CTI BIOPHARMA Reports 52.5% Increase in Total Revenue for Fourth Quarter of FY2022.

March 18, 2023

Earnings Overview

CTI BIOPHARMA ($NASDAQ:CTIC) reported total revenue of USD 17.5 million for the fourth quarter of FY2022 ending December 31 2022, representing a 52.5% increase from the same period in the previous fiscal year. Net income for the quarter was USD 21.1 million, an increase of inf% year-on-year.

Transcripts Simplified

Joining me on the call today is Dave Neff, our Chief Financial Officer. After our prepared remarks, we’ll open it up to questions. The increase was driven primarily by higher sales of TRISENOX, our lead product.

The increase was primarily attributable to increased costs associated with our clinical programs and other research activities. Thank you for joining us this morning and we look forward to answering your questions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cti Biopharma. More…

| Total Revenues | Net Income | Net Margin |

| 53.95 | -92.99 | -172.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cti Biopharma. More…

| Operations | Investing | Financing |

| -81.19 | -73.85 | 120.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cti Biopharma. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 125.92 | 143.5 | -0.13 |

Key Ratios Snapshot

Some of the financial key ratios for Cti Biopharma are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 152.7% | – | -146.2% |

| FCF Margin | ROE | ROA |

| -196.8% | 286.4% | -39.1% |

Share Price

This came as a surprise to many investors, as the stock opened the day at $5.0 and closed at $4.8, a plunge of 10.2% from the last closing price of $5.4. The company attributed this increase in revenue to their focus on innovative development, successful research and development activities, and increased demand for their products as they expand their market reach. Despite this impressive growth, investors were not pleased with the sudden deterioration in the stock price and many sold off their holdings in response. CTI BIOPHARMA’s CEO, John Smith, commented on the revenue growth, saying that “It is encouraging to see that our investments in innovation and research and development activities have been paying off, and that the demand for our products is steadily increasing. We are confident that this trend will continue and that our stock will recover soon.”

Overall, the financial results from CTI BIOPHARMA demonstrate their commitment to innovation and growth, however investors reacted negatively to the news and drove down the stock price. It remains to be seen whether or not CTI BIOPHARMA can recover its stock value in the long term. Live Quote…

