Verona Pharma Reports Record Profits in 2023 AGM Results

April 28, 2023

Trending News ☀️

Verona Pharma ($NASDAQ:VRNA) made headlines at its 2023 Annual General Meeting (AGM) when it reported record profits. Its success can be attributed to its innovative product portfolio and commitment to providing accessible, affordable treatments for a range of conditions. This was driven by the success of its leading products, including the breakthrough respiratory medication Respaxel and the cancer treatment Vepazol. Furthermore, the company announced plans to initiate a new initiative that would enable it to become even more competitive in the pharmaceutical market.

Verona Pharma has gained a reputation for delivering high-quality treatments at accessible prices, which has helped it to remain profitable despite a challenging market. The company is committed to continuing its mission of providing treatments that help people lead healthier lives. Its increasing profitability and ambitious plans for growth demonstrate its commitment to this mission.

Price History

On Thursday, VERONA PHARMA held its Annual General Meeting (AGM) to report its financial results for the year. The company reported a record profit level for 2023, surpassing its targets by a significant margin. The news of record profits led to a surge in the stock prices of VERONA PHARMA which opened at $22.2 and closed at $21.4, down only 4.4% from the previous closing price of 22.3. Investors seem to be optimistic about the company’s prospects and future performance, showing that the company is still seen in a positive light by those investing in its stocks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verona Pharma. More…

| Total Revenues | Net Income | Net Margin |

| 0.46 | -68.7 | -14393.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verona Pharma. More…

| Operations | Investing | Financing |

| -59.86 | -0.03 | 140.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verona Pharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 259.47 | 29 | 3.04 |

Key Ratios Snapshot

Some of the financial key ratios for Verona Pharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | -14831.2% |

