UP FINTECH HOLDING Reports 26% Increase in Q1 FY2023 Revenue to USD 66.3 Million

June 12, 2023

☀️Earnings Overview

UP FINTECH HOLDING ($NASDAQ:TIGR) reported their Q1 (ending March 31 2023) earnings results for FY2023 on May 30 2023, showing total revenue of USD 66.3 million, representing a 26.0% increase from the same period the year prior. Net income was reported at USD 8.0 million, a great improvement from the -5.9 million reported in FY2022 Q1.

Analysis

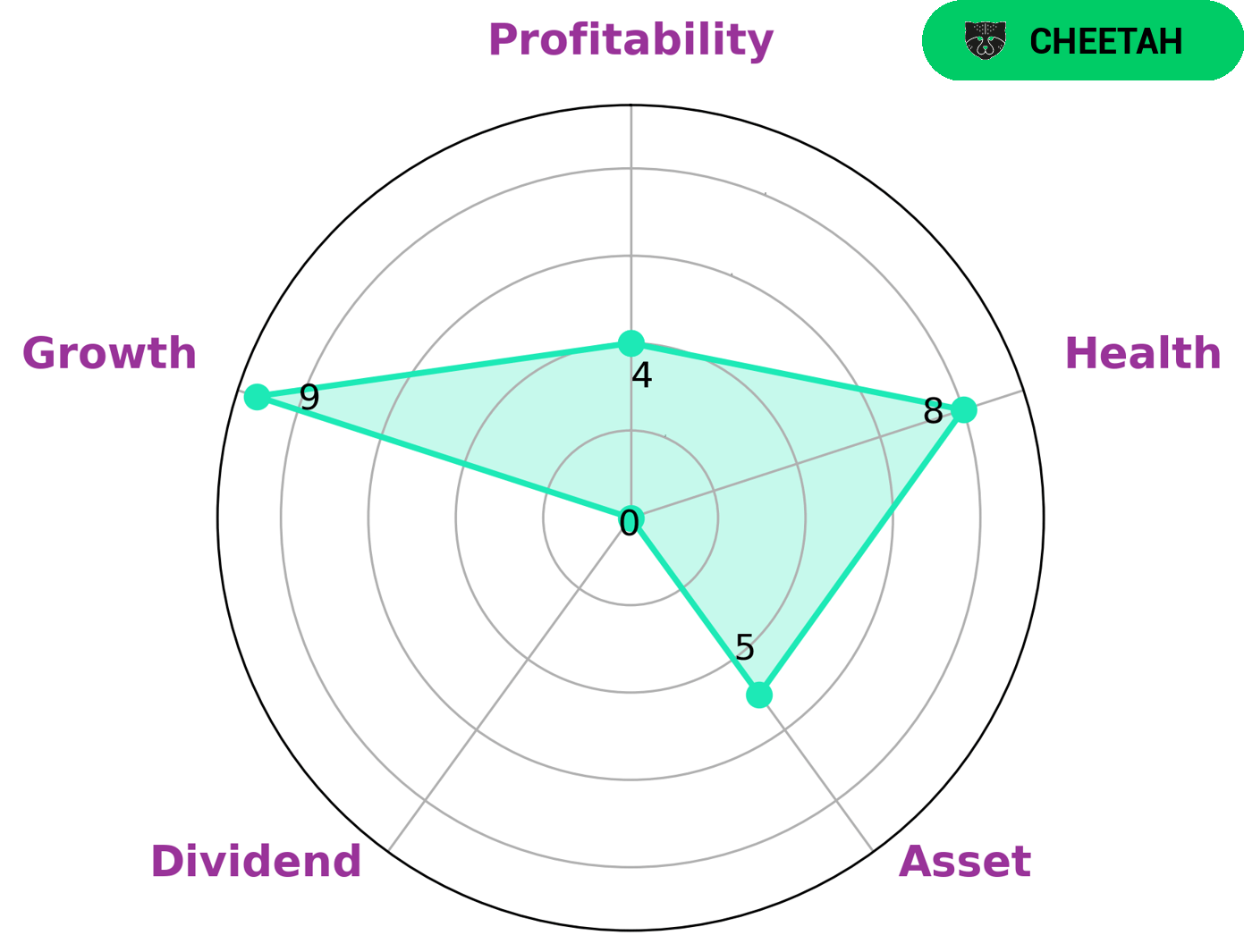

GoodWhale has conducted an analysis of UP FINTECH HOLDING’s fundamentals and concluded that the company is classified as a ‘cheetah’ due to its high revenue or earnings growth but lower stability and profitability. A cheetah company may be attractive to a certain type of investors who are interested in rapid growth. UP FINTECH HOLDING has a good health score of 8/10 with regard to its cashflows and debt, demonstrating its ability to pay off debt and fund future operations. Furthermore, the company is strong in terms of growth, medium in terms of asset, profitability and weak in dividend. This indicates that UP FINTECH HOLDING is well-positioned to grow rapidly, albeit with lower stability and dividend returns. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TIGR. More…

| Total Revenues | Net Income | Net Margin |

| 239.06 | 11.4 | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TIGR. More…

| Operations | Investing | Financing |

| 258.06 | -3.61 | 4.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TIGR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.84k | 3.38k | 2.95 |

Key Ratios Snapshot

Some of the financial key ratios for TIGR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.1% | – | 8.2% |

| FCF Margin | ROE | ROA |

| 105.9% | 2.7% | 0.3% |

Peers

The competition between UP Fintech Holding Ltd and its competitors is fierce. Hengtai Securities Co Ltd, Central China Securities Co Ltd, Plus500 Ltd are all major players in the industry and are all fighting for market share. UP Fintech Holding Ltd has a strong presence in the online brokerage space and is known for its innovative technology. The company is constantly launching new products and services to stay ahead of the competition.

– Hengtai Securities Co Ltd ($SEHK:01476)

Hengtai Securities Co Ltd is a Chinese investment bank with a market cap of $6.69 billion as of 2022. The company’s return on equity was 3.29% in that year. Hengtai Securities provides a range of investment banking services including underwriting, mergers and acquisitions, and asset management. The company is headquartered in Beijing.

– Central China Securities Co Ltd ($SEHK:01375)

Central China Securities Co Ltd is a Chinese investment company with a market cap of 14.42B as of 2022. The company has a return on equity of 1.11%. Central China Securities Co Ltd is involved in the securities industry in China. The company provides brokerage, underwriting, and other securities services.

– Plus500 Ltd ($LSE:PLUS)

Plus500 Ltd. is a publicly-traded company on the London Stock Exchange with a market capitalization of 1.72 billion as of early 2021. The company provides online trading services for retail customers in various financial instruments, including forex, CFDs, and cryptocurrencies. Plus500 Ltd. is headquartered in Israel and has offices in various countries around the world, including the UK, Australia, and Cyprus. The company has a strong reputation and is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK.

Summary

UP FINTECH HOLDING reported strong earnings for their first quarter of 2023, with total revenue of USD 66.3 million, an increase of 26.0% from the prior year. Net income increased significantly, from -5.9 million to 8.0 million. This positive news was reflected in the stock price, which saw an increase the same day.

Investors may view UP FINTECH HOLDING as a good opportunity, given the company’s ability to generate positive income and increase revenue. The stock could provide potential upside in the future, although investors should be aware of any potential risks or uncertainties that could affect the stock price.

Recent Posts