Wuxi Biologics Stock Fair Value – WuXi Biologics Reports 48% Increase in Revenue for Full Year 2022 Results.

May 3, 2023

Trending News ☀️

WUXI ($SEHK:02269): WuXi Biologics, a leading global open-access biologics technology platform company, has reported strong financial results for its full year 2022. According to WuXi’s report, the company’s total revenue for the year is expected to be CN¥15.3b, representing a 48% increase from the previous year 2021. WuXi Biologics is a highly innovative company that specializes in biologics research and development, manufacturing, and commercialization. The company provides comprehensive services across the entire biologics value chain, from discovery to commercialization.

It has established deep partnerships with some of the world’s largest pharmaceutical and biotech companies, such as Pfizer, Merck, and Novartis. With its strong financial results for 2022, WuXi Biologics is well-positioned to continue its success in the coming years.

Analysis – Wuxi Biologics Stock Fair Value

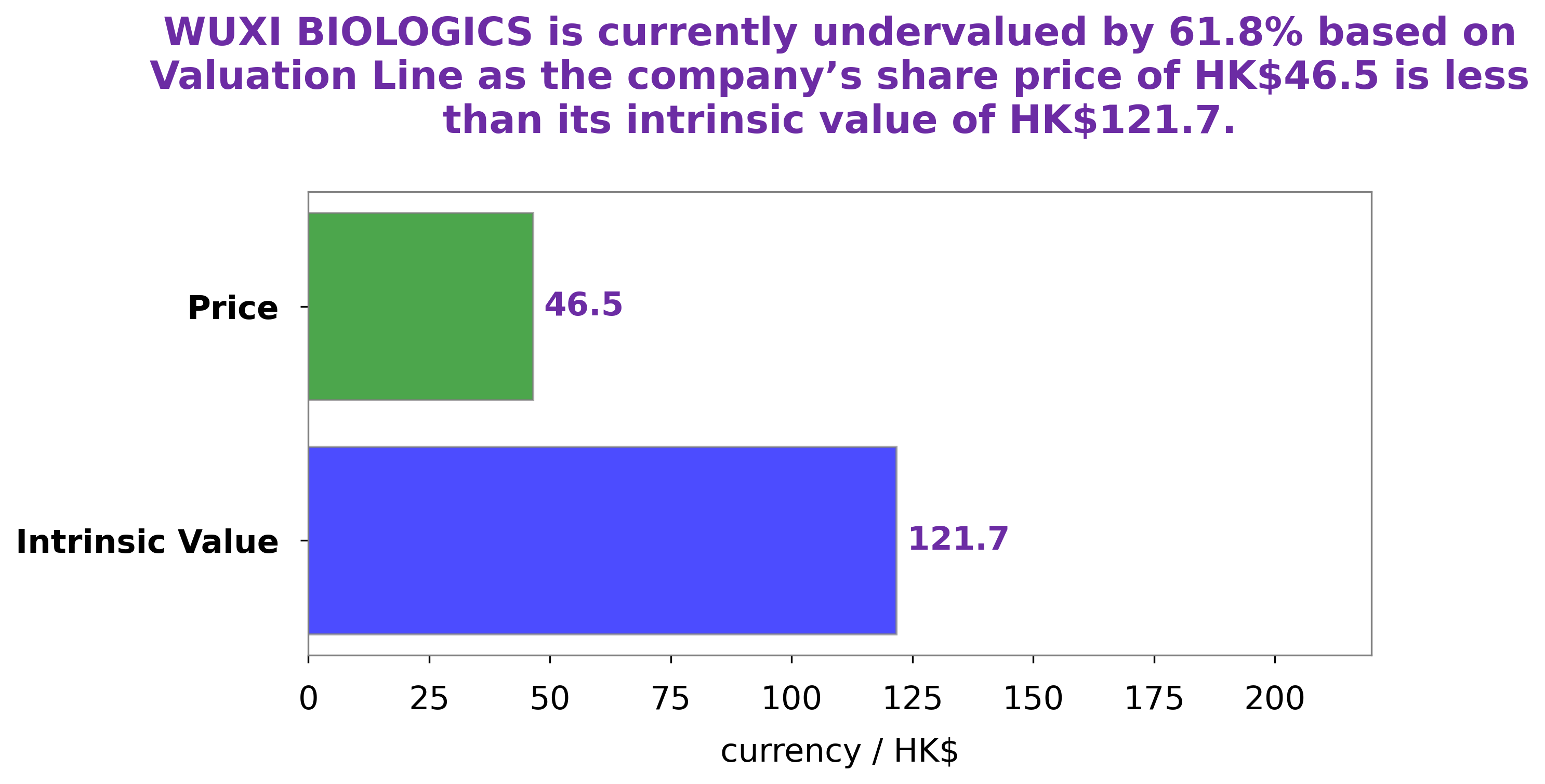

GoodWhale has conducted an analysis of WUXI BIOLOGICS‘s finances, and our proprietary Valuation Line found that the intrinsic value of WUXI BIOLOGICS share is around HK$121.7. This means that the current stock price of HK$46.5 is undervalued by 61.8%. This presents a great opportunity to invest in WUXI BIOLOGICS if you believe in the long-term prospects of this company. We at GoodWhale are confident in our valuation methodology, and urge investors to take advantage of this undervaluation. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wuxi Biologics. More…

| Total Revenues | Net Income | Net Margin |

| 15.27k | 4.42k | 33.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wuxi Biologics. More…

| Operations | Investing | Financing |

| 5.54k | -5.91k | -2.59k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wuxi Biologics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.56k | 13.35k | 8.29 |

Key Ratios Snapshot

Some of the financial key ratios for Wuxi Biologics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 56.5% | 65.6% | 35.5% |

| FCF Margin | ROE | ROA |

| -2.1% | 9.8% | 6.8% |

Peers

In the global market for biologics, WuXi Biologics (Cayman) Inc faces stiff competition from Innovent Biologics Inc, Biocon Ltd, and Avid Bioservices Inc. All four companies are striving to develop and commercialize innovative therapies to treat a variety of serious and life-threatening diseases. While WuXi Biologics has carved out a significant market share, its competitors are also major players in this growing industry.