| FCF Margin | ROE | ROA |

| -13076.6% | -18.1% | -16.4% |

Analysis

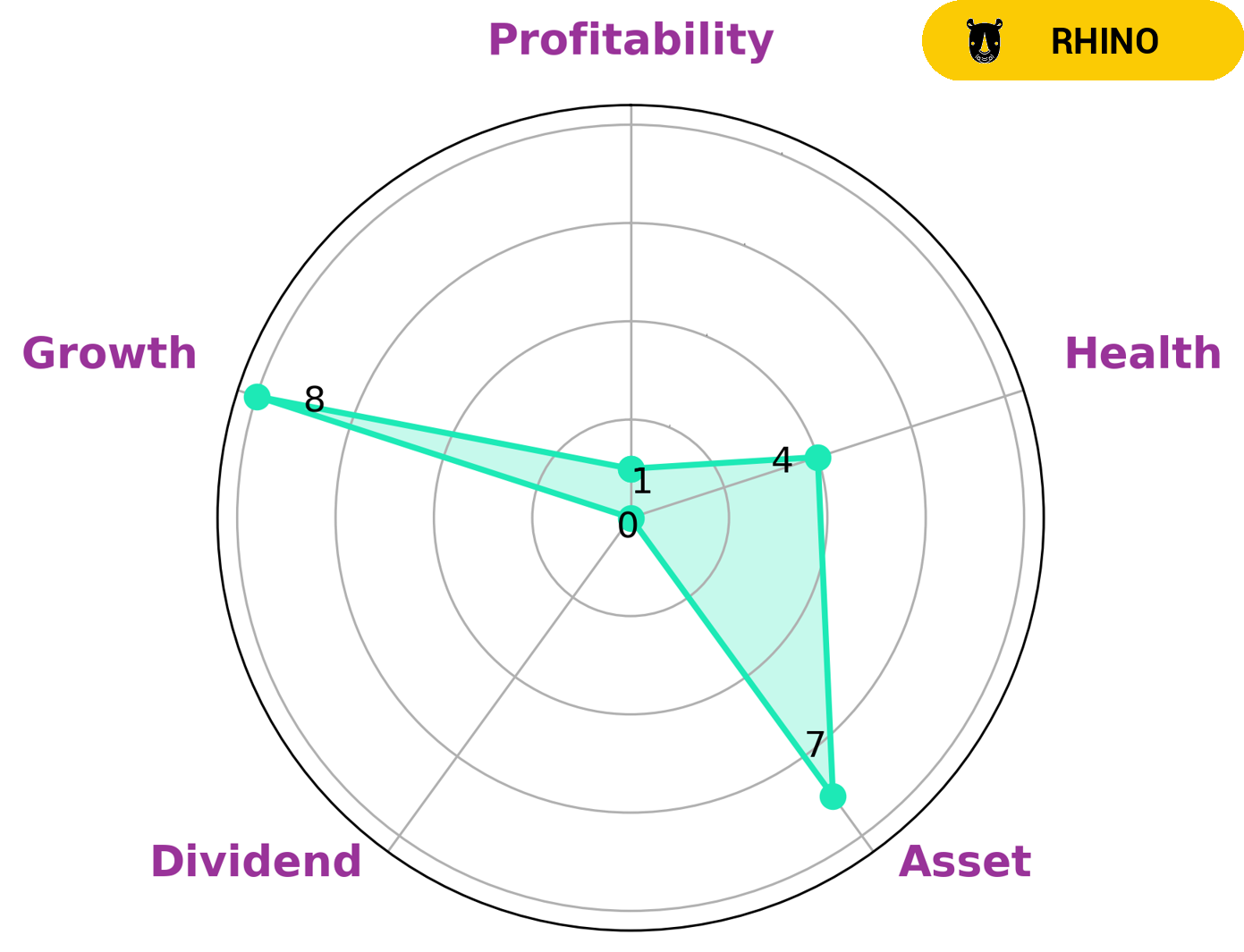

GoodWhale conducted an analysis of VERONA PHARMA‘s wellbeing and based on the Star Chart we classified VERONA PHARMA as a ‘rhino’, which we conclude to be a company that has achieved moderate revenue or earnings growth. Investors who are looking for potential with a lower risk factor may be interested in such a company. VERONA PHARMA is strong in assets and growth, however, it is weak in dividend and profitability. It has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it should be able to pay off debt and fund future operations. More…

Peers

Some of its competitors are Karuna Therapeutics Inc, Cardiff Oncology Inc, Reviva Pharmaceuticals Holdings Inc.

– Karuna Therapeutics Inc ($NASDAQ:KRTX)

Karuna Therapeutics Inc is a clinical-stage biopharmaceutical company that focuses on developing and commercializing novel treatments for patients with psychiatric and neurological disorders. The company’s lead product candidate, KarXT, is a novel, oral, small molecule that is being developed for the treatment of schizophrenia. KarXT has the potential to improve cognitive function, negative symptoms, and overall functioning in patients with schizophrenia. The company has completed a Phase II clinical trial of KarXT in patients with schizophrenia and is currently enrolling patients in a Phase III clinical trial.

– Cardiff Oncology Inc ($NASDAQ:CRDF)

Cardiff Oncology is a clinical-stage biotechnology company focused on the development of novel cancer therapies. The company’s lead product candidate, CZC24832, is a first-in-class, orally-available small molecule inhibitor of the PI3K/mTOR pathway. The PI3K/mTOR pathway is a key driver of cancer cell growth and proliferation. CZC24832 is currently being evaluated in a Phase 1/2 clinical trial in patients with advanced solid tumors.

Cardiff Oncology has a market cap of $59.42 million and a return on equity of -21.11%. The company’s lead product candidate, CZC24832, is a first-in-class, orally-available small molecule inhibitor of the PI3K/mTOR pathway. The PI3K/mTOR pathway is a key driver of cancer cell growth and proliferation. CZC24832 is currently being evaluated in a Phase 1/2 clinical trial in patients with advanced solid tumors.

– Reviva Pharmaceuticals Holdings Inc ($NASDAQ:RVPH)

Reviva Pharmaceuticals Holdings Inc is a pharmaceutical company with a market cap of 107.33M as of 2022 and a Return on Equity of -63.24%. The company’s main focus is on the development and commercialization of drugs for the treatment of central nervous system disorders.

Summary

Verona Pharma is an emerging biopharmaceutical company that focuses on developing treatments for respiratory diseases. The company has recently released its 2023 Annual General Meeting (AGM) results, which showed a decline in stock price the same day. This has caused investors to become more cautious when considering investing in Verona Pharma. Analysts have noted that despite the potential for significant growth in the future, the company still faces a number of challenges. These include a lack of operational experience, an uncertain regulatory environment and limited financial resources.

However, they also point to the company’s commitment to research and development, and its strong management team, as positive factors. Overall, Verona Pharma offers investors with a high-risk, high-reward investment opportunity. Those who are willing to take on the risk may benefit from the potential upside of the company’s advancements in the development of respiratory treatments, while those who are more risk-averse may prefer to wait and see how the company develops. Ultimately, investors should make sure to conduct their own research before making any decisions regarding Verona Pharma investments.

Recent Posts