $6.6 which is significantly lower than its intrinsic value, indicating that the stock is undervalued by 47.5%. We believe this offers an attractive buying opportunity for investors looking to capitalize on this market inefficiency. More…

Peers

The competition in the telecommunications industry is fierce. DZS Inc. is up against some of the biggest names in the business, including Extreme Networks Inc., ADVA Optical Networking SE, and Ciena Corp. Each company is striving to provide the best products and services to their customers. While DZS Inc. has a strong presence in the market, its competitors are not far behind.

– Extreme Networks Inc ($NASDAQ:EXTR)

With a market cap of $2.5 billion and a return on equity of 40.12%, Extreme Networks is a publicly traded networking company that provides software-driven networking solutions to enterprise customers. The company delivers high-performance switching, routing, and security solutions that enable customers to build agile, data-driven networks that connect their people, applications, and devices.

– ADVA Optical Networking SE ($LTS:0NOL)

ADVA Optical Networking SE has a market cap of 1.08B as of 2022, a Return on Equity of 4.24%. The company provides optical and Ethernet-based networking solutions.

– Ciena Corp ($NYSE:CIEN)

Ciena is a network specialist that provides equipment, software and services that support mission-critical applications for communications service providers, enterprises and governments worldwide. Its products and services enable its customers to drive revenue, reduce expenses and improve efficiency by delivering high-capacity, high-speed networking solutions. Ciena’s common stock is listed on the NASDAQ Global Select Market under the symbol CIEN and is included in the S&P 500 index.

ROE is return on equity and is a measure of how well a company uses investment funds to generate profits. A company with a higher ROE is using funds more effectively to generate profits. Ciena’s ROE of 6.6% indicates that it is using funds efficiently to generate profits.

Ciena’s market cap is 6.64B as of 2022. This means that the market value of Ciena’s outstanding shares is 6.64B. Ciena’s market cap is a good indicator of the company’s size and its position in the market.

Summary

DZS Inc. is an attractive investment opportunity for investors due to its projected revenue for FY23 of $400 million. Analysts expect the company to continue to grow and expand its portfolio of services and products, as well as further capitalize on current market trends. A strong management team and healthy balance sheet make DZS Inc. a viable investment opportunity in the long-term. Investors should consider the performance of the company’s underlying businesses when evaluating their potential return on investment.

Recent Posts