– Innovent Biologics Inc ($SEHK:01801)

Innovent Biologics Inc is a Chinese biopharmaceutical company with a focus on developing immunotherapies for the treatment of cancer. The company has a market cap of 41.68B as of 2022 and a Return on Equity of -18.61%. The company’s products include the anti-PD-1 antibody Tyvyt and the anti-VEGF antibody Sintilimab, both of which are approved in China for the treatment of certain types of cancer.

– Biocon Ltd ($BSE:532523)

Biocon Ltd is an Indian biotechnology company that is involved in the development, manufacture, and marketing of pharmaceuticals and biopharmaceuticals. The company has a market cap of 323.56B as of 2022 and a Return on Equity of 8.02%. Biocon was founded in 1978 by Kiran Mazumdar-Shaw and is based in Bangalore, India. The company’s products include insulin, biosimilars, monoclonal antibodies, and enzymes. Biocon has a strong presence in India and also has operations in the United States, Europe, and Asia.

– Avid Bioservices Inc ($NASDAQ:CDMO)

Avid Bioservices is a contract development and manufacturing organization (CDMO) that provides development and cGMP manufacturing services for biopharmaceutical companies. The company has a market cap of $994.68M as of 2022 and a ROE of 3.93%. Avid Bioservices offers a range of services, including cell line development, process development, cGMP manufacturing, and analytical testing. The company’s clients include both large and small biopharmaceutical companies.

Summary

WuXi Biologics has been an attractive growth stock in recent years, with revenue growing 48% year-on-year for the full year of 2022. Investors have been impressed by the company’s ability to consistently execute on its strategic objectives, particularly in the international markets. On the back of strong financial performance and strong positioning, WuXi Biologics’ stock has been outperforming the broader market in recent years.

Furthermore, management has provided a positive outlook for continued growth, focusing on expansion in Asia and other markets, as well as increasing investments in research and development. As such, investors are likely to remain bullish on the stock, given its potential for long-term growth.

Recent Posts