LOMA NEGRA CIA INDUSTRIA ARGENTINA SA Reports 150% Year-Over-Year Increase in Total Revenue for Q4 FY2022.

March 19, 2023

Earnings Overview

For the fourth quarter of FY2022, ending December 31 2022, LOMA NEGRA CIA INDUSTRIA ARGENTINA SA ($BER:8LN) reported total revenue of ARS 7.3 billion, a year-over-year increase of 150.0%. Net income totaled ARS 36.8 billion, a 90.9% increase from the same period in the previous year. The data was made public on March 9 2023.

Stock Price

Following the announcement, the company’s stock opened at €6.4 and closed at €6.4, up by 3.2% from its prior closing price of 6.2. This marks a significant jump for the company, which has seen an otherwise stable stock price over the last few quarters. The significant increase in total revenue can be attributed to a number of factors. Firstly, the company has seen an increase in demand for its products in the domestic market. This is due to the growing economic development in Argentina, which has increased consumer spending power.

Additionally, export sales have also increased due to LOMA NEGRA‘s improved reputation among international customers. Furthermore, the company has implemented a number of cost-cutting initiatives over recent months, which have allowed them to realize greater profits. These include scaling back production to reduce fixed costs, as well as negotiating better deals with suppliers and distributors. This has allowed them to remain competitive in a challenging market environment. It demonstrates that their strategy of focusing on both domestic and export markets is paying off, and suggests that there is potential for further growth in the near future. As such, the company’s stock price is likely to remain stable in the short to medium term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 8LN. More…

| Total Revenues | Net Income | Net Margin |

| 145.13k | 1.94k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 8LN. More…

| Operations | Investing | Financing |

| 31.36k | -4.72k | -24.78k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 8LN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 202.89k | 86.95k | 839.8 |

Key Ratios Snapshot

Some of the financial key ratios for 8LN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 55.0% | 49.8% | 25.2% |

| FCF Margin | ROE | ROA |

| 14.5% | 21.6% | 11.3% |

Analysis

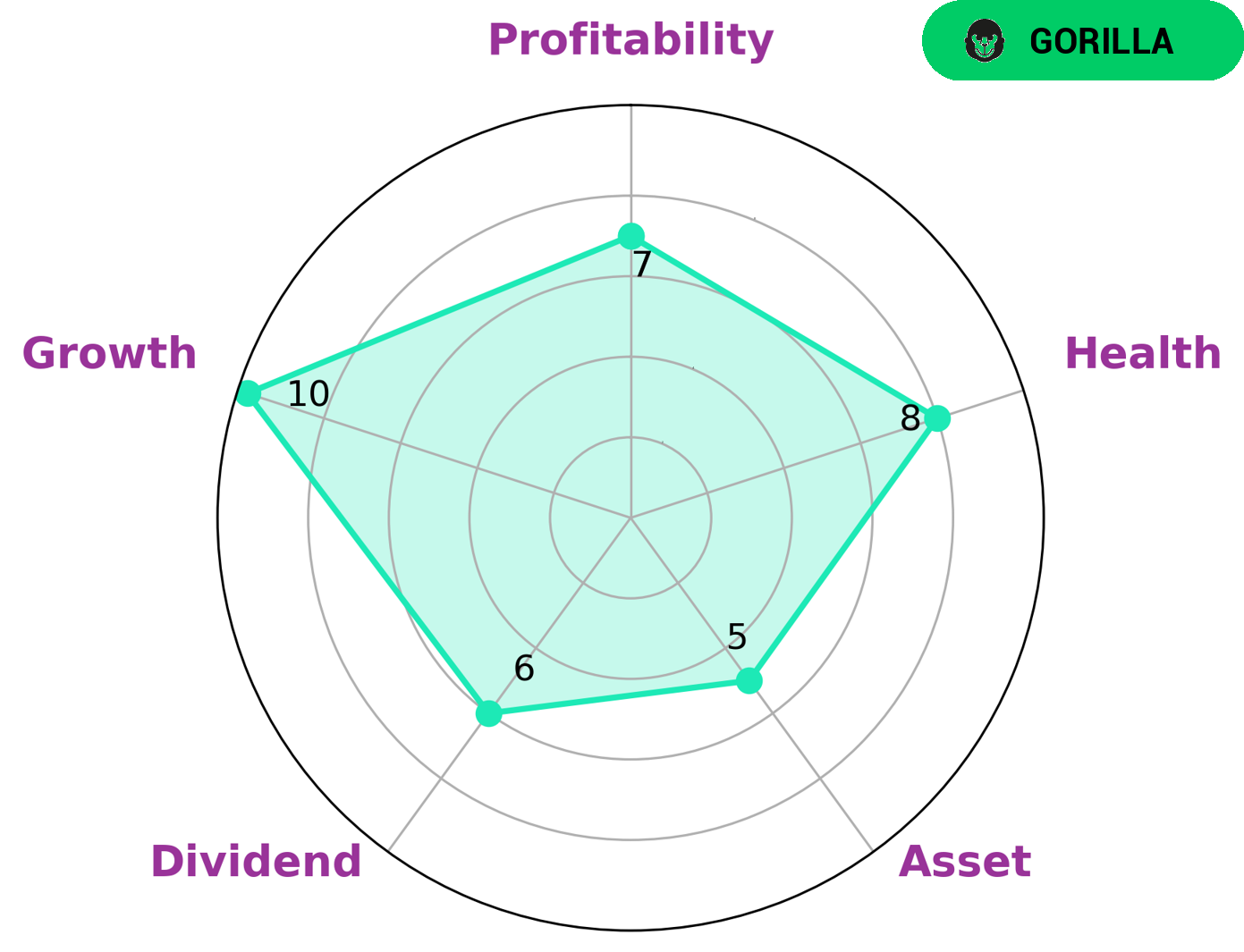

GoodWhale conducted an analysis on the fundamentals of LOMA NEGRA CIA INDUSTRIA ARGENTINA SA and determined it to be classified as a ‘gorilla’ based on the Star Chart. These companies are ones that have achieved stable and high revenue or earning growth due to their strong competitive advantages. As this company is strong in growth, profitability and medium in asset, dividend, it is likely to attract investors looking for long-term investment opportunities. Additionally, the high health score of 8/10 indicates that the company is capable to safely ride out any crisis without the risk of bankruptcy. This makes LOMA NEGRA CIA INDUSTRIA ARGENTINA SA an attractive long-term investment opportunity for those looking to benefit from its inherent stability and growth potential. More…

Summary

Investing in LOMA NEGRA CIA INDUSTRIA ARGENTINA SA (LOMA) is a sound option for investors interested in the Argentinian market. The company reported total revenue of ARS 7.3 billion for the fourth quarter of FY2022 ending December 31 2022, representing a year-over-year increase of 150.0%. Furthermore, it reported net income of ARS 36.8 billion, 90.9% higher than the same period in the previous year. On March 9 2023, stock prices rose in response to this news.

Recent Posts