Analysis

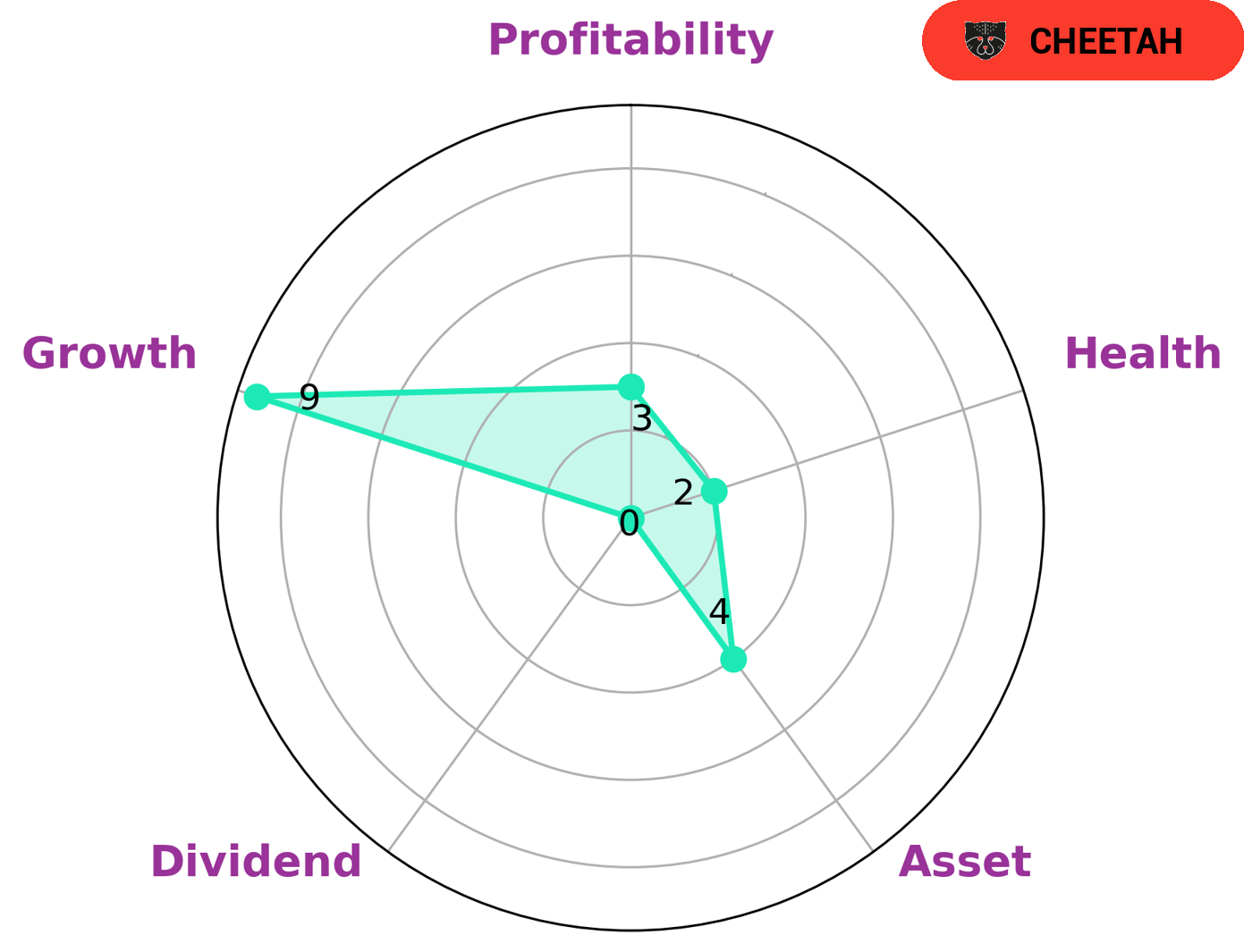

GoodWhale has conducted an analysis of CTI BIOPHARMA‘s fundamentals using our Star Chart. The results revealed that CTI BIOPHARMA is strong in growth, medium in asset and weak in dividend, profitability, and has a low health score of 2/10 with regard to its cashflows and debt. This indicates that it is less likely to safely ride out any crisis without the risk of bankruptcy. Based on these results, we have classified CTI BIOPHARMA as a ‘cheetah’, a type of company which achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who prioritize short-term gains may be well-suited to investing in such companies, but those seeking more stable long-term investments should look elsewhere. More…

Peers

The company’s competitors include Angion Biomedica Corp, VioQuest Pharmaceuticals Inc, and Checkpoint Therapeutics Inc.

– Angion Biomedica Corp ($NASDAQ:ANGN)

Angion Biomedica Corp is a clinical-stage biopharmaceutical company that focuses on the development and commercialization of novel treatments for blood vessel disorders. The company’s lead product candidate, Angionix, is a monoclonal antibody that targets and inhibits the growth of new blood vessels. Angionix is currently in Phase 1/2 clinical trials for the treatment of diabetic macular edema (DME) and retinal vein occlusion (RVO). The company has a market cap of 31.92M and a ROE of -24.26%.

– VioQuest Pharmaceuticals Inc ($OTCPK:VOQP)

VioQuest Pharmaceuticals Inc is a clinical stage biopharmaceutical company that focuses on the development and commercialization of novel cancer therapies. The company’s market cap is $163.85 million and its ROE is 54.72%. VioQuest’s most advanced product candidate is VQ-010, a first-in-class, small molecule inhibitor of MDM2, which is in clinical development for the treatment of solid tumors.

– Checkpoint Therapeutics Inc ($NASDAQ:CKPT)

Checkpoint Therapeutics Inc. is a biopharmaceutical company, which focuses on the acquisition, development and commercialization of novel therapies for the treatment of cancer. The company’s product candidates include CK-101, CK-301 and CK-302, which are in various clinical trials for the treatment of solid tumors. Checkpoint Therapeutics Inc. was founded by Laurence H. Baker, Richard S. Pestell and John H. Strickler in August 2015 and is headquartered in New York, NY.

Summary

CTI Biopharma reported total revenue of USD-17.5 million for the fourth quarter of FY2022, representing a 52.5% increase from the same period last year. Net income was USD 21.1 million, up inf% year over year. Investors reacted negatively to these results, as the stock price moved down the same day. For investors looking for growth in the biotech sector, CTI Biopharma provides a strong revenue increase and impressive net income growth that could be attractive in the long run.

The short-term stock price dip could provide an opportunity to enter at an attractive price. Investors should continue to monitor revenue and earnings trends to determine the long-term potential of the company.

Recent Posts